- Saudi Arabia

- /

- Building

- /

- SASE:2040

3 Prominent Stocks Estimated To Be Up To 49.2% Below Intrinsic Value

Reviewed by Simply Wall St

In a week marked by busy earnings reports and mixed economic signals, global markets have experienced notable fluctuations, with major indices like the S&P 500 and Nasdaq Composite reaching highs before retreating. Amidst this volatility, investors are increasingly focused on identifying stocks that may be undervalued relative to their intrinsic worth, particularly as growth stocks lag behind value shares. In such an environment, finding stocks estimated to be significantly below their intrinsic value can offer potential opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Avant Group (TSE:3836) | ¥1979.00 | ¥3936.25 | 49.7% |

| On the Beach Group (LSE:OTB) | £1.522 | £3.03 | 49.8% |

| SEI Medical (SET:SEI) | THB5.80 | THB11.54 | 49.7% |

| SciDev (ASX:SDV) | A$0.615 | A$1.23 | 49.8% |

| Laboratorio Reig Jofre (BME:RJF) | €2.88 | €5.74 | 49.8% |

| Alnylam Pharmaceuticals (NasdaqGS:ALNY) | US$273.01 | US$545.05 | 49.9% |

| Shinsung E&GLtd (KOSE:A011930) | ₩1418.00 | ₩2821.10 | 49.7% |

| Orascom Development Holding (SWX:ODHN) | CHF3.90 | CHF7.79 | 49.9% |

| Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266) | CN¥63.90 | CN¥127.14 | 49.7% |

| Cellnex Telecom (BME:CLNX) | €32.50 | €64.80 | 49.8% |

Here's a peek at a few of the choices from the screener.

Saudi Ceramic (SASE:2040)

Overview: Saudi Ceramic Company manufactures and sells ceramic products, water heaters, and other related products in Saudi Arabia and internationally, with a market cap of SAR3.40 billion.

Operations: The company's revenue segments include the manufacture and sale of ceramic products and water heaters in Saudi Arabia and international markets.

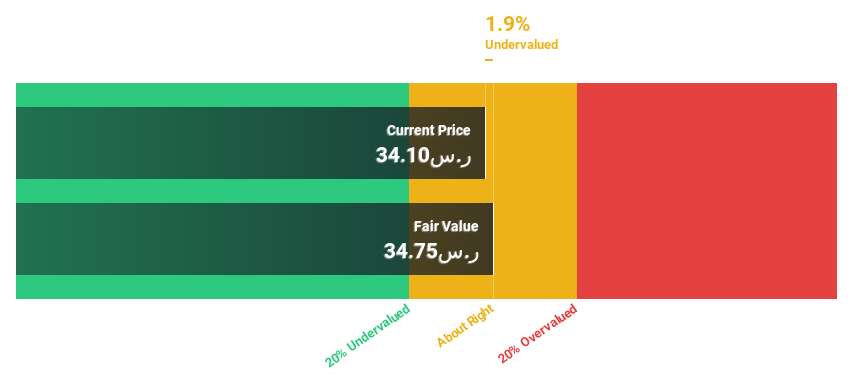

Estimated Discount To Fair Value: 14.8%

Saudi Ceramic's current trading price of SAR34.05 is approximately 14.8% below its estimated fair value of SAR39.96, making it an undervalued stock based on cash flows. Although the company carries a high level of debt and has a low forecasted return on equity at 9.1%, its revenue is expected to grow at 7.1% annually, outpacing the Saudi Arabian market average growth rate of 1.2%.

- Our expertly prepared growth report on Saudi Ceramic implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Saudi Ceramic's balance sheet health report.

Tibet Rhodiola Pharmaceutical Holding (SHSE:600211)

Overview: Tibet Rhodiola Pharmaceutical Holding Co. operates in the pharmaceutical industry, focusing on the development and production of traditional Tibetan medicine, with a market cap of CN¥12.59 billion.

Operations: Unfortunately, the provided text does not include specific revenue segment details for Tibet Rhodiola Pharmaceutical Holding Co. If you have additional information or another source, please share it so I can assist further.

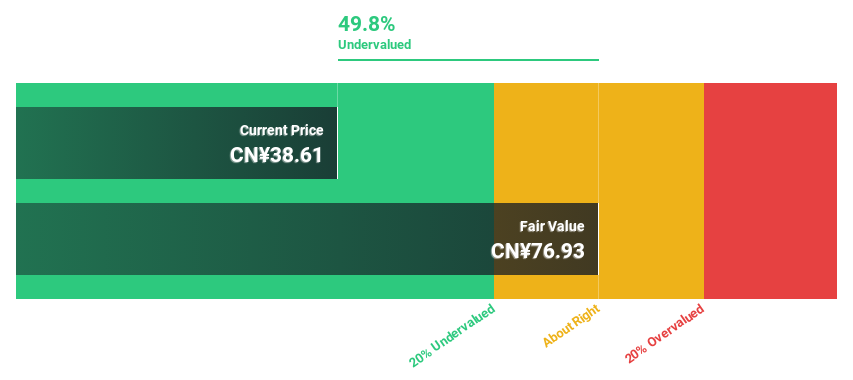

Estimated Discount To Fair Value: 49.2%

Tibet Rhodiola Pharmaceutical Holding is trading at CN¥39.05, significantly below its estimated fair value of CN¥76.93, highlighting its potential as an undervalued stock based on cash flows. Despite a recent decline in sales and net income for the nine months ending September 2024, earnings are forecasted to grow significantly at 25.7% annually over the next three years, with revenue growth expected to outpace the Chinese market average. However, its dividend track record remains unstable due to large one-off items impacting results.

- The growth report we've compiled suggests that Tibet Rhodiola Pharmaceutical Holding's future prospects could be on the up.

- Click here to discover the nuances of Tibet Rhodiola Pharmaceutical Holding with our detailed financial health report.

Xi'an Manareco New MaterialsLtd (SHSE:688550)

Overview: Xi'an Manareco New Materials Co., Ltd specializes in the production and sale of liquid crystal materials, OLED materials, and drug intermediates with a market cap of CN¥5.70 billion.

Operations: The company's revenue is primarily derived from its Specialty Chemicals segment, which generated CN¥1.37 billion.

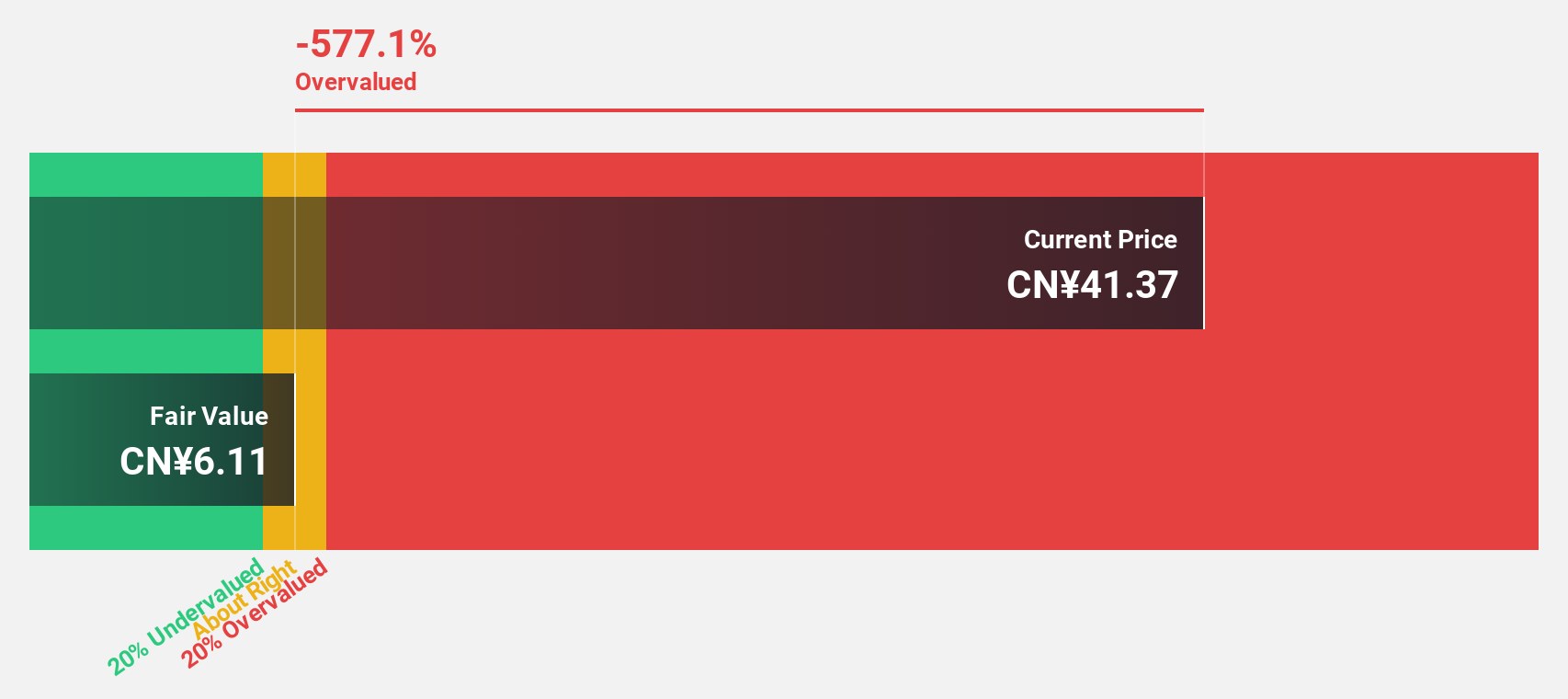

Estimated Discount To Fair Value: 40.5%

Xi'an Manareco New Materials Ltd is trading at CN¥32.95, well below its estimated fair value of CN¥55.38, suggesting it could be undervalued based on cash flows. The company reported strong earnings growth for the nine months ending September 2024, with net income nearly doubling from the previous year. Despite this, its dividend track record remains unstable. Revenue is forecasted to grow significantly faster than the Chinese market average at 22.8% annually.

- Insights from our recent growth report point to a promising forecast for Xi'an Manareco New MaterialsLtd's business outlook.

- Navigate through the intricacies of Xi'an Manareco New MaterialsLtd with our comprehensive financial health report here.

Next Steps

- Navigate through the entire inventory of 936 Undervalued Stocks Based On Cash Flows here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Saudi Ceramic, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:2040

Saudi Ceramic

Manufactures and sells ceramic products, water heaters, and other products in Saudi Arabia and internationally.

Reasonable growth potential with adequate balance sheet.