European Penny Stocks With Market Caps Over €40M To Consider

Reviewed by Simply Wall St

Amidst a backdrop of profit-taking and political turmoil, the European markets have seen a pullback from recent highs, with major indices such as Germany's DAX and France's CAC 40 experiencing declines. Despite these challenges, investors continue to seek opportunities in smaller companies that may offer growth potential at lower price points. Penny stocks, often representing smaller or newer firms, remain an intriguing area for exploration when they boast strong financials and solid fundamentals. This article highlights several European penny stocks that stand out as promising candidates for those interested in under-the-radar investment opportunities.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €3.884 | €1.34B | ✅ 5 ⚠️ 2 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.12 | €16.64M | ✅ 4 ⚠️ 4 View Analysis > |

| Maps (BIT:MAPS) | €3.33 | €44.23M | ✅ 4 ⚠️ 1 View Analysis > |

| DigiTouch (BIT:DGT) | €1.95 | €26.94M | ✅ 3 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €224.21M | ✅ 2 ⚠️ 2 View Analysis > |

| Hove (CPSE:HOVE) | DKK4.49 | DKK111.25M | ✅ 2 ⚠️ 2 View Analysis > |

| Siili Solutions Oyj (HLSE:SIILI) | €4.43 | €35.92M | ✅ 3 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.045 | €282.66M | ✅ 4 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.0786 | €8.31M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 278 stocks from our European Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Maps (BIT:MAPS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Maps S.p.A. is a software solution provider that designs and develops technological solutions to aid decision-making processes for public and private entities, with a market cap of €44.23 million.

Operations: Maps S.p.A. has not reported any specific revenue segments.

Market Cap: €44.23M

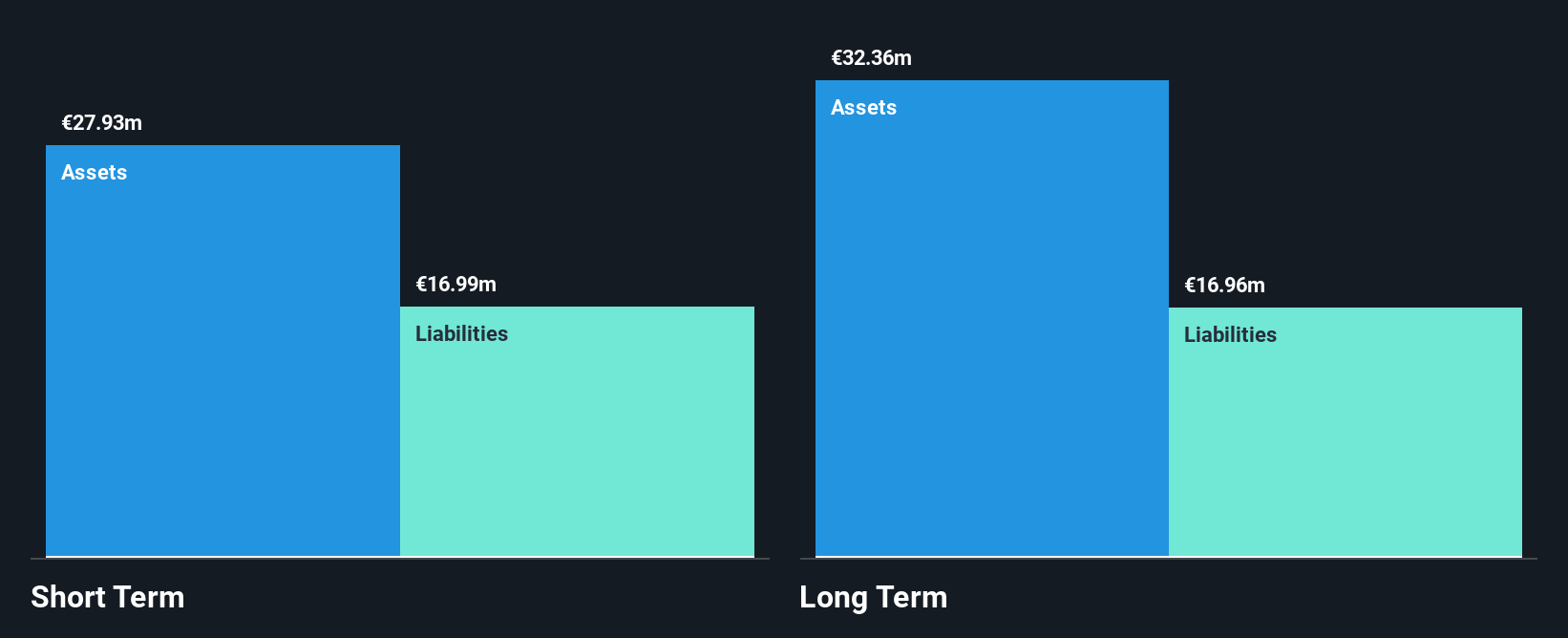

Maps S.p.A., with a market cap of €44.23 million, is trading at 37.4% below its estimated fair value, suggesting potential undervaluation in the market. The company has shown strong earnings growth of 64.3% over the past year, outpacing the software industry average and reversing its five-year decline trend. Its debt management is robust, with a reduced debt-to-equity ratio and well-covered interest payments by EBIT (10x). Despite low return on equity at 7.1%, Maps maintains high-quality earnings and stable weekly volatility (3%). Analysts forecast a stock price increase of 53.6%, indicating positive sentiment towards future performance.

- Dive into the specifics of Maps here with our thorough balance sheet health report.

- Assess Maps' future earnings estimates with our detailed growth reports.

TTS (Transport Trade Services) (BVB:TTS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: TTS (Transport Trade Services) S.A. is a Romanian company specializing in freight forwarding services, with a market cap of RON900 million.

Operations: The company's revenue is primarily derived from three segments: Forwarding (RON441.18 million), River Transport (RON283.22 million), and Port Operations (RON130.67 million).

Market Cap: RON900M

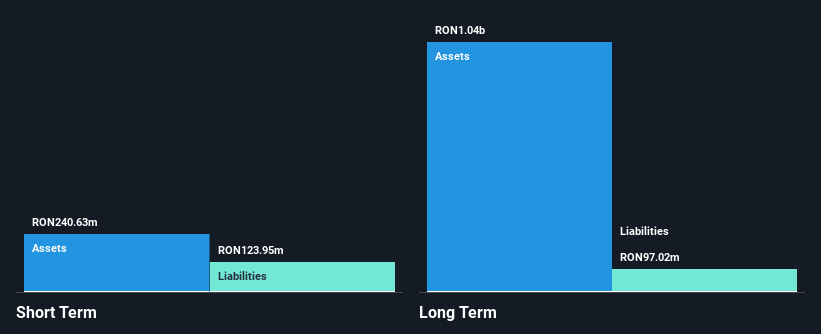

Transport Trade Services (TTS) S.A., with a market cap of RON900 million, is trading at 59.3% below its estimated fair value, indicating potential undervaluation. Despite being unprofitable and reporting a net loss of RON17.23 million for H1 2025, TTS has reduced its debt-to-equity ratio over the past five years to a satisfactory level of 6.4%. Short-term assets exceed both short-term and long-term liabilities, providing some financial stability. However, the dividend yield of 3.1% is not well covered by earnings or cash flows, highlighting sustainability concerns amidst declining sales figures compared to the previous year.

- Click to explore a detailed breakdown of our findings in TTS (Transport Trade Services)'s financial health report.

- Examine TTS (Transport Trade Services)'s earnings growth report to understand how analysts expect it to perform.

Ilkka Oyj (HLSE:ILKKA2)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ilkka Oyj, with a market cap of €100.23 million, operates in the publishing and printing sectors both in Finland and internationally through its subsidiaries.

Operations: The company's revenue is primarily generated from its Marketing and Technology Services segment, which accounts for €34.47 million.

Market Cap: €100.23M

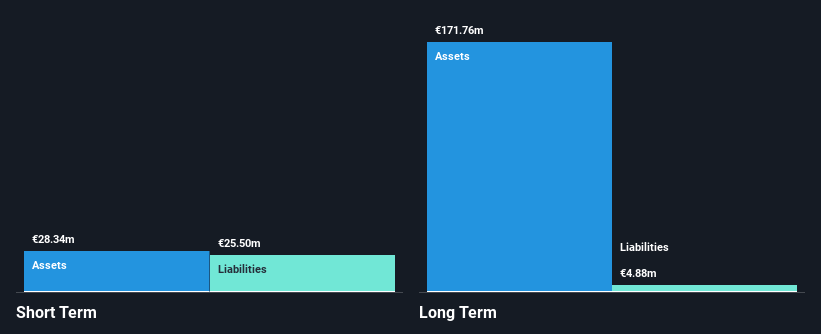

Ilkka Oyj, with a market cap of €100.23 million, has shown strong recent performance in the publishing and printing sectors, reporting second-quarter sales of €9.73 million and net income of €11.93 million. Despite this growth, its earnings are impacted by a significant one-off gain of €1.1 million over the past year. The company maintains financial stability with short-term assets exceeding liabilities and more cash than total debt; however, its dividend yield is not well covered by earnings or free cash flows. Future challenges include an expected decline in earnings by 3.7% annually over the next three years.

- Click here and access our complete financial health analysis report to understand the dynamics of Ilkka Oyj.

- Evaluate Ilkka Oyj's prospects by accessing our earnings growth report.

Next Steps

- Take a closer look at our European Penny Stocks list of 278 companies by clicking here.

- Searching for a Fresh Perspective? AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:MAPS

Maps

A software solution provider, designs and develops technological solutions to support decision-making processes in public and private businesses and organizations.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives