- Qatar

- /

- Oil and Gas

- /

- DSM:QGTS

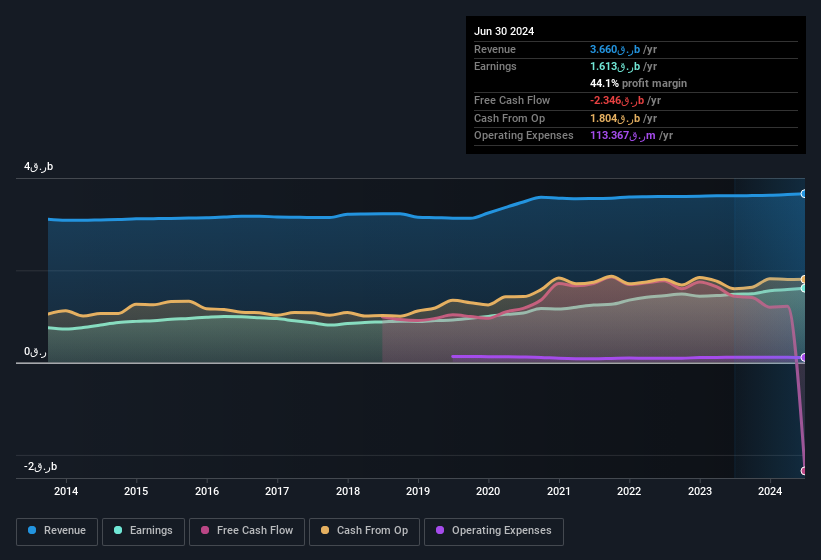

Statutory Profit Doesn't Reflect How Good Qatar Gas Transport Company Limited (Nakilat) (QPSC)'s (DSM:QGTS) Earnings Are

Qatar Gas Transport Company Limited (Nakilat) (QPSC)'s (DSM:QGTS) robust earnings report didn't manage to move the market for its stock. Our analysis suggests that shareholders have noticed something concerning in the numbers.

View our latest analysis for Qatar Gas Transport Company Limited (Nakilat) (QPSC)

Our Take On Qatar Gas Transport Company Limited (Nakilat) (QPSC)'s Profit Performance

Therefore, it seems possible to us that Qatar Gas Transport Company Limited (Nakilat) (QPSC)'s true underlying earnings power is actually less than its statutory profit. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. Our analysis shows 2 warning signs for Qatar Gas Transport Company Limited (Nakilat) (QPSC) (1 is significant!) and we strongly recommend you look at them before investing.

Our examination of Qatar Gas Transport Company Limited (Nakilat) (QPSC) has focussed on certain factors that can make its earnings look better than they are. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

Valuation is complex, but we're here to simplify it.

Discover if Qatar Gas Transport Company Limited (Nakilat) (QPSC) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DSM:QGTS

Qatar Gas Transport Company Limited (Nakilat) (QPSC)

Operates as a shipping and maritime company in Qatar.

Proven track record with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives