- Serbia

- /

- Oil and Gas

- /

- BELEX:NIIS

We Think That There Are More Issues For Naftna Industrija Srbije a.d (BELEX:NIIS) Than Just Sluggish Earnings

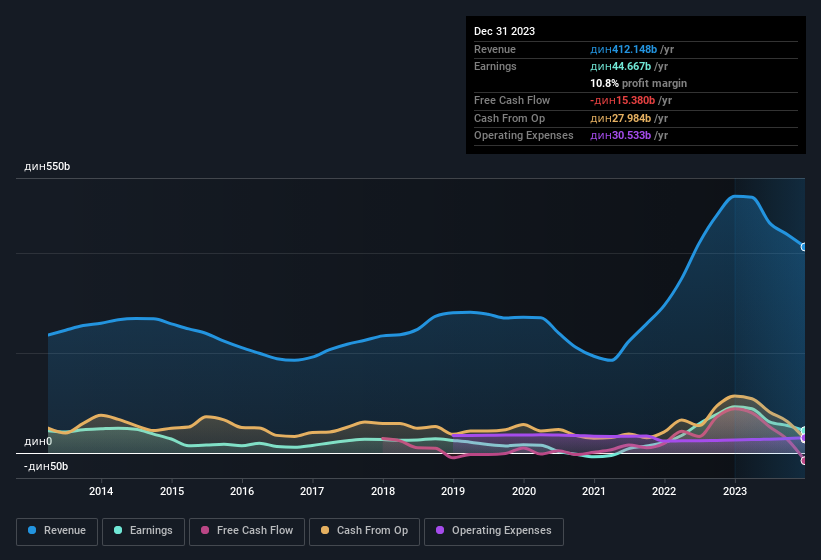

The subdued market reaction suggests that Naftna Industrija Srbije a.d.'s (BELEX:NIIS) recent earnings didn't contain any surprises. We think that investors are worried about some weaknesses underlying the earnings.

Check out our latest analysis for Naftna Industrija Srbije a.d

The Power Of Non-Operating Revenue

Most companies divide classify their revenue as either 'operating revenue', which comes from normal operations, and other revenue, which could include government grants, for example. Oftentimes, non-operating revenue spikes are not repeated, so it makes sense to be cautious where non-operating revenue has made a very large contribution to total profit. However, we note that when non-operating revenue increases suddenly, it will sometimes generate an unsustainable boost to profit. Notably, Naftna Industrija Srbije a.d had a significant increase in non-operating revenue over the last year. Indeed, its non-operating revenue rose from дин27.6b last year to дин47.6b this year. If that non-operating revenue fails to manifest in the current year, then there's a real risk the bottom line profit result will be impacted negatively. Sometimes, you can get a better idea of the underlying earnings potential of a company by excluding unusual boosts to non-operating revenue.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

How Do Unusual Items Influence Profit?

Alongside that spike in non-operating revenue, it's also important to note that Naftna Industrija Srbije a.d'sprofit was boosted by unusual items worth дин8.9b in the last twelve months. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. Which is hardly surprising, given the name. If Naftna Industrija Srbije a.d doesn't see that contribution repeat, then all else being equal we'd expect its profit to drop over the current year.

Our Take On Naftna Industrija Srbije a.d's Profit Performance

In its last report Naftna Industrija Srbije a.d benefitted from a spike in non-operating revenue which may have boosted its profit in a way that may be no more sustainable than low quality coal mining. And on top of that, it also saw an unusual item boost its profit, suggesting that next year might see a lower profit number, if these events are not repeated and everything else is equal. Considering all this we'd argue Naftna Industrija Srbije a.d's profits probably give an overly generous impression of its sustainable level of profitability. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. For instance, we've identified 4 warning signs for Naftna Industrija Srbije a.d (1 makes us a bit uncomfortable) you should be familiar with.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

Valuation is complex, but we're here to simplify it.

Discover if Naftna Industrija Srbije a.d might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BELEX:NIIS

Naftna Industrija Srbije a.d

An integrated oil company, engages in the exploration, development, and production of crude oil and gas in Serbia.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.