- Italy

- /

- Consumer Durables

- /

- BIT:BEC

European Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As European markets experience a boost in sentiment following the de-escalation of trade tensions between the U.S. and China, major indices such as Germany’s DAX and France’s CAC 40 have seen notable gains. In this context, dividend stocks can offer investors a potential source of steady income and stability, particularly appealing amid fluctuating economic conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 4.37% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.50% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.41% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.38% | ★★★★★★ |

| ERG (BIT:ERG) | 5.97% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 6.88% | ★★★★★★ |

| S.N. Nuclearelectrica (BVB:SNN) | 8.88% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.73% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.46% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.51% | ★★★★★★ |

Click here to see the full list of 233 stocks from our Top European Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

B&C Speakers (BIT:BEC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: B&C Speakers S.p.A. produces and markets professional loudspeakers under the B&C brand in Italy and internationally, with a market cap of €176.82 million.

Operations: B&C Speakers S.p.A. generates revenue through the production and marketing of professional loudspeakers globally.

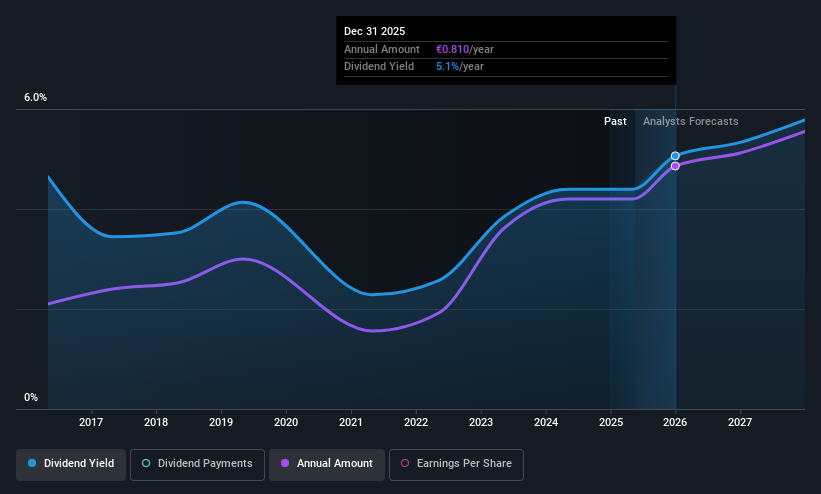

Dividend Yield: 4.3%

B&C Speakers offers a mixed dividend profile with a payout ratio of 44.1%, indicating dividends are well-covered by earnings, and a cash payout ratio of 74% showing coverage by cash flows. However, its dividend yield of 4.35% is below the top tier in Italy, and past payments have been volatile over the last decade despite recent increases. The company reported strong financial results for 2024 with net income rising to €17.8 million from €13.99 million in 2023.

- Click here to discover the nuances of B&C Speakers with our detailed analytical dividend report.

- Our expertly prepared valuation report B&C Speakers implies its share price may be lower than expected.

S.N. Nuclearelectrica (BVB:SNN)

Simply Wall St Dividend Rating: ★★★★★★

Overview: S.N. Nuclearelectrica S.A. is a Romanian company involved in the production and transmission of electricity and thermal energy, with a market capitalization of RON12.62 billion.

Operations: S.N. Nuclearelectrica S.A.'s revenue primarily comes from its activities in electricity and thermal energy production and transmission within Romania.

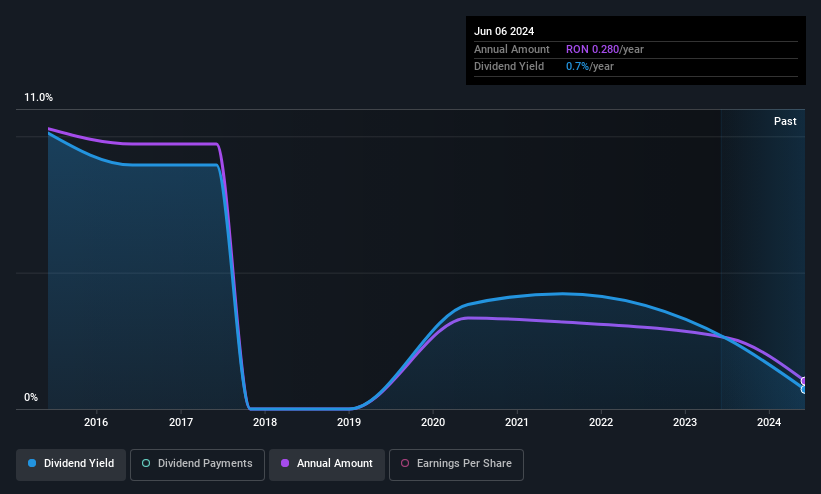

Dividend Yield: 8.9%

S.N. Nuclearelectrica offers a high dividend yield of 8.88%, placing it among the top dividend payers in Romania, supported by a payout ratio of 55.5% and cash flow coverage at 71.7%. Despite stable and reliable dividends over the past decade, recent financials show declining sales and net income, with earnings per share dropping from RON 8.24 to RON 5.6 year-over-year, prompting a reduced annual dividend of RON 2.7024 per share for June 2025.

- Dive into the specifics of S.N. Nuclearelectrica here with our thorough dividend report.

- The analysis detailed in our S.N. Nuclearelectrica valuation report hints at an inflated share price compared to its estimated value.

CNTEE Transelectrica (BVB:TEL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: CNTEE Transelectrica SA operates as the transmission and system operator for Romania's national power system, with a market cap of RON3.45 billion.

Operations: CNTEE Transelectrica SA generates revenue primarily through its role as a transmission and system operator for Romania's national power system.

Dividend Yield: 8.1%

CNTEE Transelectrica's dividend yield is 8.1%, ranking it in the top 25% of Romanian dividend payers. The company recently announced an annual dividend of RON 3.81 per share, payable in July 2025, with a payout ratio of 44.4% and cash flow coverage at 66%. Despite earnings growth and solid coverage by earnings and cash flows, its dividends have been volatile over the past decade, raising concerns about reliability despite recent improvements in net income.

- Click here and access our complete dividend analysis report to understand the dynamics of CNTEE Transelectrica.

- Upon reviewing our latest valuation report, CNTEE Transelectrica's share price might be too pessimistic.

Where To Now?

- Embark on your investment journey to our 233 Top European Dividend Stocks selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if B&C Speakers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:BEC

B&C Speakers

Engages in the production and marketing of professional loudspeakers under the B&C brand name in Italy, Latin America, Europe, North America, the Middle East, Africa, and Asia-Pacific.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives