As global markets react to cooling U.S. inflation and strong bank earnings, major indices like the S&P 500 and Dow Jones Industrial Average have seen notable gains, with value stocks outperforming growth shares significantly. Amidst this backdrop of optimism and economic recalibration, investors are increasingly turning their attention to small-cap companies that may offer unique opportunities for growth in a shifting landscape. In such an environment, identifying promising stocks often involves looking beyond the usual suspects to uncover those with solid fundamentals and potential for expansion—qualities that can make them stand out as undiscovered gems in the market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| L&K Engineering | 14.36% | 37.26% | 54.49% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Sesoda | 71.33% | 11.54% | 15.53% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Great China Metal Ind | 0.32% | 2.69% | -3.41% | ★★★★★★ |

| China Electric Mfg | 13.74% | -13.57% | -32.70% | ★★★★★★ |

| ASRock Rack Incorporation | NA | 45.76% | 269.05% | ★★★★★★ |

| Savior Lifetec | NA | -7.74% | -0.77% | ★★★★★★ |

| Firich Enterprises | 34.24% | -2.31% | 25.41% | ★★★★★☆ |

| Systex | 31.75% | 12.06% | -1.88% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Societatea Energetica Electrica (BVB:EL)

Simply Wall St Value Rating: ★★★★☆☆

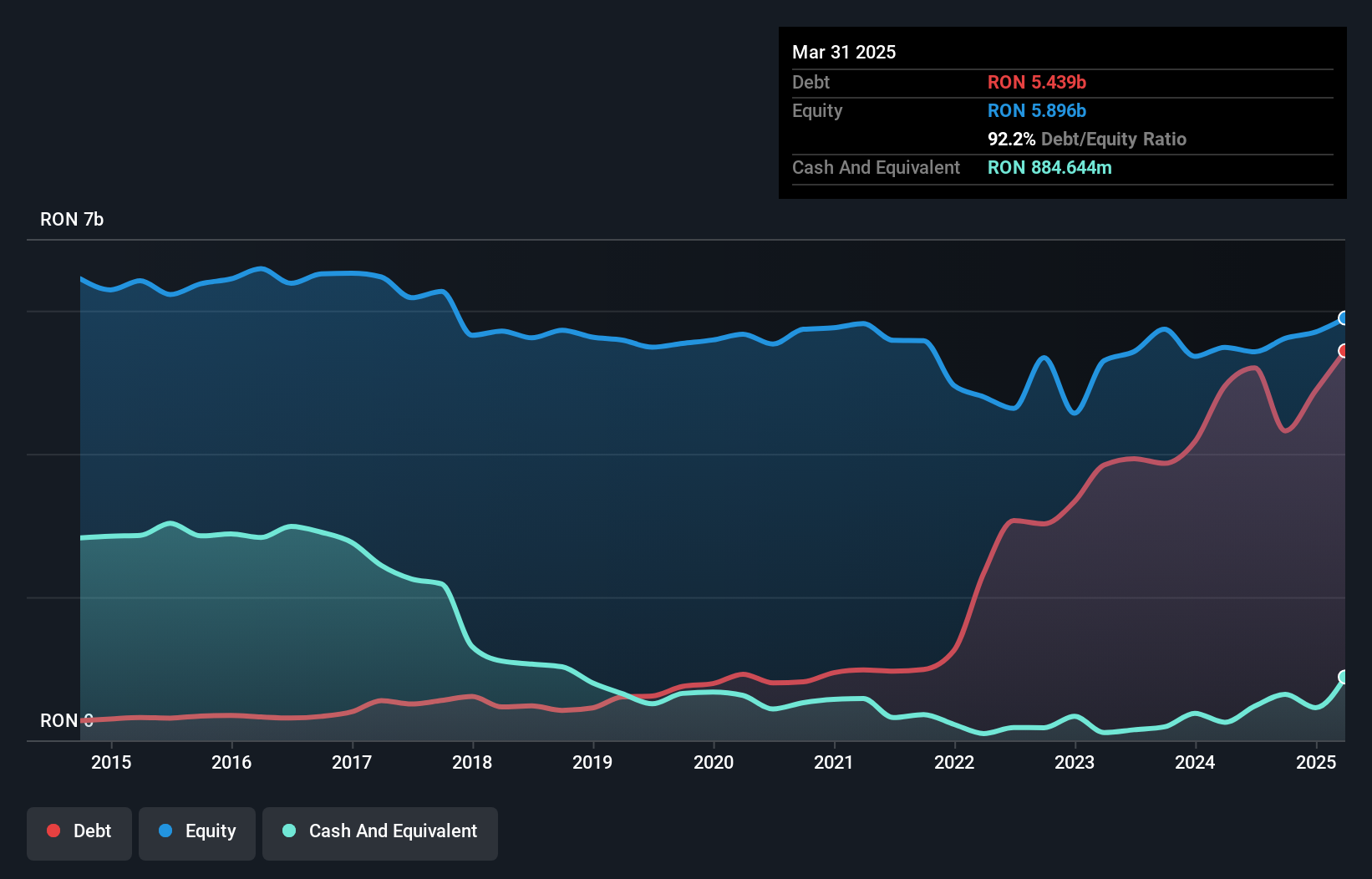

Overview: Societatea Energetica Electrica S.A. operates in Romania, focusing on the construction and maintenance of electricity distribution networks, with a market capitalization of RON4.99 billion.

Operations: Electrica generates significant revenue from its electricity and natural gas supply segment, amounting to RON9.86 billion, followed by electricity distribution at RON4.82 billion. The company's net profit margin is a key financial metric to consider when evaluating its profitability trends over time.

