- Saudi Arabia

- /

- Commercial Services

- /

- SASE:1832

Getting In Cheap On Sadr Logistics Company (TADAWUL:1832) Might Be Difficult

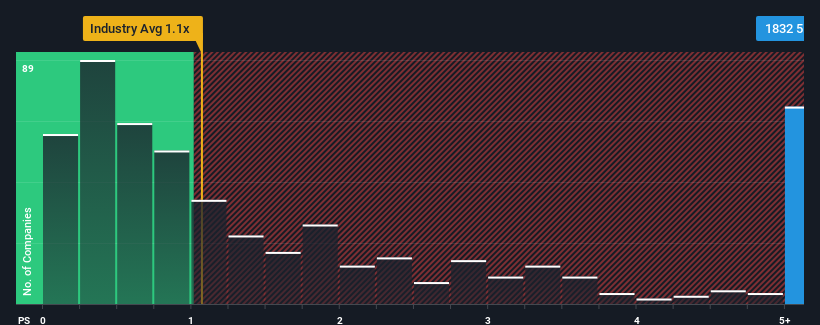

Sadr Logistics Company's (TADAWUL:1832) price-to-sales (or "P/S") ratio of 5.9x may look like a poor investment opportunity when you consider close to half the companies in the Commercial Services industry in Saudi Arabia have P/S ratios below 1.2x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Sadr Logistics

How Sadr Logistics Has Been Performing

For instance, Sadr Logistics' receding revenue in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Sadr Logistics will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Sadr Logistics?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Sadr Logistics' to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 28%. Still, the latest three year period has seen an excellent 61% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 14% shows it's noticeably more attractive.

With this information, we can see why Sadr Logistics is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

What Does Sadr Logistics' P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Sadr Logistics revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 1 warning sign for Sadr Logistics that you need to take into consideration.

If you're unsure about the strength of Sadr Logistics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:1832

Sadr Logistics

Manufactures and supplies storage, warehousing, handling, pallets, and office solutions in Saudi Arabia.

Mediocre balance sheet very low.

Market Insights

Community Narratives