Is Now The Time To Put Russian Commercial Roads Bank (MCX:RDRB) On Your Watchlist?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like Russian Commercial Roads Bank (MCX:RDRB). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Russian Commercial Roads Bank

How Fast Is Russian Commercial Roads Bank Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. Over the last three years, Russian Commercial Roads Bank has grown EPS by 4.0% per year. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

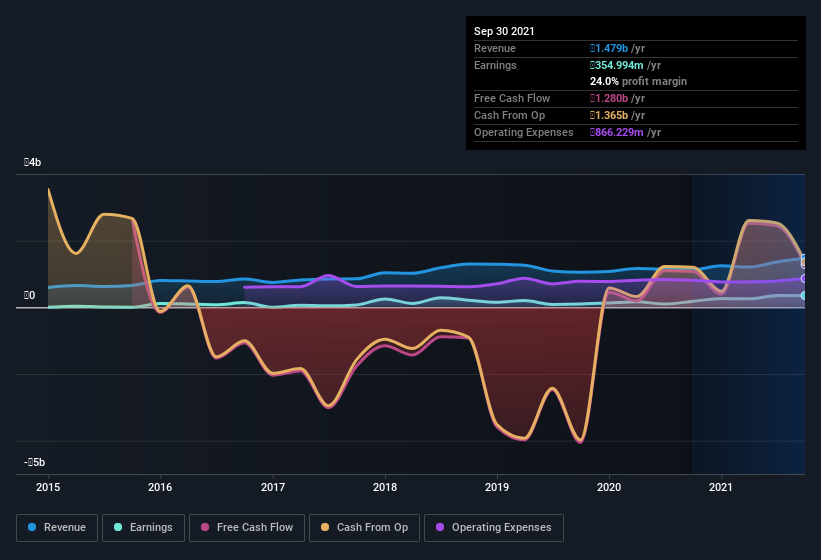

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. I note that Russian Commercial Roads Bank's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Russian Commercial Roads Bank maintained stable EBIT margins over the last year, all while growing revenue 31% to ₽1.5b. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

Since Russian Commercial Roads Bank is no giant, with a market capitalization of ₽3.3b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Russian Commercial Roads Bank Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So we're pleased to report that Russian Commercial Roads Bank insiders own a meaningful share of the business. Indeed, with a collective holding of 81%, company insiders are in control and have plenty of capital behind the venture. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. With that sort of holding, insiders have about ₽2.7b riding on the stock, at current prices. That's nothing to sneeze at!

Does Russian Commercial Roads Bank Deserve A Spot On Your Watchlist?

One positive for Russian Commercial Roads Bank is that it is growing EPS. That's nice to see. Just as polish makes silverware pop, the high level of insider ownership enhances my enthusiasm for this growth. That combination appeals to me, for one. So yes, I do think the stock is worth keeping an eye on. You should always think about risks though. Case in point, we've spotted 2 warning signs for Russian Commercial Roads Bank you should be aware of.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About MISX:RDRB

Russian Commercial Roads Bank

The Russian Public Joint-Stock Commercial Roads Bank (Public joint-stock company) provides various financial services in Russia.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives