- Saudi Arabia

- /

- Industrials

- /

- SASE:1212

Astra Industrial Group's (TADAWUL:1212) earnings growth rate lags the 59% CAGR delivered to shareholders

While Astra Industrial Group Company (TADAWUL:1212) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 16% in the last quarter. But that doesn't undermine the fantastic longer term performance (measured over five years). In that time, the share price has soared some 786% higher! Arguably, the recent fall is to be expected after such a strong rise. Only time will tell if there is still too much optimism currently reflected in the share price. Anyone who held for that rewarding ride would probably be keen to talk about it.

Although Astra Industrial Group has shed ر.س992m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

We've discovered 2 warning signs about Astra Industrial Group. View them for free.In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

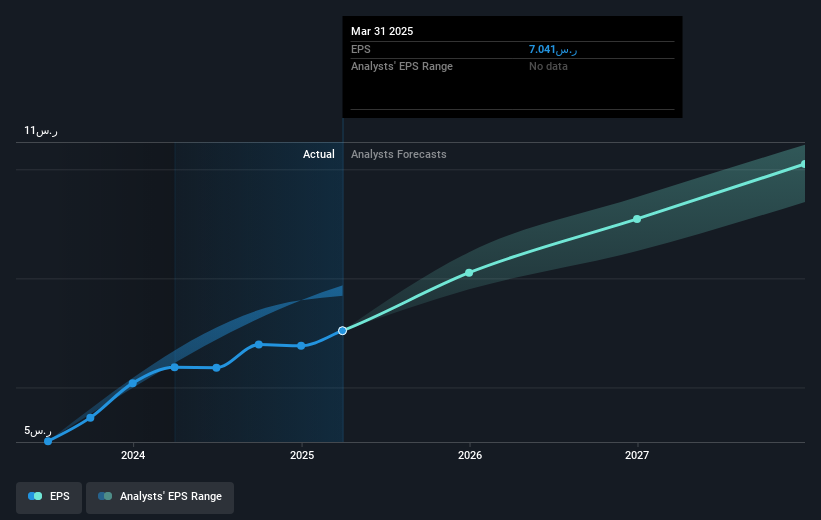

Over half a decade, Astra Industrial Group managed to grow its earnings per share at 59% a year. This EPS growth is reasonably close to the 55% average annual increase in the share price. This indicates that investor sentiment towards the company has not changed a great deal. Rather, the share price has approximately tracked EPS growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It is of course excellent to see how Astra Industrial Group has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at Astra Industrial Group's financial health with this free report on its balance sheet.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Astra Industrial Group's TSR for the last 5 years was 906%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While it's certainly disappointing to see that Astra Industrial Group shares lost 1.1% throughout the year, that wasn't as bad as the market loss of 8.7%. Longer term investors wouldn't be so upset, since they would have made 59%, each year, over five years. It could be that the business is just facing some short term problems, but shareholders should keep a close eye on the fundamentals. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for Astra Industrial Group that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Saudi exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:1212

Astra Industrial Group

Through its subsidiaries, engages in the pharmaceuticals, specialty chemicals, power, steel, and mining businesses worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives