S.C. Caromet S.A. (BVB:ARMT) Stock Rockets 30% But Many Are Still Ignoring The Company

S.C. Caromet S.A. (BVB:ARMT) shareholders would be excited to see that the share price has had a great month, posting a 30% gain and recovering from prior weakness. Looking further back, the 12% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

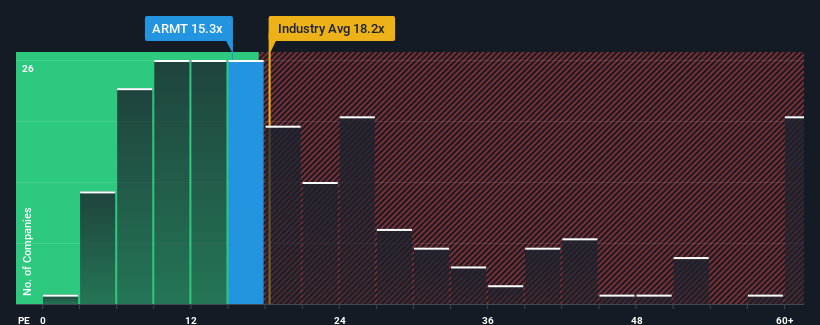

In spite of the firm bounce in price, there still wouldn't be many who think S.C. Caromet's price-to-earnings (or "P/E") ratio of 15.3x is worth a mention when the median P/E in Romania is similar at about 15x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Our free stock report includes 3 warning signs investors should be aware of before investing in S.C. Caromet. Read for free now.Earnings have risen firmly for S.C. Caromet recently, which is pleasing to see. It might be that many expect the respectable earnings performance to wane, which has kept the P/E from rising. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

Check out our latest analysis for S.C. Caromet

Is There Some Growth For S.C. Caromet?

In order to justify its P/E ratio, S.C. Caromet would need to produce growth that's similar to the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 23% last year. The latest three year period has also seen an excellent 61% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 4.2% shows it's noticeably more attractive on an annualised basis.

In light of this, it's curious that S.C. Caromet's P/E sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Final Word

Its shares have lifted substantially and now S.C. Caromet's P/E is also back up to the market median. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that S.C. Caromet currently trades on a lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with S.C. Caromet (at least 2 which don't sit too well with us), and understanding these should be part of your investment process.

You might be able to find a better investment than S.C. Caromet. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BVB:ARMT

S.C. Caromet

Manufactures and sells railway rolling stocks, hydro-mechanical equipment, and welded assemblies in Romania.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives