Zad Holding Company Q.P.S.C (DSM:ZHCD) Has Announced That Its Dividend Will Be Reduced To ر.ق0.65

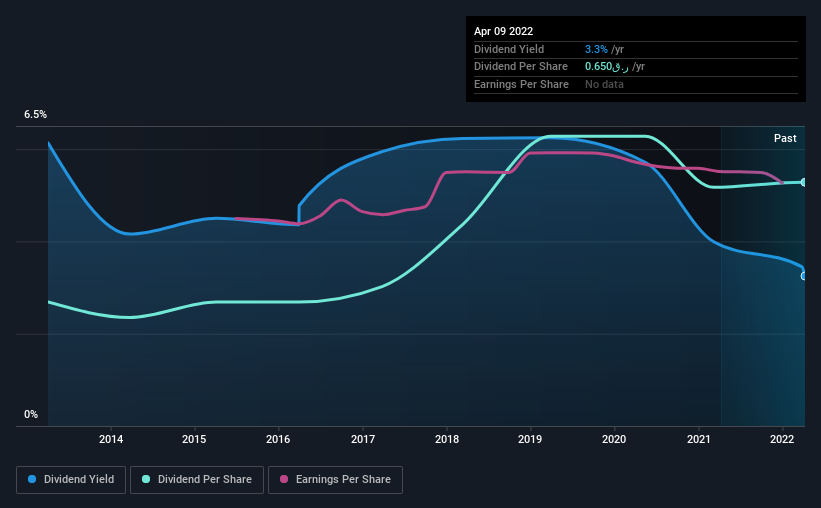

Zad Holding Company Q.P.S.C.'s (DSM:ZHCD) dividend is being reduced to ر.ق0.65 on the 1st of January. The yield is still above the industry average at 3.3%.

View our latest analysis for Zad Holding Company Q.P.S.C

Zad Holding Company Q.P.S.C Doesn't Earn Enough To Cover Its Payments

A big dividend yield for a few years doesn't mean much if it can't be sustained. Prior to this announcement, Zad Holding Company Q.P.S.C's dividend was making up a very large proportion of earnings and perhaps more concerning was that it was 109% of cash flows. This is certainly a risk factor, as reduced cash flows could force the company to pay a lower dividend.

EPS is set to grow by 2.5% over the next year if recent trends continue. Assuming the dividend continues along recent trends, we think the payout ratio could reach 98%, which probably can't continue without starting to put some pressure on the balance sheet.

Zad Holding Company Q.P.S.C's Dividend Has Lacked Consistency

Looking back, Zad Holding Company Q.P.S.C's dividend hasn't been particularly consistent. This suggests that the dividend might not be the most reliable. The first annual payment during the last 9 years was ر.ق0.33 in 2013, and the most recent fiscal year payment was ر.ق0.65. This works out to be a compound annual growth rate (CAGR) of approximately 7.8% a year over that time. We like to see dividends have grown at a reasonable rate, but with at least one substantial cut in the payments, we're not certain this dividend stock would be ideal for someone intending to live on the income.

Zad Holding Company Q.P.S.C May Find It Hard To Grow The Dividend

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. However, Zad Holding Company Q.P.S.C has only grown its earnings per share at 2.5% per annum over the past five years. Earnings are not growing quickly at all, and the company is paying out most of its profit as dividends. That's fine as far as it goes, but we're less enthusiastic as this often signals that the dividend is likely to grow slower in the future.

Zad Holding Company Q.P.S.C's Dividend Doesn't Look Sustainable

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. The track record isn't great, and the payments are a bit high to be considered sustainable. We would probably look elsewhere for an income investment.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 1 warning sign for Zad Holding Company Q.P.S.C that you should be aware of before investing. Is Zad Holding Company Q.P.S.C not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zad Holding Company Q.P.S.C might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DSM:ZHCD

Zad Holding Company Q.P.S.C

Engages in the manufacture and distribution of fast-moving-consumer-goods in Qatar and internationally.

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)