- Russia

- /

- Metals and Mining

- /

- MISX:URKZ

Urals Stampings Plant PAO (MCX:URKZ) Seems To Use Debt Quite Sensibly

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Urals Stampings Plant PAO (MCX:URKZ) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Urals Stampings Plant PAO

What Is Urals Stampings Plant PAO's Net Debt?

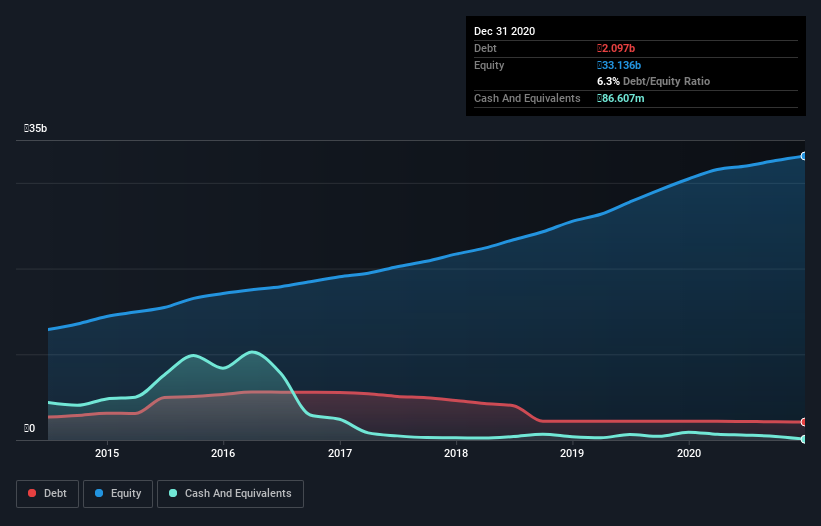

As you can see below, Urals Stampings Plant PAO had ₽2.10b of debt, at December 2020, which is about the same as the year before. You can click the chart for greater detail. However, it does have ₽86.6m in cash offsetting this, leading to net debt of about ₽2.01b.

A Look At Urals Stampings Plant PAO's Liabilities

According to the last reported balance sheet, Urals Stampings Plant PAO had liabilities of ₽1.83b due within 12 months, and liabilities of ₽2.13b due beyond 12 months. Offsetting this, it had ₽86.6m in cash and ₽8.58b in receivables that were due within 12 months. So it can boast ₽4.71b more liquid assets than total liabilities.

This surplus strongly suggests that Urals Stampings Plant PAO has a rock-solid balance sheet (and the debt is of no concern whatsoever). On this view, lenders should feel as safe as the beloved of a black-belt karate master.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Urals Stampings Plant PAO's net debt to EBITDA ratio of about 1.6 suggests only moderate use of debt. And its strong interest cover of 1k times, makes us even more comfortable. The modesty of its debt load may become crucial for Urals Stampings Plant PAO if management cannot prevent a repeat of the 77% cut to EBIT over the last year. When it comes to paying off debt, falling earnings are no more useful than sugary sodas are for your health. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Urals Stampings Plant PAO will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Happily for any shareholders, Urals Stampings Plant PAO actually produced more free cash flow than EBIT over the last three years. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

The good news is that Urals Stampings Plant PAO's demonstrated ability to cover its interest expense with its EBIT delights us like a fluffy puppy does a toddler. But the stark truth is that we are concerned by its EBIT growth rate. Zooming out, Urals Stampings Plant PAO seems to use debt quite reasonably; and that gets the nod from us. After all, sensible leverage can boost returns on equity. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Urals Stampings Plant PAO's earnings per share history for free.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you decide to trade Urals Stampings Plant PAO, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About MISX:URKZ

Urals Stampings Plant PAO

Urals Stampings Plant PAO engages in the production and sale of hot stampings and forgings in Russia.

Flawless balance sheet and slightly overvalued.