S.C. Independenta S.A. (BVB:INTA) Stock Rockets 30% As Investors Are Less Pessimistic Than Expected

S.C. Independenta S.A. (BVB:INTA) shares have had a really impressive month, gaining 30% after a shaky period beforehand. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

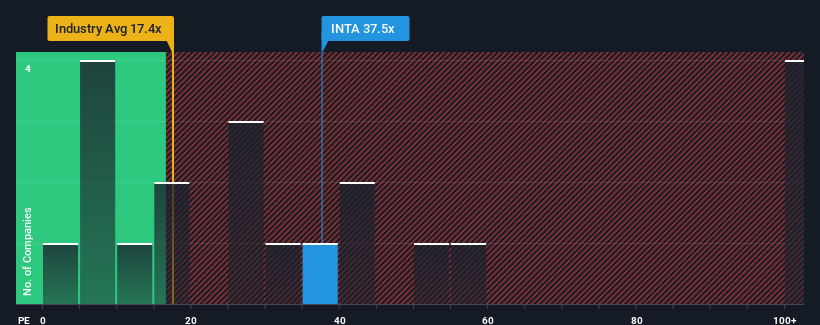

Since its price has surged higher, given close to half the companies in Romania have price-to-earnings ratios (or "P/E's") below 13x, you may consider S.C. Independenta as a stock to avoid entirely with its 37.5x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Recent times have been quite advantageous for S.C. Independenta as its earnings have been rising very briskly. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for S.C. Independenta

Is There Enough Growth For S.C. Independenta?

In order to justify its P/E ratio, S.C. Independenta would need to produce outstanding growth well in excess of the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 106% last year. Still, incredibly EPS has fallen 58% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for a contraction of 7.1% shows the market is more attractive on an annualised basis regardless.

With this information, it's strange that S.C. Independenta is trading at a higher P/E in comparison. In general, when earnings shrink rapidly the P/E premium often shrinks too, which could set up shareholders for future disappointment. There's potential for the P/E to fall to lower levels if the company doesn't improve its profitability, which would be difficult to do with the current market outlook.

The Key Takeaway

S.C. Independenta's P/E is flying high just like its stock has during the last month. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of S.C. Independenta revealed its sharp three-year contraction in earnings isn't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to shrink less severely. When we see below average earnings, we suspect the share price is at risk of declining, sending the high P/E lower. We're also cautious about the company's ability to stay its recent medium-term course and resist even greater pain to its business from the broader market turmoil. This would place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Plus, you should also learn about these 3 warning signs we've spotted with S.C. Independenta (including 1 which is potentially serious).

If these risks are making you reconsider your opinion on S.C. Independenta, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if S.C. Independenta might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.