- Qatar

- /

- Food and Staples Retail

- /

- DSM:MERS

Al Meera Consumer Goods Company Q.P.S.C.'s (DSM:MERS) On An Uptrend But Financial Prospects Look Pretty Weak: Is The Stock Overpriced?

Al Meera Consumer Goods Company Q.P.S.C (DSM:MERS) has had a great run on the share market with its stock up by a significant 7.1% over the last week. We, however wanted to have a closer look at its key financial indicators as the markets usually pay for long-term fundamentals, and in this case, they don't look very promising. Particularly, we will be paying attention to Al Meera Consumer Goods Company Q.P.S.C's ROE today.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Put another way, it reveals the company's success at turning shareholder investments into profits.

See our latest analysis for Al Meera Consumer Goods Company Q.P.S.C

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Al Meera Consumer Goods Company Q.P.S.C is:

13% = ر.ق210m ÷ ر.ق1.6b (Based on the trailing twelve months to December 2020).

The 'return' is the profit over the last twelve months. That means that for every QAR1 worth of shareholders' equity, the company generated QAR0.13 in profit.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Al Meera Consumer Goods Company Q.P.S.C's Earnings Growth And 13% ROE

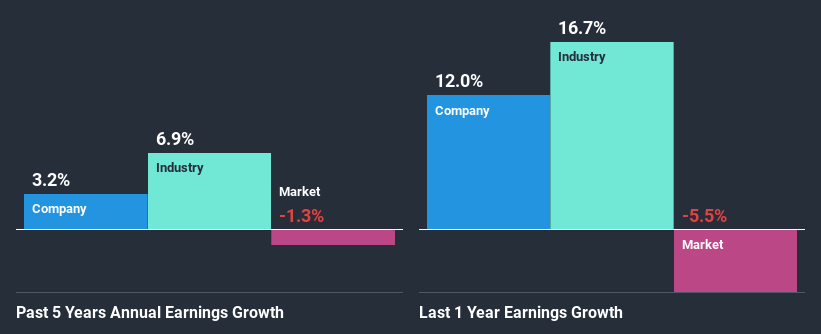

At first glance, Al Meera Consumer Goods Company Q.P.S.C's ROE doesn't look very promising. However, the fact that the its ROE is quite higher to the industry average of 9.2% doesn't go unnoticed by us. Still, Al Meera Consumer Goods Company Q.P.S.C's net income growth of 3.2% over the past five years was mediocre at best. Bear in mind, the company does have a low ROE. It is just that the industry ROE is lower. Therefore, the low growth in earnings could also be the result of this.

Next, on comparing with the industry net income growth, we found that Al Meera Consumer Goods Company Q.P.S.C's reported growth was lower than the industry growth of 6.8% in the same period, which is not something we like to see.

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Al Meera Consumer Goods Company Q.P.S.C is trading on a high P/E or a low P/E, relative to its industry.

Is Al Meera Consumer Goods Company Q.P.S.C Using Its Retained Earnings Effectively?

With a high three-year median payout ratio of 91% (or a retention ratio of 8.9%), most of Al Meera Consumer Goods Company Q.P.S.C's profits are being paid to shareholders. This definitely contributes to the low earnings growth seen by the company.

Moreover, Al Meera Consumer Goods Company Q.P.S.C has been paying dividends for at least ten years or more suggesting that management must have perceived that the shareholders prefer dividends over earnings growth. Based on the latest analysts' estimates, we found that the company's future payout ratio over the next three years is expected to hold steady at 81%. Still, forecasts suggest that Al Meera Consumer Goods Company Q.P.S.C's future ROE will rise to 18% even though the the company's payout ratio is not expected to change by much.

Summary

On the whole, Al Meera Consumer Goods Company Q.P.S.C's performance is quite a big let-down. The company has shown a disappointing growth in its earnings as a result of it retaining little to almost none of its profits. So, the decent ROE it does have, is not much useful to investors given that the company is reinvesting very little into its business. That being so, the latest analyst forecasts show that the company will continue to see an expansion in its earnings. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

When trading Al Meera Consumer Goods Company Q.P.S.C or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About DSM:MERS

Al Meera Consumer Goods Company Q.P.S.C

Engages in the wholesale and retail trade of various types of consumer goods commodities in Qatar and the Sultanate of Oman.

Mediocre balance sheet with poor track record.

Market Insights

Community Narratives