Investors Still Aren't Entirely Convinced By Qatar General Insurance & Reinsurance Company Q.P.S.C.'s (DSM:QGRI) Revenues Despite 37% Price Jump

Despite an already strong run, Qatar General Insurance & Reinsurance Company Q.P.S.C. (DSM:QGRI) shares have been powering on, with a gain of 37% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 32% in the last year.

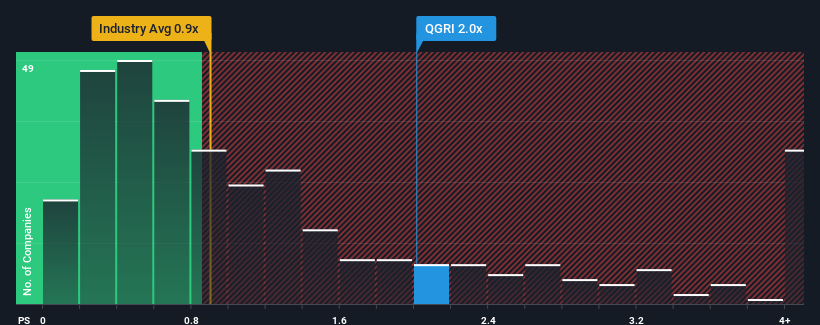

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Qatar General Insurance & Reinsurance Company Q.P.S.C's P/S ratio of 2x, since the median price-to-sales (or "P/S") ratio for the Insurance industry in Qatar is also close to 1.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Qatar General Insurance & Reinsurance Company Q.P.S.C

What Does Qatar General Insurance & Reinsurance Company Q.P.S.C's P/S Mean For Shareholders?

For example, consider that Qatar General Insurance & Reinsurance Company Q.P.S.C's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Qatar General Insurance & Reinsurance Company Q.P.S.C will help you shine a light on its historical performance.How Is Qatar General Insurance & Reinsurance Company Q.P.S.C's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Qatar General Insurance & Reinsurance Company Q.P.S.C's is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 14%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 49% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 7.3% shows it's a great look while it lasts.

With this in mind, we find it intriguing that Qatar General Insurance & Reinsurance Company Q.P.S.C's P/S matches its industry peers. It looks like most investors are not convinced the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

The Final Word

Its shares have lifted substantially and now Qatar General Insurance & Reinsurance Company Q.P.S.C's P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As mentioned previously, Qatar General Insurance & Reinsurance Company Q.P.S.C currently trades on a P/S on par with the wider industry, but this is lower than expected considering its recent three-year revenue growth is beating forecasts for a struggling industry. There could be some unobserved threats to revenue preventing the P/S ratio from outpacing the industry much like its revenue performance. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader industry turmoil. The fact that the company's relative performance has not provided a kick to the share price suggests that some investors are anticipating revenue instability.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Qatar General Insurance & Reinsurance Company Q.P.S.C that you should be aware of.

If these risks are making you reconsider your opinion on Qatar General Insurance & Reinsurance Company Q.P.S.C, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Qatar General Insurance & Reinsurance Company Q.P.S.C might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DSM:QGRI

Qatar General Insurance & Reinsurance Company Q.P.S.C

Engages in the provision of general insurance and reinsurance products.

Mediocre balance sheet very low.

Market Insights

Community Narratives