- Saudi Arabia

- /

- Banks

- /

- SASE:1020

Investing in Bank AlJazira (TADAWUL:1020) five years ago would have delivered you a 66% gain

Stock pickers are generally looking for stocks that will outperform the broader market. And the truth is, you can make significant gains if you buy good quality businesses at the right price. To wit, the Bank AlJazira share price has climbed 54% in five years, easily topping the market return of 2.3% (ignoring dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 21% in the last year.

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

Check out our latest analysis for Bank AlJazira

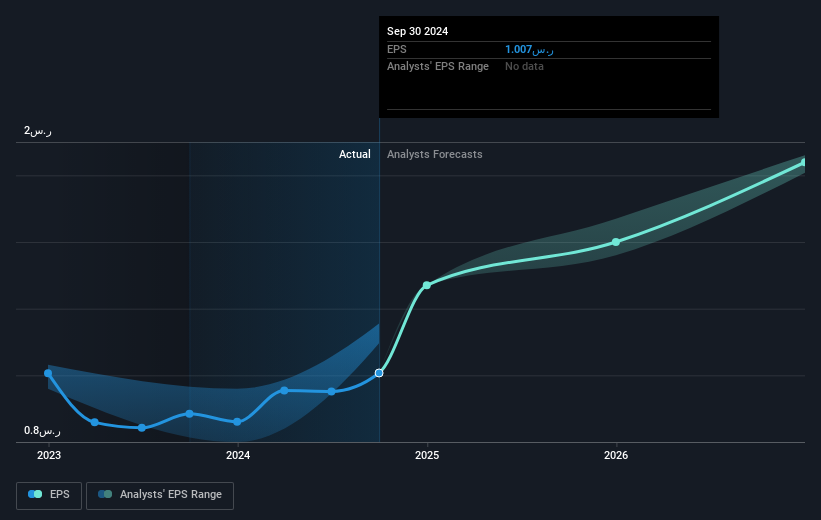

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over half a decade, Bank AlJazira managed to grow its earnings per share at 21% a year. This EPS growth is higher than the 9% average annual increase in the share price. So one could conclude that the broader market has become more cautious towards the stock.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It is of course excellent to see how Bank AlJazira has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at Bank AlJazira's financial health with this free report on its balance sheet.

What About The Total Shareholder Return (TSR)?

We've already covered Bank AlJazira's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Bank AlJazira's TSR of 66% for the 5 years exceeded its share price return, because it has paid dividends.

A Different Perspective

It's good to see that Bank AlJazira has rewarded shareholders with a total shareholder return of 21% in the last twelve months. That gain is better than the annual TSR over five years, which is 11%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Before deciding if you like the current share price, check how Bank AlJazira scores on these 3 valuation metrics.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Saudi exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Bank AlJazira might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:1020

Bank AlJazira

Provides a range of Shari’ah compliant banking products and services for individuals, corporates, small to medium sized businesses, and institutions in the Kingdom of Saudi Arabia.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives