David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies SNGN Romgaz SA (BVB:SNG) makes use of debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for SNGN Romgaz

What Is SNGN Romgaz's Debt?

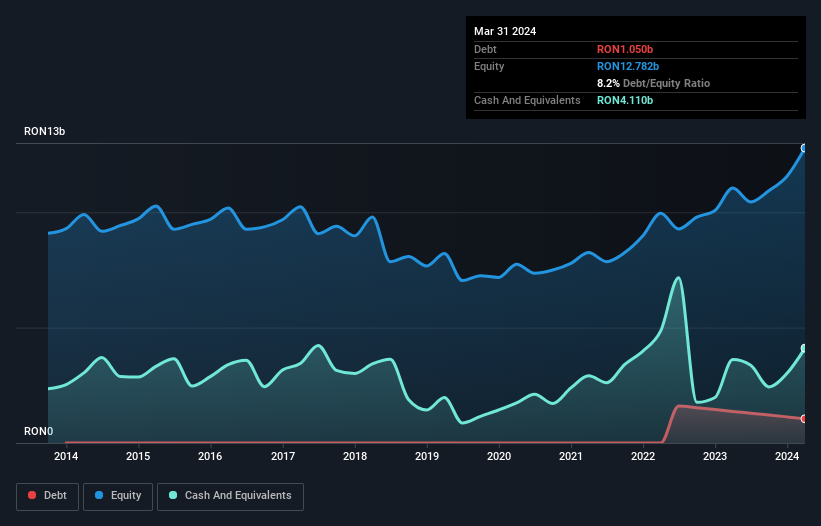

As you can see below, SNGN Romgaz had RON1.05b of debt at March 2024, down from RON1.37b a year prior. But on the other hand it also has RON4.11b in cash, leading to a RON3.06b net cash position.

How Healthy Is SNGN Romgaz's Balance Sheet?

We can see from the most recent balance sheet that SNGN Romgaz had liabilities of RON3.49b falling due within a year, and liabilities of RON1.67b due beyond that. Offsetting this, it had RON4.11b in cash and RON1.48b in receivables that were due within 12 months. So it actually has RON439.1m more liquid assets than total liabilities.

This state of affairs indicates that SNGN Romgaz's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the RON23.0b company is short on cash, but still worth keeping an eye on the balance sheet. Simply put, the fact that SNGN Romgaz has more cash than debt is arguably a good indication that it can manage its debt safely.

The good news is that SNGN Romgaz has increased its EBIT by 2.3% over twelve months, which should ease any concerns about debt repayment. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if SNGN Romgaz can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. SNGN Romgaz may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last three years, SNGN Romgaz recorded free cash flow worth a fulsome 87% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that SNGN Romgaz has net cash of RON3.06b, as well as more liquid assets than liabilities. The cherry on top was that in converted 87% of that EBIT to free cash flow, bringing in RON3.2b. So we don't think SNGN Romgaz's use of debt is risky. Over time, share prices tend to follow earnings per share, so if you're interested in SNGN Romgaz, you may well want to click here to check an interactive graph of its earnings per share history.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you're looking to trade SNGN Romgaz, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BVB:SNG

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives