- Qatar

- /

- Oil and Gas

- /

- DSM:QGTS

Qatar Gas Transport Company Limited (Nakilat) (QPSC)'s (DSM:QGTS) Business Is Trailing The Market But Its Shares Aren't

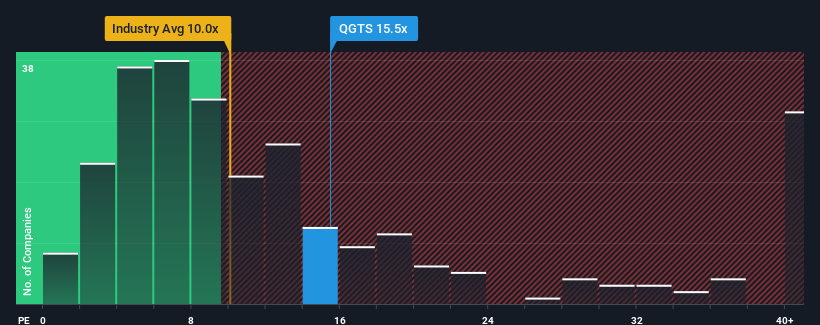

When close to half the companies in Qatar have price-to-earnings ratios (or "P/E's") below 12x, you may consider Qatar Gas Transport Company Limited (Nakilat) (QPSC) (DSM:QGTS) as a stock to potentially avoid with its 15.5x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Qatar Gas Transport Company Limited (Nakilat) (QPSC) certainly has been doing a good job lately as it's been growing earnings more than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Qatar Gas Transport Company Limited (Nakilat) (QPSC)

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as Qatar Gas Transport Company Limited (Nakilat) (QPSC)'s is when the company's growth is on track to outshine the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 12% last year. The latest three year period has also seen an excellent 30% overall rise in EPS, aided somewhat by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 8.4% each year as estimated by the six analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 8.7% per year, which is not materially different.

In light of this, it's curious that Qatar Gas Transport Company Limited (Nakilat) (QPSC)'s P/E sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Bottom Line On Qatar Gas Transport Company Limited (Nakilat) (QPSC)'s P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Qatar Gas Transport Company Limited (Nakilat) (QPSC) currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware Qatar Gas Transport Company Limited (Nakilat) (QPSC) is showing 1 warning sign in our investment analysis, you should know about.

Of course, you might also be able to find a better stock than Qatar Gas Transport Company Limited (Nakilat) (QPSC). So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Qatar Gas Transport Company Limited (Nakilat) (QPSC) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DSM:QGTS

Qatar Gas Transport Company Limited (Nakilat) (QPSC)

Operates as a shipping and maritime company in Qatar.

Proven track record with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives