- Saudi Arabia

- /

- Building

- /

- SASE:4144

Further Upside For Raoom trading Company (TADAWUL:9529) Shares Could Introduce Price Risks After 27% Bounce

Raoom trading Company (TADAWUL:9529) shareholders have had their patience rewarded with a 27% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 70% in the last year.

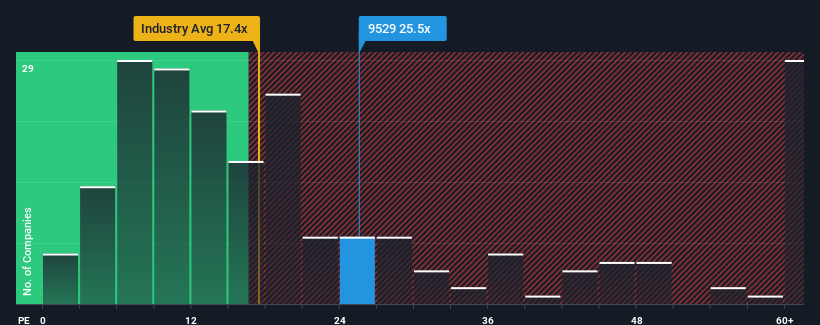

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Raoom trading's P/E ratio of 25.4x, since the median price-to-earnings (or "P/E") ratio in Saudi Arabia is also close to 24x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

The earnings growth achieved at Raoom trading over the last year would be more than acceptable for most companies. It might be that many expect the respectable earnings performance to wane, which has kept the P/E from rising. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

See our latest analysis for Raoom trading

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Raoom trading's to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 12%. Pleasingly, EPS has also lifted 83% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 19% shows it's noticeably more attractive on an annualised basis.

In light of this, it's curious that Raoom trading's P/E sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Final Word

Raoom trading appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Raoom trading revealed its three-year earnings trends aren't contributing to its P/E as much as we would have predicted, given they look better than current market expectations. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

You need to take note of risks, for example - Raoom trading has 2 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:4144

Raoom trading

Engages in the manufacture, trade, and installation of glass, mirrors, and aluminum decorations in the Kingdom of Saudi Arabia.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives