- Qatar

- /

- Marine and Shipping

- /

- DSM:QNNS

Need To Know: One Analyst Is Much More Bullish On Qatar Navigation Q.P.S.C. (DSM:QNNS) Revenues

Celebrations may be in order for Qatar Navigation Q.P.S.C. (DSM:QNNS) shareholders, with the covering analyst delivering a significant upgrade to their statutory estimates for the company. The revenue forecast for next year has experienced a facelift, with the analyst now much more optimistic on its sales pipeline.

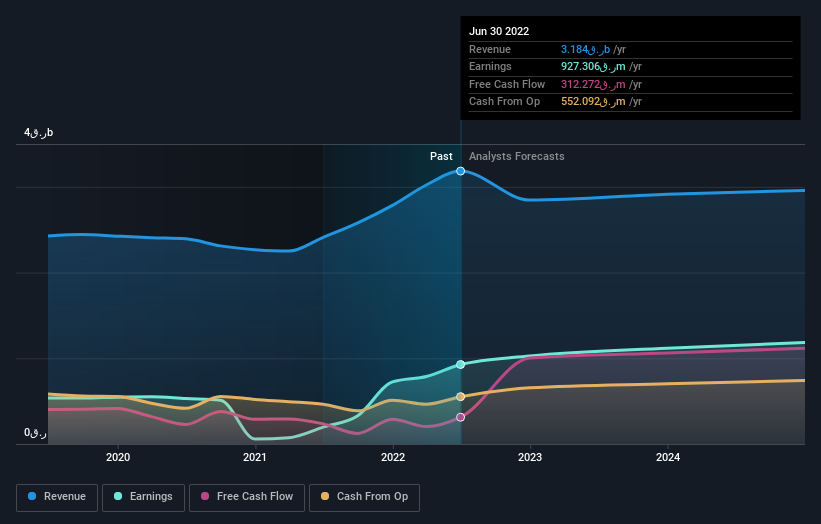

Following the latest upgrade, Qatar Navigation Q.P.S.C's single analyst currently expects revenues in 2023 to be ر.ق3.2b, approximately in line with the last 12 months. Per-share earnings are expected to soar 26% to ر.ق1.03. Before this latest update, the analyst had been forecasting revenues of ر.ق2.9b and earnings per share (EPS) of ر.ق0.98 in 2023. The most recent forecasts are noticeably more optimistic, with a solid increase in revenue estimates and a lift to earnings per share as well.

Our analysis indicates that QNNS is potentially undervalued!

Despite these upgrades, the analyst has not made any major changes to their price target of ر.ق11.25, suggesting that the higher estimates are not likely to have a long term impact on what the stock is worth. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. The most optimistic Qatar Navigation Q.P.S.C analyst has a price target of ر.ق12.40 per share, while the most pessimistic values it at ر.ق10.00. The narrow spread of estimates could suggest that the business' future is relatively easy to value, or that the analyst has a clear view on its prospects.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. We would highlight that Qatar Navigation Q.P.S.C's revenue growth is expected to slow, with the forecast 1.4% annualised growth rate until the end of 2023 being well below the historical 3.0% p.a. growth over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenue shrink 13% per year. Factoring in the forecast slowdown in growth, it's pretty clear that Qatar Navigation Q.P.S.C is still expected to grow faster than the wider industry.

The Bottom Line

The most important thing to take away from this upgrade is that the analyst upgraded their earnings per share estimates for next year, expecting improving business conditions. On the plus side, they also lifted their revenue estimates, and the company is expected to perform better than the wider market. Given that the analyst appears to be expecting substantial improvement in the sales pipeline, now could be the right time to take another look at Qatar Navigation Q.P.S.C.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At least one analyst has provided forecasts out to 2024, which can be seen for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if Qatar Navigation Q.P.S.C might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DSM:QNNS

Qatar Navigation Q.P.S.C

Operates as a maritime and logistics company in Qatar, the United Arab Emirates, Singapore, and Germany.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Landlord of Orbit" – A Deep Value Play Ahead of the Starlab Era

The "AI-Immunology" Asymmetric Opportunity – Validated by Merck (MSD)

The Hidden Gem of AI Hardware – Solving the Data Center Bottleneck

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026