- Netherlands

- /

- Machinery

- /

- ENXTAM:ENVI

European Growth Companies With High Insider Ownership To Watch In May 2025

Reviewed by Simply Wall St

As European markets experience a boost in sentiment following the de-escalation of U.S.-China trade tensions, investors are keenly observing growth companies that demonstrate resilience and potential. In this environment, stocks with high insider ownership can be particularly appealing, as they often indicate strong confidence from those closest to the company's operations and strategy.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| KebNi (OM:KEBNI B) | 38.3% | 67% |

| Yubico (OM:YUBICO) | 36.6% | 30.4% |

| Vow (OB:VOW) | 13.1% | 81% |

| Pharma Mar (BME:PHM) | 11.8% | 43.1% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 63.2% |

| Elicera Therapeutics (OM:ELIC) | 23.8% | 107.1% |

| CD Projekt (WSE:CDR) | 29.7% | 37.4% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 57.1% |

| Lokotech Group (OB:LOKO) | 14.5% | 58.1% |

| Nordic Halibut (OB:NOHAL) | 29.7% | 60.7% |

Let's take a closer look at a couple of our picks from the screened companies.

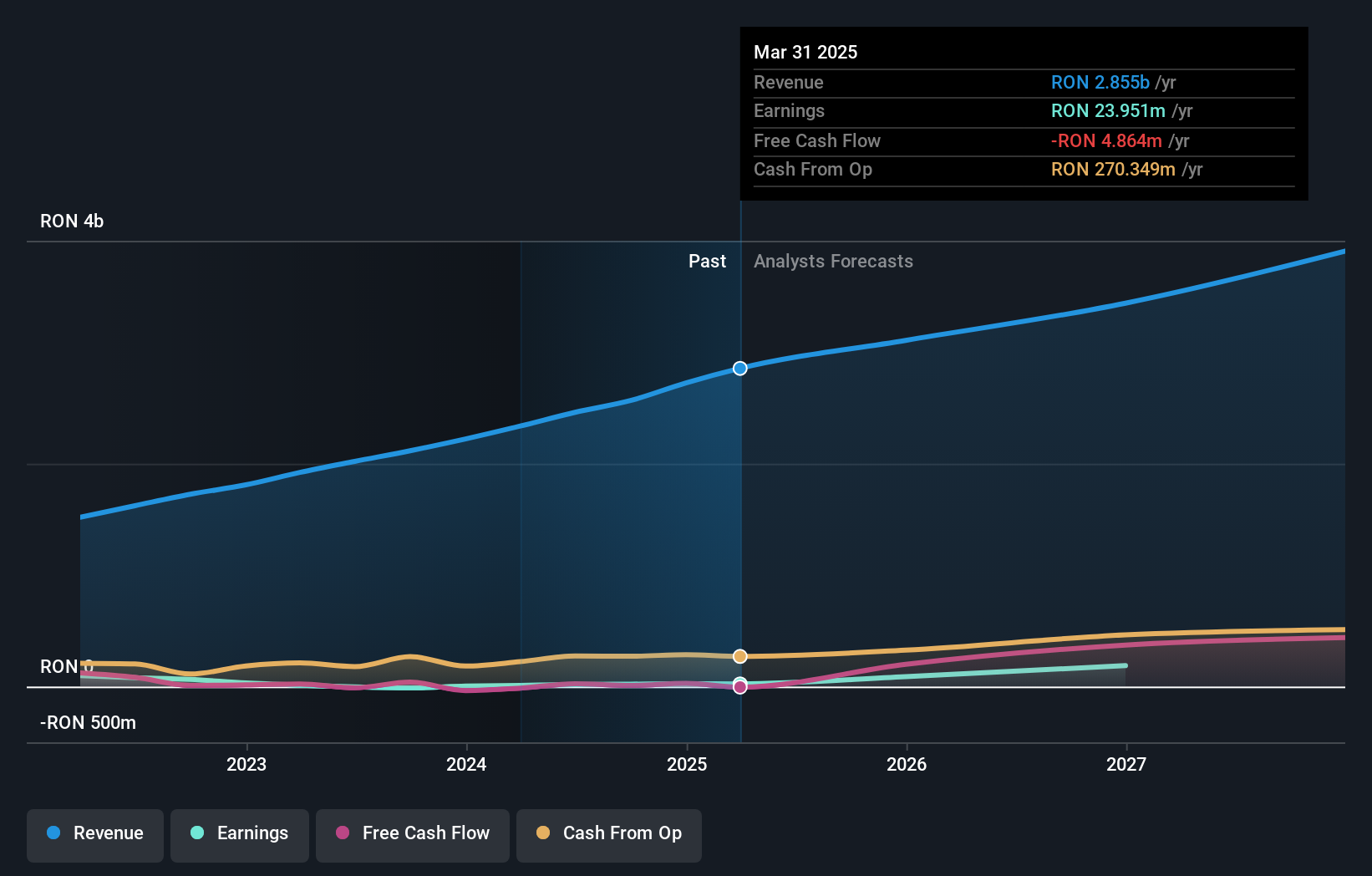

Med Life (BVB:M)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Med Life S.A. is a private healthcare provider offering services through medical centers in various Romanian cities, with a market cap of RON3.27 billion.

