- Russia

- /

- Oil and Gas

- /

- MISX:SIBN

News Flash: Analysts Just Made A Meaningful Upgrade To Their Public Joint Stock Company Gazprom Neft (MCX:SIBN) Forecasts

Public Joint Stock Company Gazprom Neft (MCX:SIBN) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's statutory forecasts. The consensus estimated revenue numbers rose, with their view now clearly much more bullish on the company's business prospects. Investor sentiment seems to be improving too, with the share price up 6.0% to ₽359 over the past 7 days. Could this big upgrade push the stock even higher?

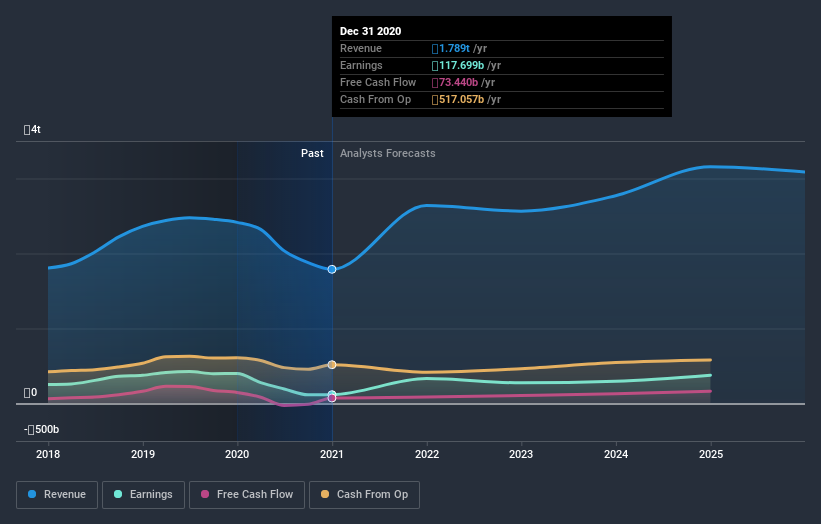

Following the upgrade, the latest consensus from Gazprom Neft's five analysts is for revenues of ₽2.6t in 2021, which would reflect a huge 48% improvement in sales compared to the last 12 months. Per-share earnings are expected to shoot up 97% to ₽49.06. Prior to this update, the analysts had been forecasting revenues of ₽2.4t and earnings per share (EPS) of ₽47.73 in 2021. Sentiment certainly seems to have improved in recent times, with a decent improvement in revenue and a small lift in earnings per share estimates.

Check out our latest analysis for Gazprom Neft

Despite these upgrades, the analysts have not made any major changes to their price target of US$4.76, suggesting that the higher estimates are not likely to have a long term impact on what the stock is worth. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. There are some variant perceptions on Gazprom Neft, with the most bullish analyst valuing it at US$454 and the most bearish at US$164 per share. As you can see the range of estimates is wide, with the lowest valuation coming in at less than half the most bullish estimate, suggesting there are some strongly diverging views on how think this business will perform. With this in mind, we wouldn't rely too heavily on the consensus price target, as it is just an average and analysts clearly have some deeply divergent views on the business.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. It's clear from the latest estimates that Gazprom Neft's rate of growth is expected to accelerate meaningfully, with the forecast 48% annualised revenue growth to the end of 2021 noticeably faster than its historical growth of 9.0% p.a. over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 9.0% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that Gazprom Neft is expected to grow much faster than its industry.

The Bottom Line

The biggest takeaway for us from these new estimates is that analysts upgraded their earnings per share estimates, with improved earnings power expected for this year. Fortunately, analysts also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. Seeing the dramatic upgrade to this year's forecasts, it might be time to take another look at Gazprom Neft.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. At Simply Wall St, we have a full range of analyst estimates for Gazprom Neft going out to 2025, and you can see them free on our platform here..

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you’re looking to trade Gazprom Neft, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About MISX:SIBN

Gazprom Neft

Public Joint Stock Company Gazprom Neft, an integrated oil company, engages in the exploration, development, production, and sale of crude oil and gas in Russia, the CIS countries, and internationally.

Outstanding track record with excellent balance sheet.