European Stocks That May Be Priced Below Intrinsic Value In August 2025

Reviewed by Simply Wall St

As the European markets experience a lift from the prospect of lower U.S. borrowing costs, with indices like the STOXX Europe 600 Index and the UK's FTSE 100 reaching new highs, investors are increasingly focused on identifying stocks that may be undervalued amidst this optimistic environment. In such conditions, a good stock is often characterized by strong fundamentals and potential for growth that is not yet fully reflected in its current market price.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Robit Oyj (HLSE:ROBIT) | €1.16 | €2.26 | 48.8% |

| Norconsult (OB:NORCO) | NOK45.80 | NOK90.81 | 49.6% |

| innoscripta (XTRA:1INN) | €101.60 | €197.30 | 48.5% |

| Honkarakenne Oyj (HLSE:HONBS) | €2.87 | €5.60 | 48.8% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.57 | €6.91 | 48.3% |

| ATON Green Storage (BIT:ATON) | €2.08 | €4.09 | 49.2% |

| Atea (OB:ATEA) | NOK146.20 | NOK285.00 | 48.7% |

| Aquila Part Prod Com (BVB:AQ) | RON1.458 | RON2.85 | 48.8% |

| Apotea (OM:APOTEA) | SEK107.22 | SEK209.15 | 48.7% |

| ABO Energy GmbH KGaA (XTRA:AB9) | €36.60 | €71.71 | 49% |

Here's a peek at a few of the choices from the screener.

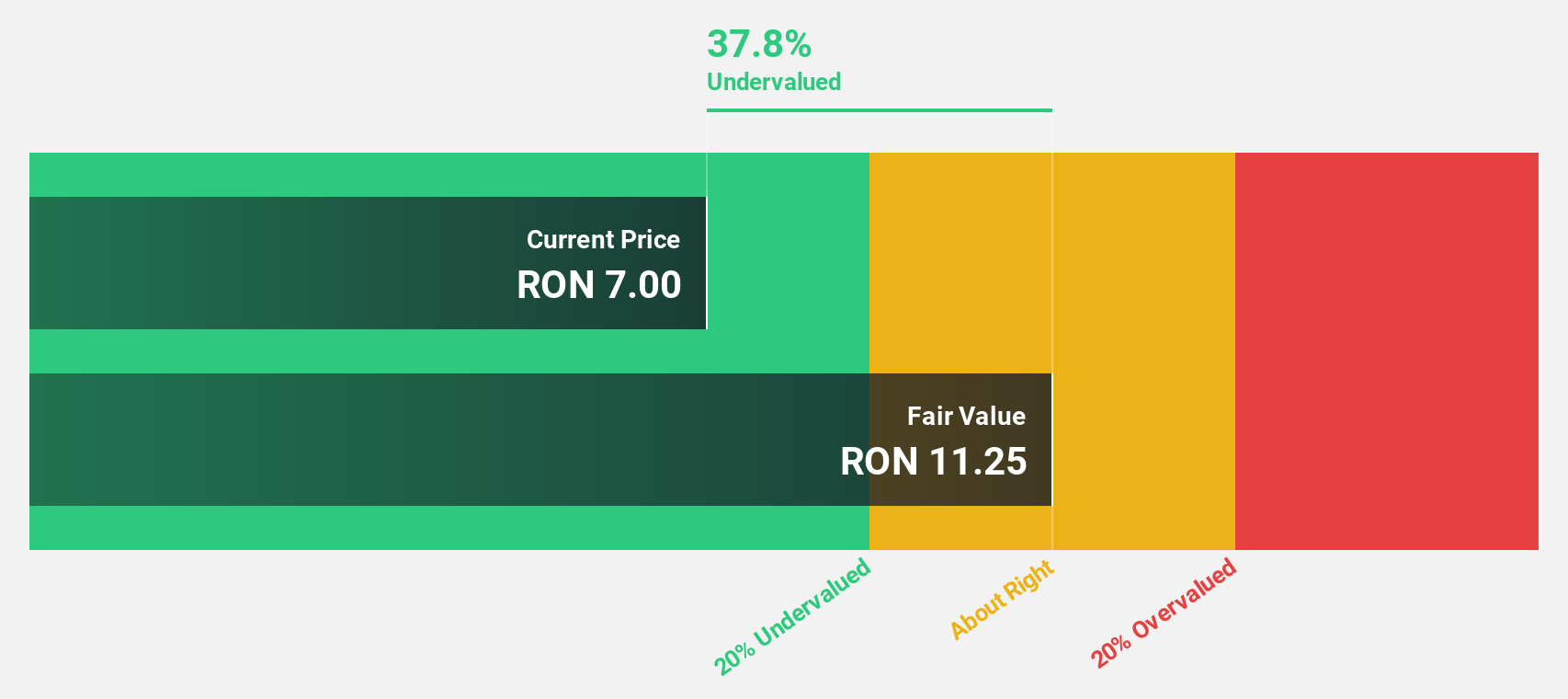

SNGN Romgaz (BVB:SNG)

Overview: SNGN Romgaz SA is a Romanian company engaged in the exploration, production, and supply of natural gas, with a market capitalization of RON32.72 billion.

Operations: The company's revenue segments include Upstream at RON7.79 billion, Storage at RON589.22 million, and Electricity at RON548.74 million.

Estimated Discount To Fair Value: 32.6%

SNGN Romgaz appears undervalued, trading 32.6% below its estimated fair value of RON 12.6, with a current price of RON 8.49. Recent earnings showed an increase in sales to RON 1.87 billion for Q2, up from RON 1.62 billion a year earlier, and net income rose to RON 728 million from RON 592 million. Forecasts indicate annual earnings growth of 11.7%, outpacing the Romanian market average of 5.6%.

- Insights from our recent growth report point to a promising forecast for SNGN Romgaz's business outlook.

- Dive into the specifics of SNGN Romgaz here with our thorough financial health report.

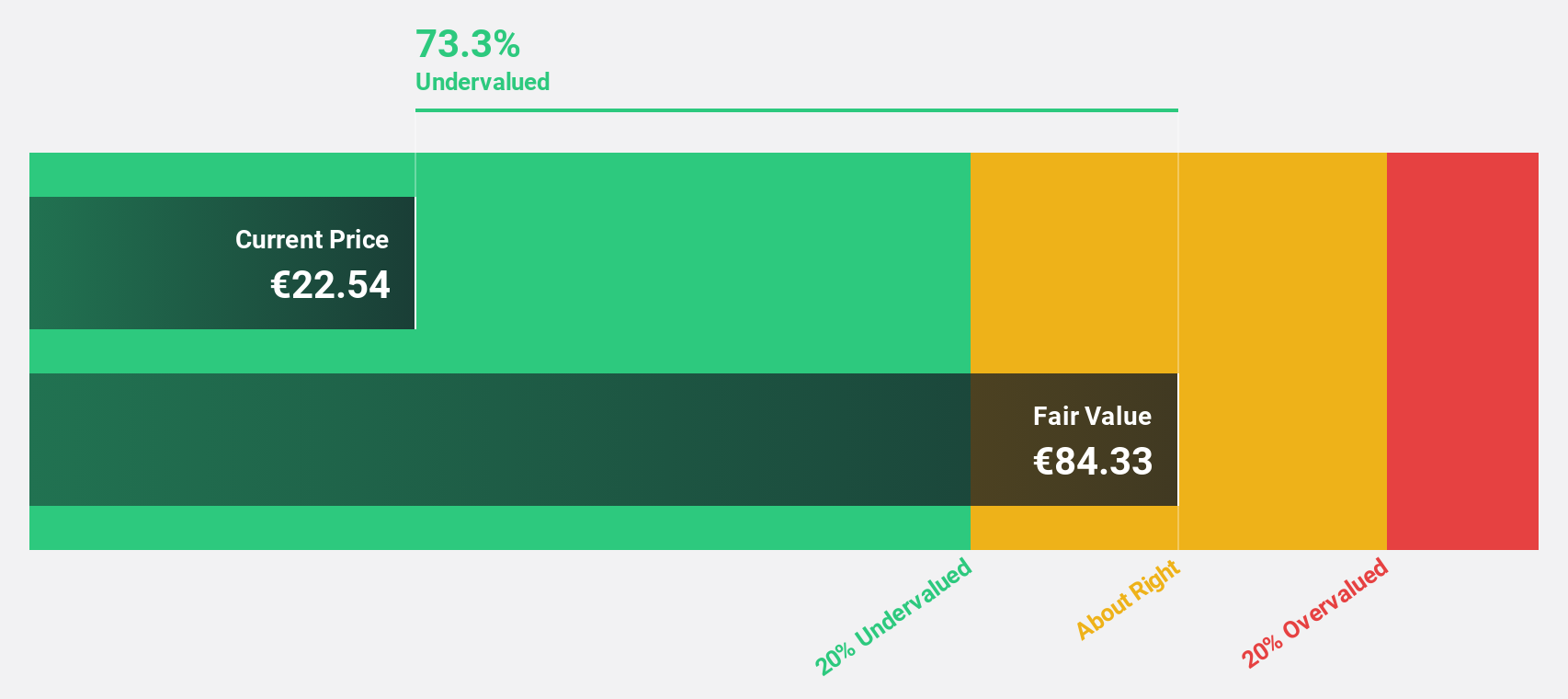

Verallia Société Anonyme (ENXTPA:VRLA)

Overview: Verallia Société Anonyme is a global manufacturer and seller of glass packaging products for the beverage and food industries, with a market cap of €3.16 billion.

Operations: The company's revenue segments consist of €413.90 million from Latin America, €739.40 million from Northern and Eastern Europe, and €2.27 billion from Southern and Western Europe.

Estimated Discount To Fair Value: 13.5%

Verallia Société Anonyme is trading at €26.82, below its estimated fair value of €30.99, indicating undervaluation based on cash flows. Despite a forecasted slower revenue growth of 2.1% per year compared to the French market, earnings are expected to grow significantly at 22.07% annually, surpassing market averages. However, profit margins have decreased from last year and the dividend yield of 6.34% is not well-covered by earnings. Recent M&A activity saw BW Gestao de Investimentos Ltda acquiring a significant stake in Verallia for €2.5 billion, offering shareholders an immediate liquidity window with a premium price per share offer of €30 while maintaining Verallia's public listing status and management strategy support.

- Our comprehensive growth report raises the possibility that Verallia Société Anonyme is poised for substantial financial growth.

- Take a closer look at Verallia Société Anonyme's balance sheet health here in our report.

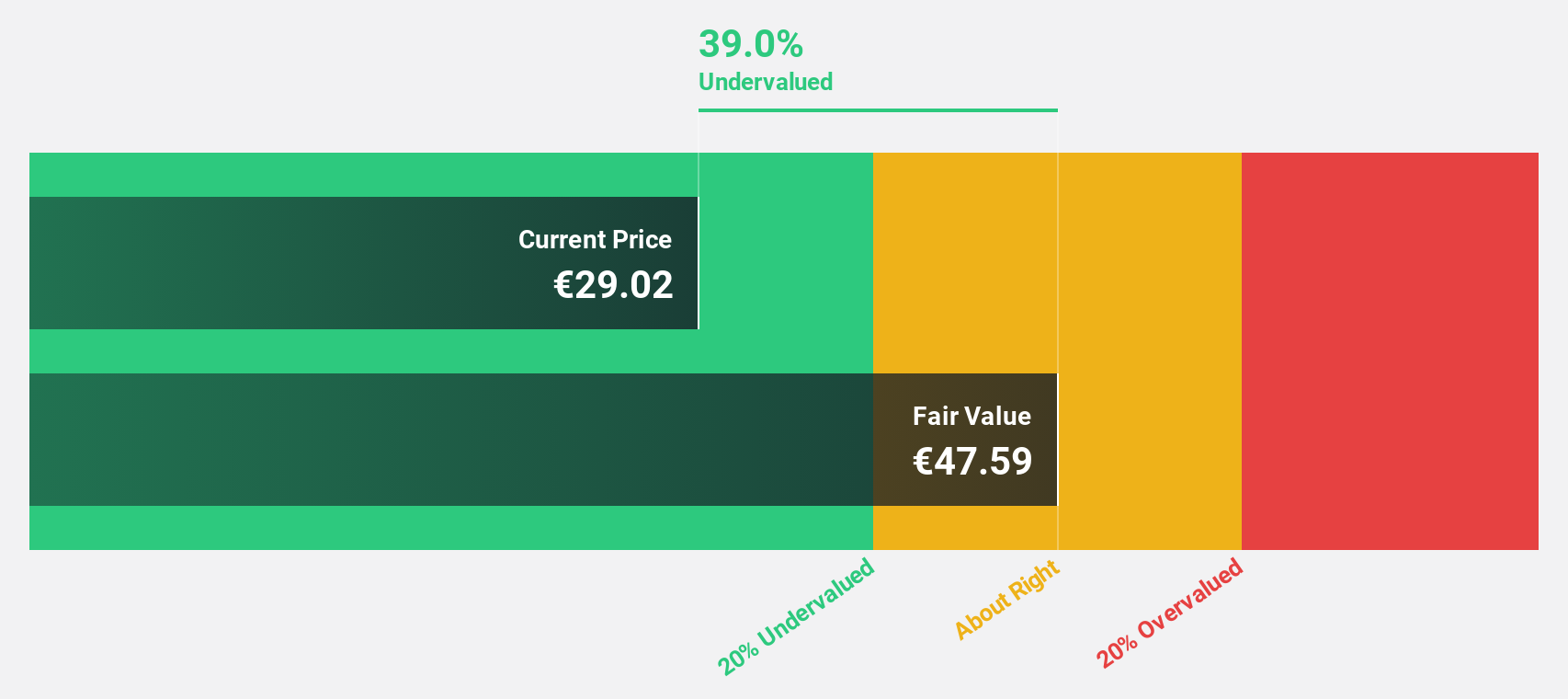

Valmet Oyj (HLSE:VALMT)

Overview: Valmet Oyj is a company that develops and supplies process technologies, automation, and services for the pulp, paper, and energy industries across various global regions, with a market cap of €5.54 billion.

Operations: Valmet Oyj generates its revenue through three primary segments: Services (€1.91 billion), Automation (€1.49 billion), and Process Technologies (€1.85 billion).

Estimated Discount To Fair Value: 38.8%

Valmet Oyj, trading at €30.09, is undervalued with a fair value estimate of €49.15 based on cash flows. Earnings are forecasted to grow significantly at 24.5% annually, outpacing the Finnish market's growth rate. However, recent earnings have been impacted by large one-off items and the dividend yield of 4.49% is not well-covered by earnings. Recent strategic agreements in China and Brazil highlight Valmet's strong customer relationships and potential for future revenue streams despite current financial challenges.

- According our earnings growth report, there's an indication that Valmet Oyj might be ready to expand.

- Get an in-depth perspective on Valmet Oyj's balance sheet by reading our health report here.

Make It Happen

- Investigate our full lineup of 211 Undervalued European Stocks Based On Cash Flows right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VRLA

Verallia Société Anonyme

Manufactures and sells glass packaging products for beverages and food products worldwide.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives