- Saudi Arabia

- /

- Healthcare Services

- /

- SASE:9544

Undiscovered Gems Promising Stocks With Strong Fundamentals December 2024

Reviewed by Simply Wall St

As global markets navigate a period of rate cuts from major central banks, small-cap stocks have faced challenges, with the Russell 2000 Index underperforming against larger benchmarks. Amidst this backdrop of shifting monetary policies and economic indicators, identifying stocks with strong fundamentals becomes crucial for investors seeking potential opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Cita Mineral Investindo | NA | -3.08% | 16.56% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Mandiri Herindo Adiperkasa | NA | 20.72% | 11.08% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| ShareHope Medicine | 38.07% | 3.80% | -7.16% | ★★★★★☆ |

| Standard Chartered Bank Kenya | 9.32% | 12.22% | 22.08% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Dongsung FineTec (KOSDAQ:A033500)

Simply Wall St Value Rating: ★★★★★★

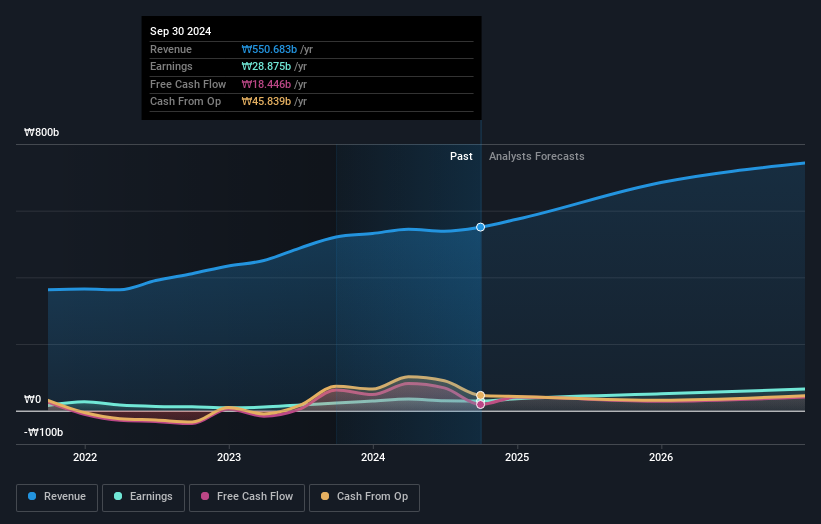

Overview: Dongsung FineTec Co., Ltd. specializes in the manufacture and sale of cryogenic insulation products in South Korea, with a market cap of ₩423.88 billion.

Operations: Dongsung FineTec generates revenue primarily from its Cooling Material segment, which accounts for ₩528.74 billion, significantly overshadowing the Gas Business segment's ₩21.94 billion.

Dongsung FineTec, a notable player in the chemical sector, has been making waves with its robust financial performance. Over the past year, earnings grew by 27.5%, outpacing the industry average of 20.9%. The company's debt to equity ratio impressively decreased from 131.6% to 18.6% over five years, indicating improved financial health. With interest payments well covered at 23.6 times EBIT and trading at nearly 60% below estimated fair value, it seems undervalued in today's market landscape. Recent results show net income for nine months at KRW 20,662 million compared to KRW 20,533 million last year, reflecting steady profitability despite slight fluctuations in quarterly figures.

- Navigate through the intricacies of Dongsung FineTec with our comprehensive health report here.

Gain insights into Dongsung FineTec's past trends and performance with our Past report.

Middle East Specialized Cables (SASE:2370)

Simply Wall St Value Rating: ★★★★★★

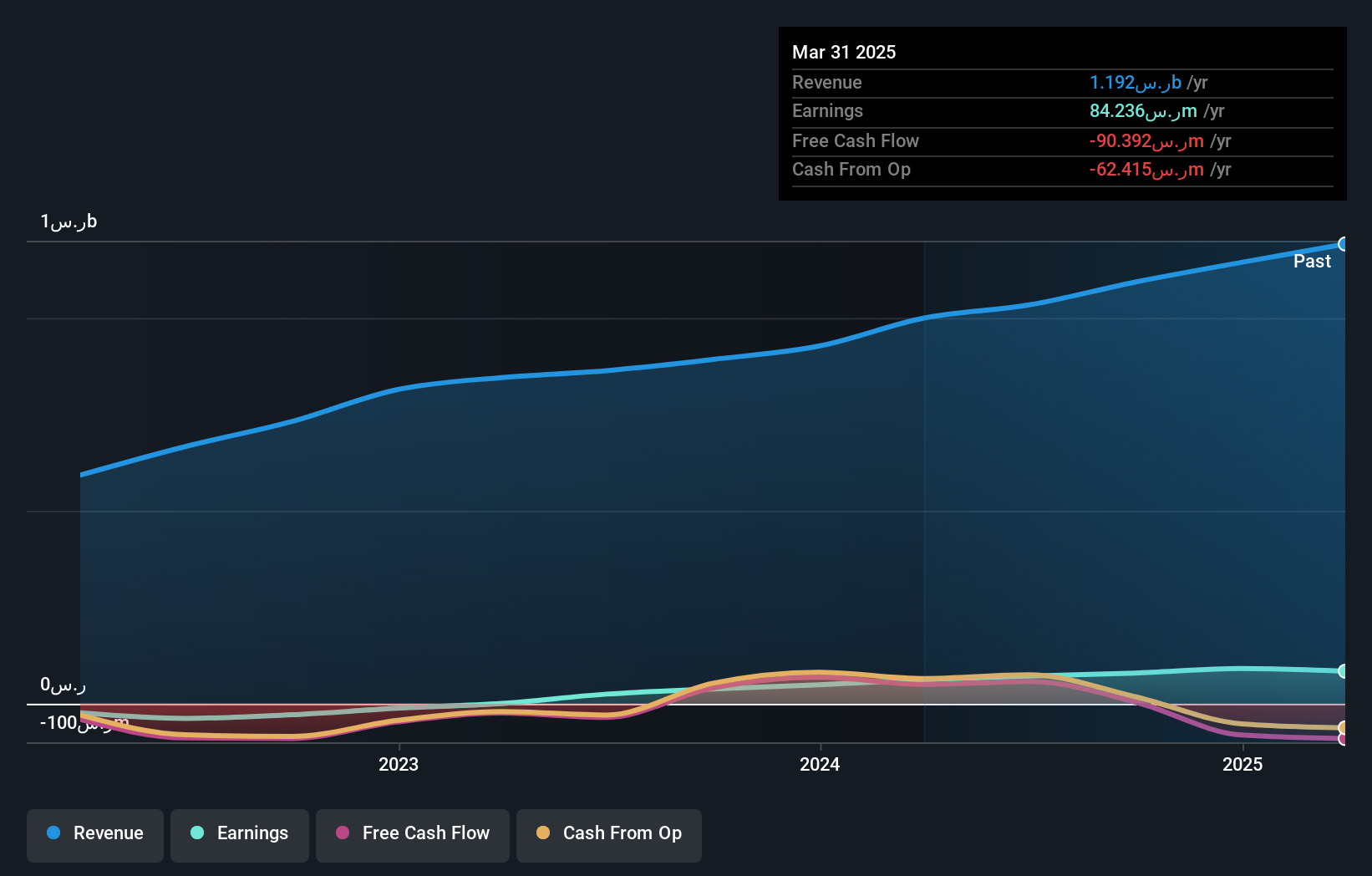

Overview: Middle East Specialized Cables Company, along with its subsidiaries, operates in Saudi Arabia and the United Arab Emirates, manufacturing and selling fiber optic cables, steel insulated wires and cables, copper insulated wires and cables, and aluminum insulated wires and cables; it has a market capitalization of SAR1.59 billion.

Operations: The primary revenue stream for Middle East Specialized Cables Company is derived from its wire and cable products, generating SAR1.09 billion.

Middle East Specialized Cables, a smaller player in its sector, has demonstrated notable financial growth recently. Earnings surged by 107.5% over the past year, outpacing the Electrical industry's 9.2%. The company reported third-quarter sales of SAR 289.2 million and net income of SAR 20.93 million, marking an improvement from last year's figures of SAR 229.89 million and SAR 13.56 million respectively. With a net debt to equity ratio at a satisfactory level of 4.6%, financial stability seems assured while interest payments are well covered by EBIT at a robust 45x coverage, indicating sound operational health and potential for continued success in its market niche.

Future Care Trading (SASE:9544)

Simply Wall St Value Rating: ★★★★★★

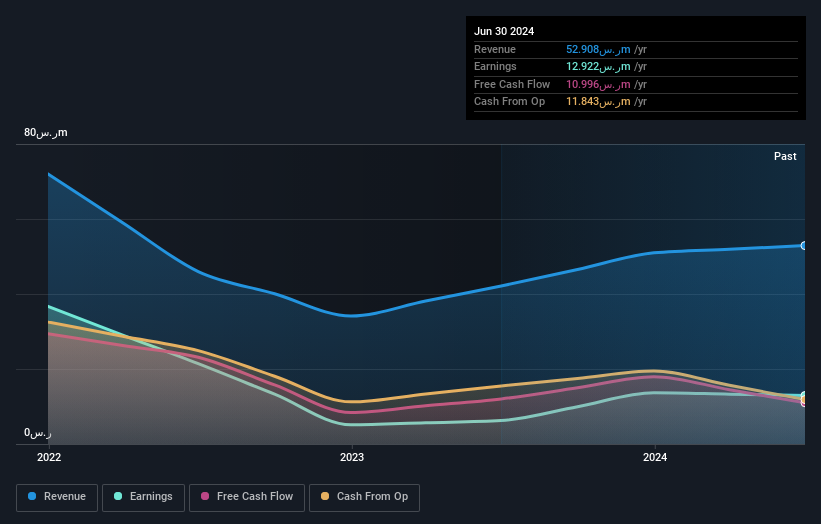

Overview: Future Care Trading Co. offers home medical and laboratory services in Saudi Arabia, with a market capitalization of SAR4.75 billion.

Operations: The company generates revenue primarily from its healthcare facilities and services segment, totaling SAR52.91 million.

Future Care Trading, a promising player in the healthcare sector, has demonstrated significant earnings growth of 106.9% over the past year, outpacing the industry average of 13.5%. Despite its volatile share price recently, this debt-free company shows financial resilience with consistent profitability and positive free cash flow. Over five years, however, earnings have decreased by 40.4% annually. Its addition to major indices like the S&P Pan Arab Composite suggests growing recognition in broader markets. With no debt for five years and high-quality earnings reported consistently, Future Care seems well-positioned for future opportunities despite past challenges.

- Get an in-depth perspective on Future Care Trading's performance by reading our health report here.

Understand Future Care Trading's track record by examining our Past report.

Summing It All Up

- Access the full spectrum of 4622 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:9544

Future Care Trading

Provides a range of home medical and laboratory services in the Kingdom of Saudi Arabia.

Flawless balance sheet with proven track record.