Electrica, a notable player in Romania's energy sector, has recently turned profitable and is trading at 26.6% below its estimated fair value, presenting an intriguing opportunity. Despite a high net debt to equity ratio of 65.6%, the company's interest payments are well covered by EBIT at 3.4x coverage, suggesting manageable debt servicing capabilities. Over the past five years, its debt to equity ratio increased from 13.6% to 77%, indicating rising leverage but also potential for strategic investments like Electrica Esyasoft Smart Solutions S.A., which focuses on smart grid technologies aimed at transforming the Romanian energy landscape with innovative solutions.

Digiwin (SZSE:300378)

Simply Wall St Value Rating: ★★★★★★

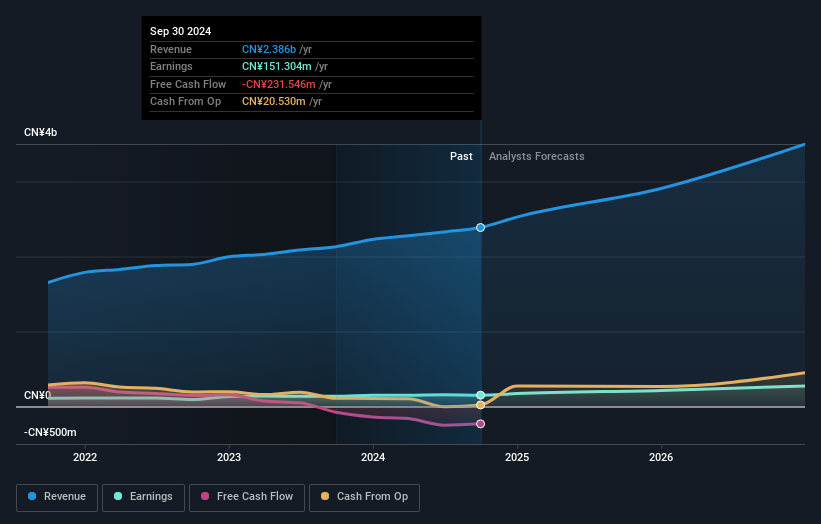

Overview: Digiwin Co., Ltd. offers industry-specific software solutions both in Mainland China and internationally, with a market capitalization of CN¥7.23 billion.

Operations: Digiwin Co., Ltd. generates revenue primarily from software services, amounting to CN¥2.39 billion.

Digiwin has shown promising growth with earnings increasing by 12.1% over the past year, outpacing the Software industry's -11.2%. The company reported sales of ¥1.57 billion for nine months ending September 2024, up from ¥1.41 billion a year earlier, while net income rose slightly to ¥49.89 million from ¥48.84 million. Despite its volatile share price recently, Digiwin’s price-to-earnings ratio of 47.8x remains attractive compared to the industry average of 83x, and it holds more cash than total debt, indicating financial stability and potential for future growth with forecasted earnings increase of 25.37% annually.

- Dive into the specifics of Digiwin here with our thorough health report.

Explore historical data to track Digiwin's performance over time in our Past section.

Lelon Electronics (TWSE:2472)

Simply Wall St Value Rating: ★★★★★★

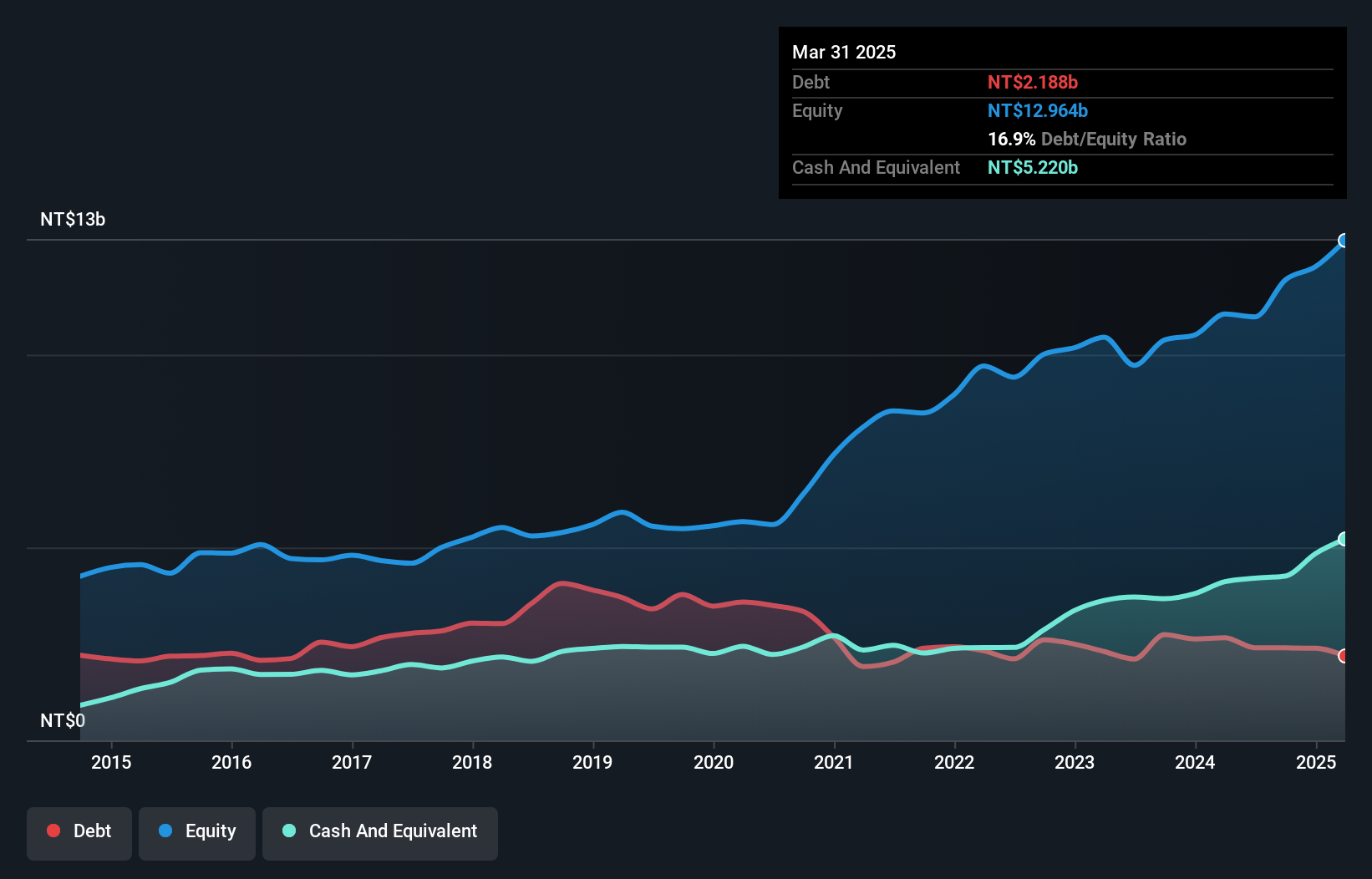

Overview: Lelon Electronics Corp. is engaged in the development, manufacturing, marketing, trading, and sales of electrolytic capacitors globally with a market cap of approximately NT$16.89 billion.

Operations: Lelon Electronics generates revenue primarily from its LELON Department and Li Dun Department, with NT$6.29 billion and NT$4.15 billion, respectively. The company has a market cap of approximately NT$16.89 billion.

Lelon Electronics, a smaller player in the electronics sector, has shown notable financial resilience. With earnings growing by 23% over the past year, it outpaced the industry average of 6.6%. The company's price-to-earnings ratio stands at 15.8x, which is below Taiwan's market average of 20.6x, suggesting potential value for investors. Lelon's debt management appears prudent as its debt to equity ratio decreased from 68.9% to 20.1% over five years and it holds more cash than total debt, indicating strong financial health and stability despite recent share price volatility.

- Click here to discover the nuances of Lelon Electronics with our detailed analytical health report.

Assess Lelon Electronics' past performance with our detailed historical performance reports.

Next Steps

- Embark on your investment journey to our 4649 Undiscovered Gems With Strong Fundamentals selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Digiwin, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300378

Digiwin

Provides industry-specific software solutions in Mainland China and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives