- Saudi Arabia

- /

- Building

- /

- SASE:2040

Why Investors Shouldn't Be Surprised By Saudi Ceramic Company's (TADAWUL:2040) 28% Share Price Surge

Despite an already strong run, Saudi Ceramic Company (TADAWUL:2040) shares have been powering on, with a gain of 28% in the last thirty days. The last month tops off a massive increase of 147% in the last year.

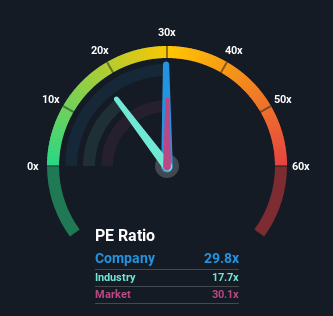

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Saudi Ceramic's P/E ratio of 29.8x, since the median price-to-earnings (or "P/E") ratio in Saudi Arabia is also close to 30x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times have been advantageous for Saudi Ceramic as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for Saudi Ceramic

Is There Some Growth For Saudi Ceramic?

There's an inherent assumption that a company should be matching the market for P/E ratios like Saudi Ceramic's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 222% last year. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, EPS is anticipated to climb by 22% per annum during the coming three years according to the three analysts following the company. That's shaping up to be similar to the 22% each year growth forecast for the broader market.

With this information, we can see why Saudi Ceramic is trading at a fairly similar P/E to the market. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

Saudi Ceramic's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Saudi Ceramic maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. Unless these conditions change, they will continue to support the share price at these levels.

It is also worth noting that we have found 3 warning signs for Saudi Ceramic that you need to take into consideration.

Of course, you might also be able to find a better stock than Saudi Ceramic. So you may wish to see this free collection of other companies that sit on P/E's below 20x and have grown earnings strongly.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SASE:2040

Saudi Ceramic

Manufactures and sells ceramic products, water heaters, and other products in Saudi Arabia and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives