- Russia

- /

- Electric Utilities

- /

- MISX:VRSB

These 4 Measures Indicate That TNS energo Voronezh (MCX:VRSB) Is Using Debt Extensively

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Public Joint-stock Company "TNS energo Voronezh" (MCX:VRSB) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for TNS energo Voronezh

What Is TNS energo Voronezh's Debt?

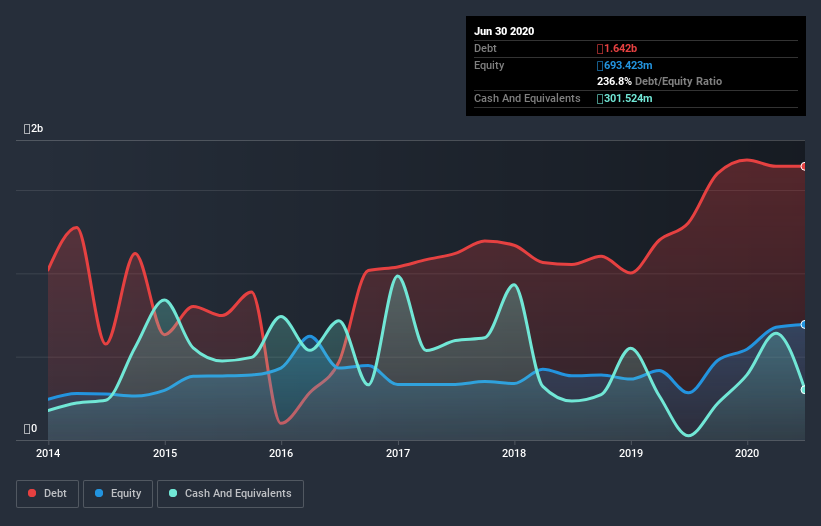

You can click the graphic below for the historical numbers, but it shows that as of June 2020 TNS energo Voronezh had ₽1.64b of debt, an increase on ₽1.30b, over one year. However, it also had ₽301.5m in cash, and so its net debt is ₽1.34b.

How Healthy Is TNS energo Voronezh's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that TNS energo Voronezh had liabilities of ₽4.04b due within 12 months and liabilities of ₽376.6m due beyond that. Offsetting these obligations, it had cash of ₽301.5m as well as receivables valued at ₽3.62b due within 12 months. So its liabilities total ₽492.1m more than the combination of its cash and short-term receivables.

Since publicly traded TNS energo Voronezh shares are worth a total of ₽3.80b, it seems unlikely that this level of liabilities would be a major threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

TNS energo Voronezh has a debt to EBITDA ratio of 3.7 and its EBIT covered its interest expense 2.7 times. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. One redeeming factor for TNS energo Voronezh is that it turned last year's EBIT loss into a gain of ₽351m, over the last twelve months. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since TNS energo Voronezh will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. Over the last year, TNS energo Voronezh recorded negative free cash flow, in total. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Our View

Both TNS energo Voronezh's conversion of EBIT to free cash flow and its interest cover were discouraging. But its not so bad at staying on top of its total liabilities. We should also note that Electric Utilities industry companies like TNS energo Voronezh commonly do use debt without problems. When we consider all the factors discussed, it seems to us that TNS energo Voronezh is taking some risks with its use of debt. While that debt can boost returns, we think the company has enough leverage now. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Take risks, for example - TNS energo Voronezh has 3 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you’re looking to trade TNS energo Voronezh, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if TNS energo Voronezh might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About MISX:VRSB

TNS energo Voronezh

Public Joint-stock Company “TNS energo Voronezh” purchases and sells electricity to individuals in the retail electricity market of the region in Russia.

Mediocre balance sheet with questionable track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026