Operations: Revenue segments for the private healthcare provider include medical centers located in Bucharest, Cluj, Braila, Timisoara, Iasi, Galati, Ploiesti, Constanta, and Targu Mures.

Insider Ownership: 39.3%

Med Life is trading at 45.2% below its estimated fair value, indicating potential undervaluation. Its earnings are expected to grow significantly over the next three years, with a forecasted annual growth rate of 93.63%, outpacing the regional market's average. Although revenue growth is slower than 20% annually, it still exceeds the regional market's pace. Despite strong growth prospects, interest payments are not well covered by earnings, which may pose financial challenges.

- Click here to discover the nuances of Med Life with our detailed analytical future growth report.

- Our valuation report here indicates Med Life may be overvalued.

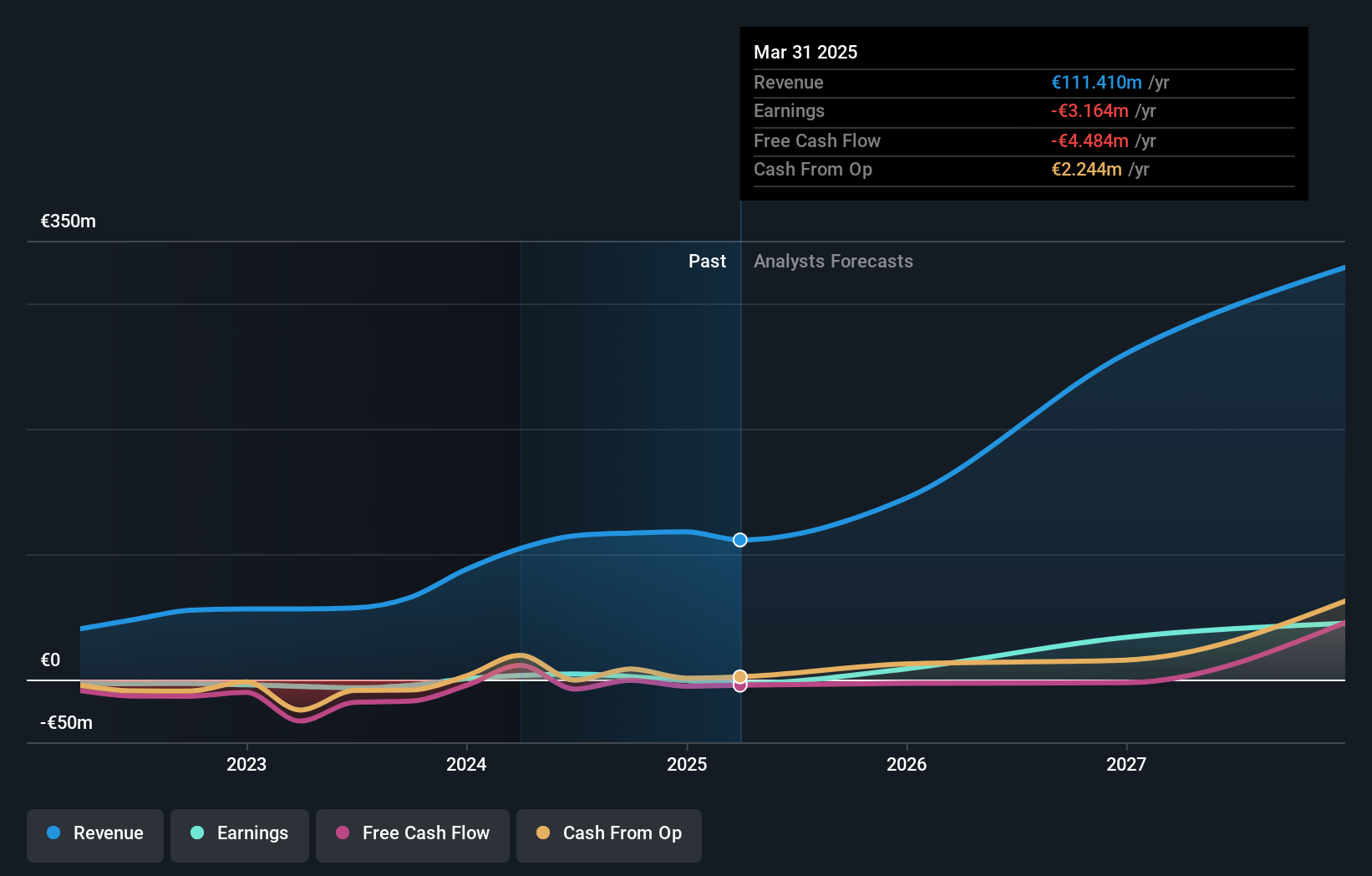

Envipco Holding (ENXTAM:ENVI)

Simply Wall St Growth Rating: ★★★★★★

Overview: Envipco Holding N.V. operates by designing, developing, manufacturing, assembling, marketing, selling, leasing, and servicing reverse vending machines to collect and process used beverage containers across the Netherlands, North America, and Europe with a market cap of €375.36 million.

Operations: Envipco Holding N.V.'s revenue is primarily derived from the design, development, manufacture, assembly, marketing, sale, leasing, and servicing of reverse vending machines for collecting and processing used beverage containers in the Netherlands, North America, and Europe.

Insider Ownership: 37.7%

Envipco Holding's strategic expansion in Romania, including a new Engineering Center of Excellence and substantial RVM orders, highlights its commitment to growth in Europe's circular economy. Despite recent financial setbacks with a Q1 2025 net loss of €2.39 million, the company's revenue is forecast to grow significantly at 39.6% annually, surpassing market averages. Trading at 93.6% below estimated fair value and expected profitability within three years suggest potential for future growth despite current volatility.

- Click to explore a detailed breakdown of our findings in Envipco Holding's earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of Envipco Holding shares in the market.

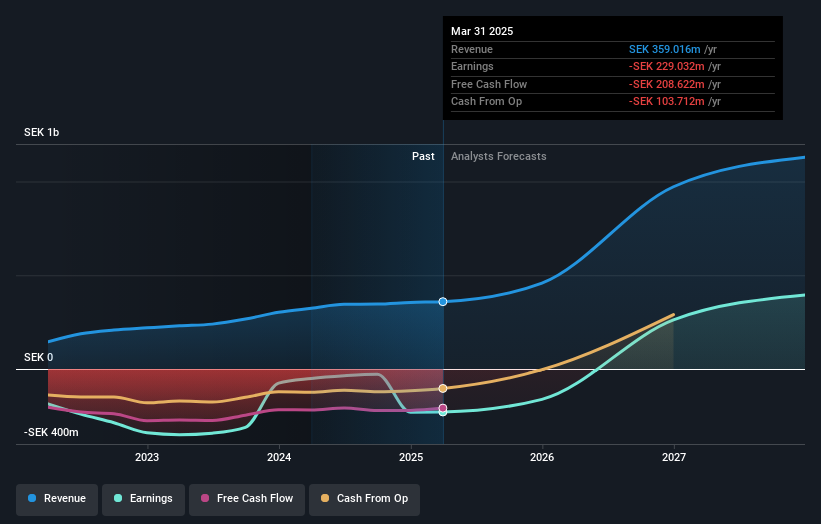

Smart Eye (OM:SEYE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Smart Eye AB (publ) specializes in developing AI technology solutions that analyze and predict human behavior across the Nordics, Europe, North America, Asia, and globally, with a market cap of SEK24.79 billion.

Operations: Smart Eye AB (publ) generates revenue through its AI technology solutions that focus on understanding and predicting human behavior across various regions, including the Nordics, Europe, North America, Asia, and other international markets.

Insider Ownership: 15.3%

Smart Eye's growth trajectory is underscored by its substantial insider ownership and strategic advancements in the automotive industry. The company anticipates a 42.6% annual revenue increase, outpacing the Swedish market significantly. Recent board changes and new client agreements with major European and Asian car manufacturers enhance its market position. Despite a net loss of SEK 55.1 million in Q1 2025, Smart Eye's innovative driver monitoring technologies are gaining traction, with projected profitability within three years.

- Dive into the specifics of Smart Eye here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Smart Eye's share price might be too optimistic.

Summing It All Up

- Get an in-depth perspective on all 216 Fast Growing European Companies With High Insider Ownership by using our screener here.

- Contemplating Other Strategies? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Envipco Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ENVI

Envipco Holding

Designs, develops, manufactures, assembles, markets, sells, leases, and services reverse vending machines (RVM) to collect and process used beverage containers primarily in the Netherlands, North America, and rest of Europe.

Exceptional growth potential and good value.

Market Insights

Community Narratives