Is Mesaieed Petrochemical Holding Company Q.P.S.C.'s (DSM:MPHC) 2.2% Dividend Sustainable?

Is Mesaieed Petrochemical Holding Company Q.P.S.C. (DSM:MPHC) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. Yet sometimes, investors buy a popular dividend stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

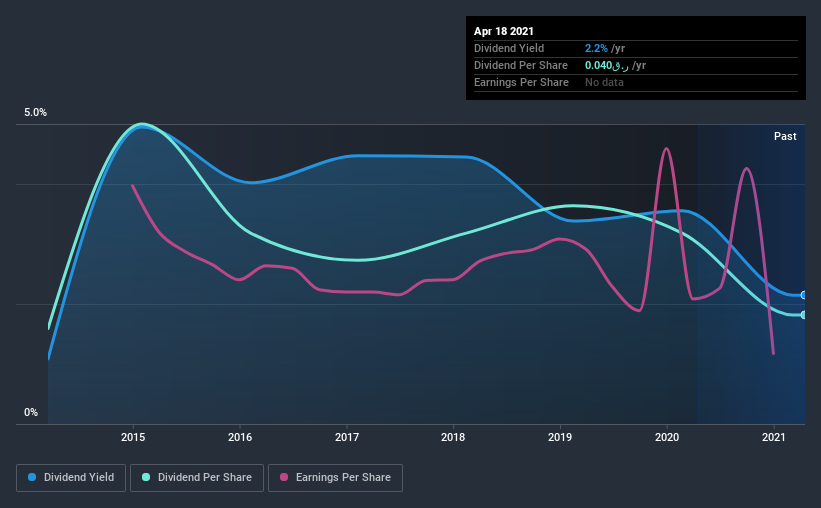

With a 2.2% yield and a seven-year payment history, investors probably think Mesaieed Petrochemical Holding Company Q.P.S.C looks like a reliable dividend stock. While the yield may not look too great, the relatively long payment history is interesting. Before you buy any stock for its dividend however, you should always remember Warren Buffett's two rules: 1) Don't lose money, and 2) Remember rule #1. We'll run through some checks below to help with this.

Click the interactive chart for our full dividend analysis

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. In the last year, Mesaieed Petrochemical Holding Company Q.P.S.C paid out 94% of its profit as dividends. Its payout ratio is quite high, and the dividend is not well covered by earnings. If earnings are growing or the company has a large cash balance, this might be sustainable - still, we think it is a concern.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. Unfortunately, while Mesaieed Petrochemical Holding Company Q.P.S.C pays a dividend, it also reported negative free cash flow last year. While there may be a good reason for this, it's not ideal from a dividend perspective.

With a strong net cash balance, Mesaieed Petrochemical Holding Company Q.P.S.C investors may not have much to worry about in the near term from a dividend perspective.

Consider getting our latest analysis on Mesaieed Petrochemical Holding Company Q.P.S.C's financial position here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. Mesaieed Petrochemical Holding Company Q.P.S.C has been paying a dividend for the past seven years. Although it has been paying a dividend for several years now, the dividend has been cut at least once, and we're cautious about the consistency of its dividend across a full economic cycle. During the past seven-year period, the first annual payment was ر.ق0.04 in 2014, compared to ر.ق0.04 last year. This works out to be a compound annual growth rate (CAGR) of approximately 1.9% a year over that time. The growth in dividends has not been linear, but the CAGR is a decent approximation of the rate of change over this time frame.

It's good to see some dividend growth, but the dividend has been cut at least once, and the size of the cut would eliminate most of the growth, anyway. We're not that enthused by this.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to see if earnings per share (EPS) are growing. Why take the risk of a dividend getting cut, unless there's a good chance of bigger dividends in future? Over the past five years, it looks as though Mesaieed Petrochemical Holding Company Q.P.S.C's EPS have declined at around 13% a year. A sharp decline in earnings per share is not great from from a dividend perspective, as even conservative payout ratios can come under pressure if earnings fall far enough.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. It's a concern to see that the company paid out such a high percentage of its earnings and cashflow as dividends. Second, earnings per share have been in decline, and its dividend has been cut at least once in the past. Using these criteria, Mesaieed Petrochemical Holding Company Q.P.S.C looks quite suboptimal from a dividend investment perspective.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Are management backing themselves to deliver performance? Check their shareholdings in Mesaieed Petrochemical Holding Company Q.P.S.C in our latest insider ownership analysis.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

If you decide to trade Mesaieed Petrochemical Holding Company Q.P.S.C, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About DSM:MPHC

Mesaieed Petrochemical Holding Company Q.P.S.C

Mesaieed Petrochemical Holding Company Q.P.S.C.

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)