Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, S.P.E.E.H. Hidroelectrica S.A. (BVB:H2O) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

What Is S.P.E.E.H. Hidroelectrica's Debt?

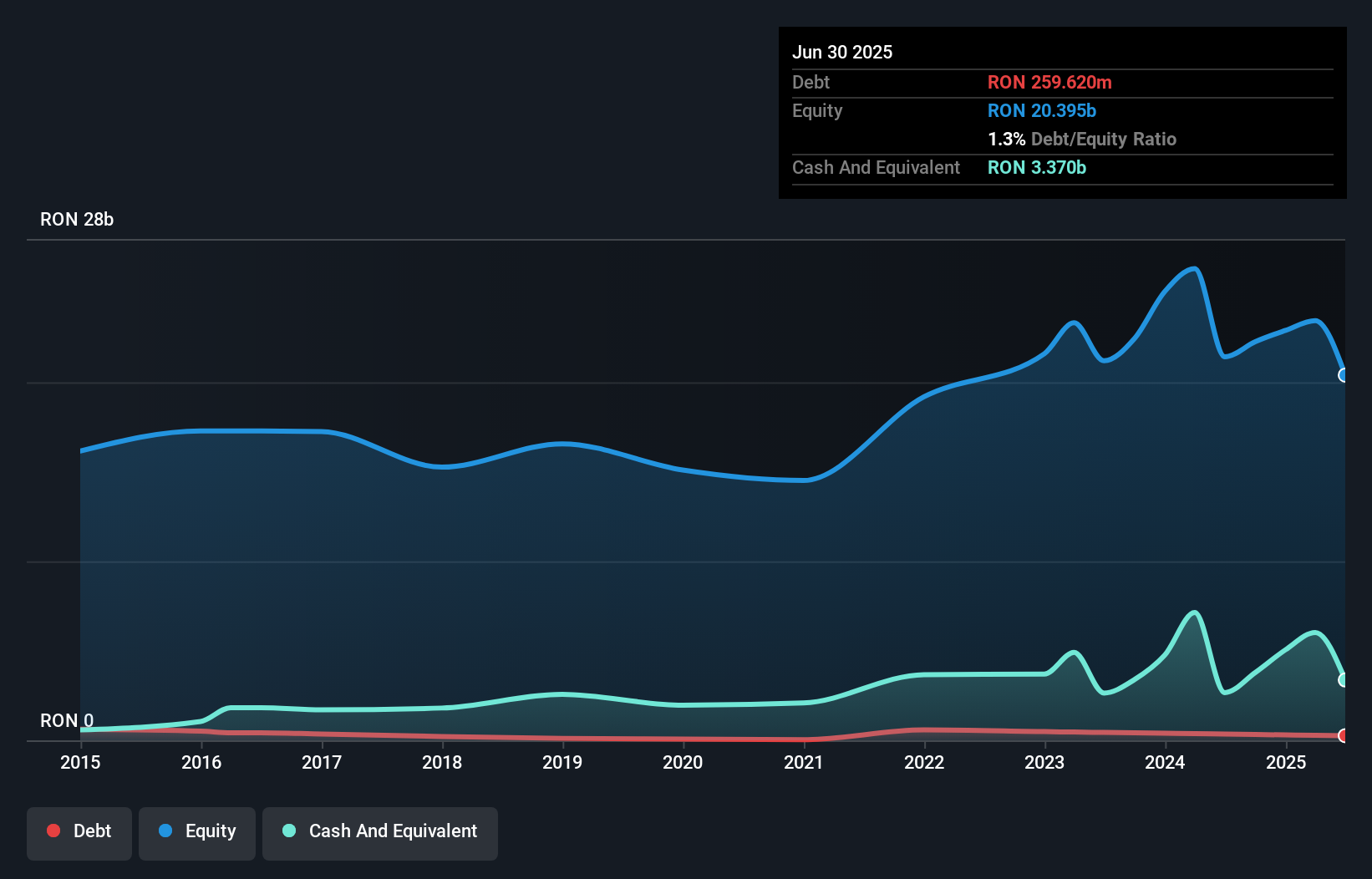

You can click the graphic below for the historical numbers, but it shows that S.P.E.E.H. Hidroelectrica had RON259.6m of debt in June 2025, down from RON347.3m, one year before. However, it does have RON3.37b in cash offsetting this, leading to net cash of RON3.11b.

A Look At S.P.E.E.H. Hidroelectrica's Liabilities

Zooming in on the latest balance sheet data, we can see that S.P.E.E.H. Hidroelectrica had liabilities of RON1.73b due within 12 months and liabilities of RON3.03b due beyond that. Offsetting these obligations, it had cash of RON3.37b as well as receivables valued at RON1.70b due within 12 months. So it can boast RON304.2m more liquid assets than total liabilities.

This state of affairs indicates that S.P.E.E.H. Hidroelectrica's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the RON54.4b company is short on cash, but still worth keeping an eye on the balance sheet. Succinctly put, S.P.E.E.H. Hidroelectrica boasts net cash, so it's fair to say it does not have a heavy debt load!

View our latest analysis for S.P.E.E.H. Hidroelectrica

It is just as well that S.P.E.E.H. Hidroelectrica's load is not too heavy, because its EBIT was down 44% over the last year. Falling earnings (if the trend continues) could eventually make even modest debt quite risky. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if S.P.E.E.H. Hidroelectrica can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While S.P.E.E.H. Hidroelectrica has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, S.P.E.E.H. Hidroelectrica generated free cash flow amounting to a very robust 95% of its EBIT, more than we'd expect. That positions it well to pay down debt if desirable to do so.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that S.P.E.E.H. Hidroelectrica has net cash of RON3.11b, as well as more liquid assets than liabilities. And it impressed us with free cash flow of RON4.3b, being 95% of its EBIT. So we are not troubled with S.P.E.E.H. Hidroelectrica's debt use. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that S.P.E.E.H. Hidroelectrica is showing 1 warning sign in our investment analysis , you should know about...

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BVB:H2O

S.P.E.E.H. Hidroelectrica

Produces and supplies hydro, wind, and energy electricity in Romania.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026