- Saudi Arabia

- /

- Banks

- /

- SASE:1050

Is Now The Time To Put Banque Saudi Fransi (TADAWUL:1050) On Your Watchlist?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Banque Saudi Fransi (TADAWUL:1050). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Banque Saudi Fransi

Banque Saudi Fransi's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. Recognition must be given to the that Banque Saudi Fransi has grown EPS by 43% per year, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

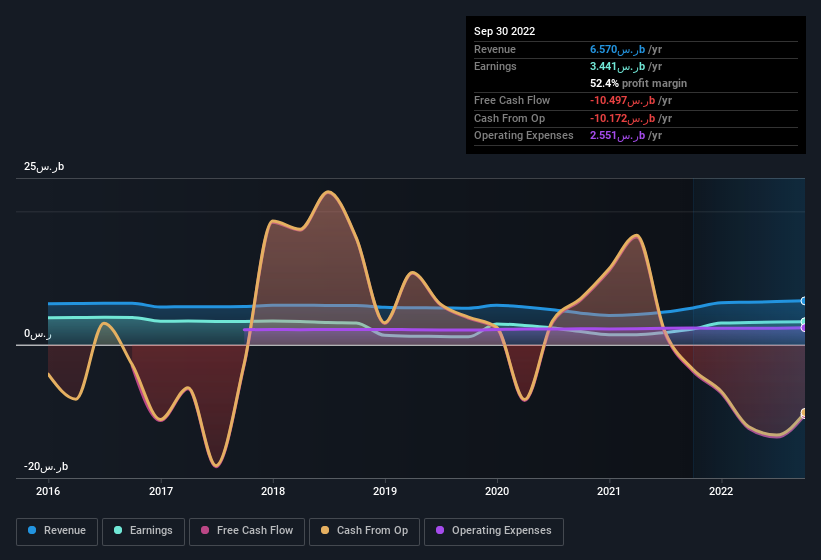

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. It's noted that Banque Saudi Fransi's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. Banque Saudi Fransi maintained stable EBIT margins over the last year, all while growing revenue 19% to ر.س6.6b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Banque Saudi Fransi?

Are Banque Saudi Fransi Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a ر.س49b company like Banque Saudi Fransi. But we are reassured by the fact they have invested in the company. Notably, they have an enviable stake in the company, worth ر.س1.7b. Investors will appreciate management having this amount of skin in the game as it shows their commitment to the company's future.

Does Banque Saudi Fransi Deserve A Spot On Your Watchlist?

Banque Saudi Fransi's earnings per share growth have been climbing higher at an appreciable rate. That EPS growth certainly is attention grabbing, and the large insider ownership only serves to further stoke our interest. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. So based on this quick analysis, we do think it's worth considering Banque Saudi Fransi for a spot on your watchlist. You still need to take note of risks, for example - Banque Saudi Fransi has 2 warning signs (and 1 which is significant) we think you should know about.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Banque Saudi Fransi, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Banque Saudi Fransi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:1050

Banque Saudi Fransi

Provides banking and financial services for individuals and businesses in the Kingdom of Saudi Arabia and internationally.

Flawless balance sheet established dividend payer.