- Qatar

- /

- Capital Markets

- /

- DSM:IHGS

Here's Why INMA Holding Company (Q.P.S.C.) (DSM:IHGS) Has Caught The Eye Of Investors

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in INMA Holding Company (Q.P.S.C.) (DSM:IHGS). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for INMA Holding Company (Q.P.S.C.)

How Fast Is INMA Holding Company (Q.P.S.C.) Growing Its Earnings Per Share?

Over the last three years, INMA Holding Company (Q.P.S.C.) has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. Thus, it makes sense to focus on more recent growth rates, instead. Outstandingly, INMA Holding Company (Q.P.S.C.)'s EPS shot from ر.ق0.10 to ر.ق0.20, over the last year. It's not often a company can achieve year-on-year growth of 98%. That could be a sign that the business has reached a true inflection point.

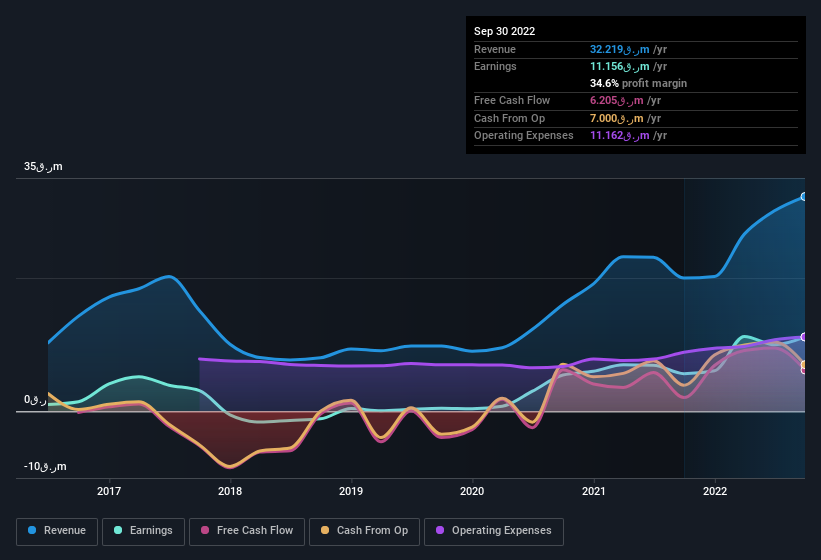

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of INMA Holding Company (Q.P.S.C.)'s revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. EBIT margins for INMA Holding Company (Q.P.S.C.) remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 61% to ر.ق32m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

INMA Holding Company (Q.P.S.C.) isn't a huge company, given its market capitalisation of ر.ق220m. That makes it extra important to check on its balance sheet strength.

Are INMA Holding Company (Q.P.S.C.) Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. INMA Holding Company (Q.P.S.C.) followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. To be specific, they have ر.ق46m worth of shares. That's a lot of money, and no small incentive to work hard. Those holdings account for over 21% of the company; visible skin in the game.

Should You Add INMA Holding Company (Q.P.S.C.) To Your Watchlist?

INMA Holding Company (Q.P.S.C.)'s earnings have taken off in quite an impressive fashion. That EPS growth certainly is attention grabbing, and the large insider ownership only serves to further stoke our interest. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So based on this quick analysis, we do think it's worth considering INMA Holding Company (Q.P.S.C.) for a spot on your watchlist. You should always think about risks though. Case in point, we've spotted 2 warning signs for INMA Holding Company (Q.P.S.C.) you should be aware of, and 1 of them can't be ignored.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DSM:IHGS

INMA Holding Company Q.P.S.C

Invests in shares and bonds; and provides brokerage services in Qatar.

Excellent balance sheet with slight risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026