- Romania

- /

- Healthcare Services

- /

- BVB:M

Top Growth Companies With Insider Ownership In February 2025

Reviewed by Simply Wall St

As global markets continue to navigate a landscape marked by rising inflation and cautious monetary policy, U.S. stock indexes are climbing toward record highs, with growth stocks outperforming their value counterparts. In this environment, companies with high insider ownership can be particularly appealing as they often signify strong alignment between management and shareholders, potentially offering resilience and strategic focus during uncertain times.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.7% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| On Holding (NYSE:ONON) | 19.1% | 29.9% |

| Pharma Mar (BME:PHM) | 11.9% | 45.4% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

We'll examine a selection from our screener results.

Med Life (BVB:M)

Simply Wall St Growth Rating: ★★★★★☆

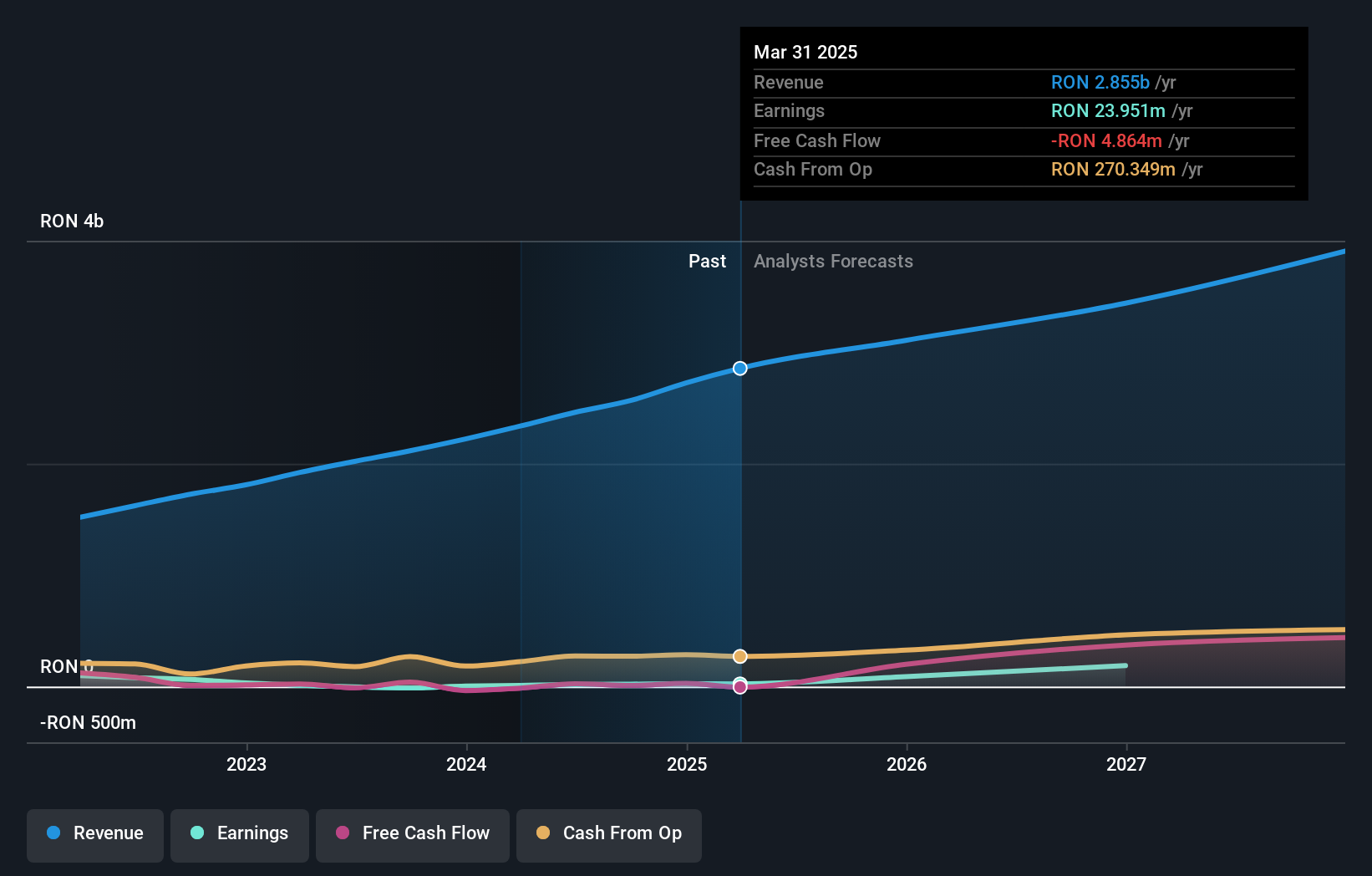

Overview: Med Life S.A. is a private healthcare provider offering services across multiple cities in Romania, with a market cap of RON3.11 billion.

Operations: The company's revenue is primarily generated from its Clinics segment at RON964.73 million, followed by Hospitals at RON595.99 million, Corporate services at RON294.65 million, Laboratories at RON284.81 million, Dentistry services at RON124.30 million, and Pharmacies contributing RON64.82 million.

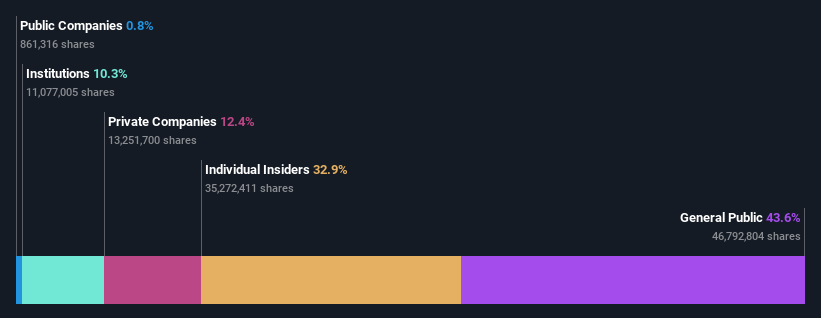

Insider Ownership: 39.3%

Earnings Growth Forecast: 92.9% p.a.

Med Life is positioned for significant growth, with earnings projected to increase substantially at 92.9% annually over the next three years, outpacing the broader market. While trading at a substantial discount of 46.7% below its estimated fair value, Med Life's revenue is expected to grow at 11% per year. However, interest payments are not well covered by current earnings, which may pose financial challenges despite its profitability achieved this year.

- Click here to discover the nuances of Med Life with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Med Life is trading beyond its estimated value.

Foosung (KOSE:A093370)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Foosung Co., Ltd. operates in South Korea, manufacturing and selling chemical products for industries such as automotive, iron and steel, semiconductor, construction, and environmental sectors with a market cap of approximately ₩555.58 billion.

Operations: The company's revenue is primarily derived from its Fluorine Compounds Sector, generating approximately ₩288.93 billion, and its Chemical Engineering Division, contributing around ₩162.84 billion.

Insider Ownership: 32.9%

Earnings Growth Forecast: 120.4% p.a.

Foosung, with high insider ownership, is poised for significant growth. Its earnings are forecast to surge 120.35% annually and revenue is expected to grow at 19.3% per year, surpassing the KR market's average growth rate of 9%. Despite its high debt levels, Foosung trades at a substantial discount of 74.1% below fair value estimates and aims for profitability within three years, although its projected Return on Equity remains low at 5.6%.

- Dive into the specifics of Foosung here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Foosung's share price might be too optimistic.

Strike CompanyLimited (TSE:6196)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Strike Company, Limited offers mergers and acquisitions brokerage services for small and medium-sized companies in Japan, with a market cap of ¥62.31 billion.

Operations: The company generates revenue of ¥18.13 billion from its M&A Intermediary Business segment, focusing on brokerage services for small and medium-sized enterprises in Japan.

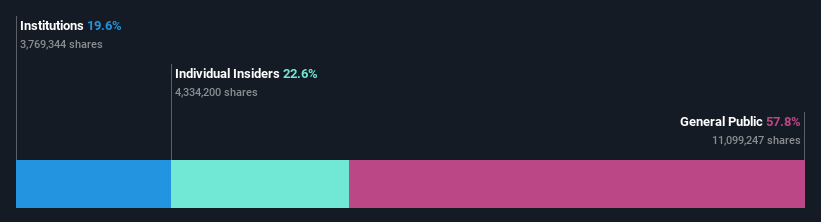

Insider Ownership: 22.6%

Earnings Growth Forecast: 17.2% p.a.

Strike Company Limited's revenue is projected to grow at 17.5% annually, outpacing the JP market's 4.2% growth rate, while earnings are expected to increase by 17.23% per year. The stock trades at a significant discount of 55.1% below fair value estimates and boasts a high forecasted Return on Equity of 26.7%. Despite recent share price volatility and no substantial insider trading activity reported in the past three months, its growth potential remains strong.

- Unlock comprehensive insights into our analysis of Strike CompanyLimited stock in this growth report.

- Our expertly prepared valuation report Strike CompanyLimited implies its share price may be lower than expected.

Make It Happen

- Dive into all 1460 of the Fast Growing Companies With High Insider Ownership we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BVB:M

Med Life

A private healthcare provider, offers healthcare services in Bucharest, Cluj, Braila, Timisoara, Iasi, Galati, Ploiesti, Constanta, and Targu Mures.

High growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives