- Saudi Arabia

- /

- Professional Services

- /

- SASE:1833

3 Undervalued Stocks Estimated To Be Trading At Discounts Up To 35.4%

Reviewed by Simply Wall St

As global markets react to interest rate cuts from the ECB and SNB, and with expectations for a Federal Reserve rate cut solidifying, investors are navigating a landscape of mixed economic signals. Amidst this environment, identifying undervalued stocks can be crucial as they may offer potential opportunities when trading at significant discounts.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Gaming Realms (AIM:GMR) | £0.36 | £0.72 | 49.8% |

| Xiamen Bank (SHSE:601187) | CN¥5.70 | CN¥11.35 | 49.8% |

| Hanwha Systems (KOSE:A272210) | ₩20850.00 | ₩41692.30 | 50% |

| Decisive Dividend (TSXV:DE) | CA$5.92 | CA$11.83 | 50% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP290.00 | CLP579.00 | 49.9% |

| Wetteri Oyj (HLSE:WETTERI) | €0.297 | €0.59 | 49.9% |

| Compagnia dei Caraibi (BIT:TIME) | €0.542 | €1.08 | 50% |

| ReadyTech Holdings (ASX:RDY) | A$3.15 | A$6.28 | 49.9% |

| Fnac Darty (ENXTPA:FNAC) | €29.45 | €58.67 | 49.8% |

| Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266) | CN¥63.00 | CN¥125.29 | 49.7% |

Let's explore several standout options from the results in the screener.

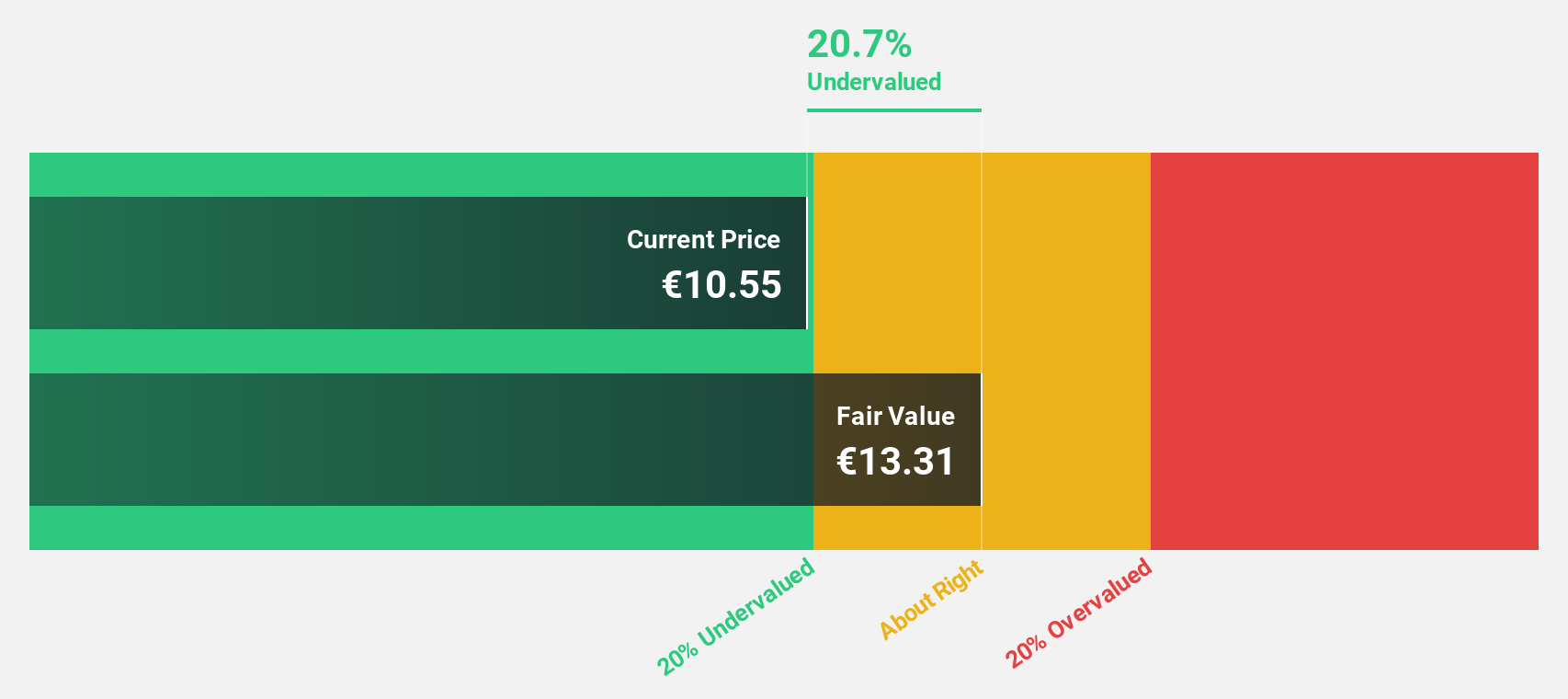

Kempower Oyj (HLSE:KEMPOWR)

Overview: Kempower Oyj manufactures and sells electric vehicle charging equipment and solutions under the Kempower brand across the Nordics, Europe, North America, and internationally, with a market cap of €514.60 million.

Operations: The company's revenue primarily comes from its electric equipment segment, amounting to €234.81 million.

Estimated Discount To Fair Value: 33.7%

Kempower Oyj, trading at €9.31, is significantly undervalued compared to its estimated fair value of €14.05, offering a potential opportunity based on cash flow analysis. Despite recent guidance indicating lower revenue expectations for 2024 and a negative EBIT margin, profitability is anticipated to improve by year-end. The company’s forecasted earnings growth of 72% annually and expected profitability within three years highlight its potential despite current volatility and market challenges.

- Our earnings growth report unveils the potential for significant increases in Kempower Oyj's future results.

- Take a closer look at Kempower Oyj's balance sheet health here in our report.

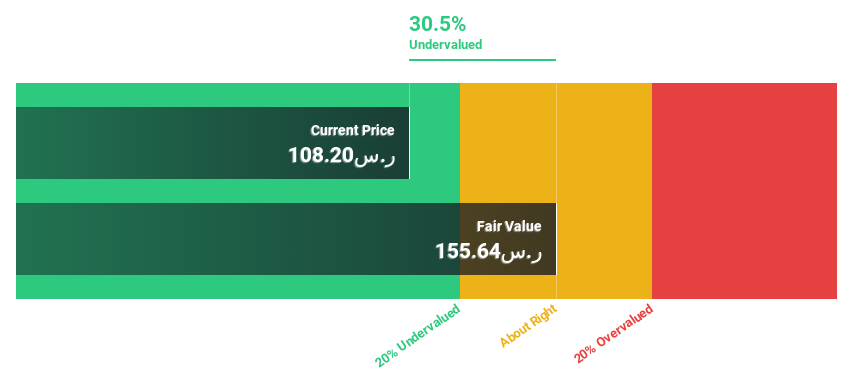

Almawarid Manpower (SASE:1833)

Overview: Almawarid Manpower Company offers professional manpower services to individuals and businesses in Saudi Arabia, with a market capitalization of SAR1.62 billion.

Operations: The company's revenue is derived from three main segments: the Hourly Segment with SAR154.09 million, the Corporate Segment contributing SAR1.19 billion, and the Individual Segment generating SAR255.28 million.

Estimated Discount To Fair Value: 30.5%

Almawarid Manpower, trading at SAR 108.2, is significantly undervalued with an estimated fair value of SAR 155.64. Despite a dip in net income to SAR 17.1 million for Q3 compared to last year, the company shows promising growth prospects with forecasted annual earnings growth of 17.5%, surpassing the SA market average. Analysts expect a potential price increase of 31.4%, supported by strong revenue forecasts and robust return on equity projections in three years.

- Our growth report here indicates Almawarid Manpower may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Almawarid Manpower stock in this financial health report.

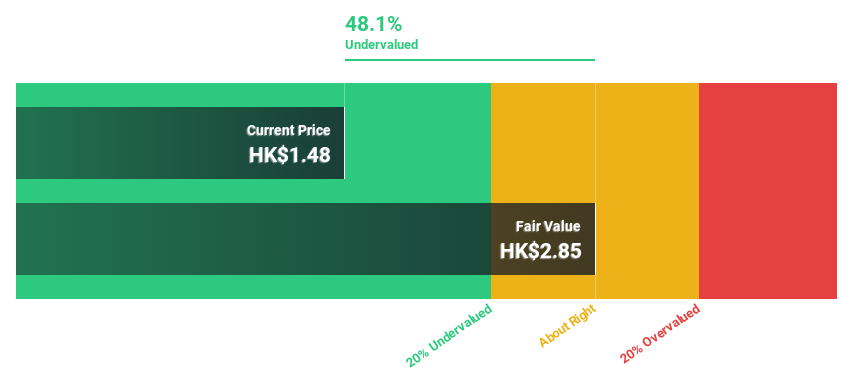

Pacific Textiles Holdings (SEHK:1382)

Overview: Pacific Textiles Holdings Limited manufactures and trades textile products across various regions including China, Vietnam, Bangladesh, and internationally, with a market cap of HK$2.09 billion.

Operations: The company generates revenue of HK$5.04 billion from its manufacturing and trading of textile products segment.

Estimated Discount To Fair Value: 35.4%

Pacific Textiles Holdings is trading at HK$1.5, significantly below its estimated fair value of HK$2.32, suggesting undervaluation based on cash flows. Despite recent earnings showing a decline in net income to HKD 106.86 million, revenue increased to HKD 2,667.18 million for the half-year ended September 2024. The company initiated a share buyback program enhancing shareholder value and forecasts robust annual earnings growth of over 50%, outpacing the Hong Kong market average.

- Upon reviewing our latest growth report, Pacific Textiles Holdings' projected financial performance appears quite optimistic.

- Navigate through the intricacies of Pacific Textiles Holdings with our comprehensive financial health report here.

Seize The Opportunity

- Embark on your investment journey to our 885 Undervalued Stocks Based On Cash Flows selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:1833

Almawarid Manpower

Provides professional manpower to individuals and businesses in the Kingdom of Saudi Arabia.

Very undervalued with flawless balance sheet.