Every investor in Mannai Corporation Q.P.S.C. (DSM:MCCS) should be aware of the most powerful shareholder groups. Large companies usually have institutions as shareholders, and we usually see insiders owning shares in smaller companies. We also tend to see lower insider ownership in companies that were previously publicly owned.

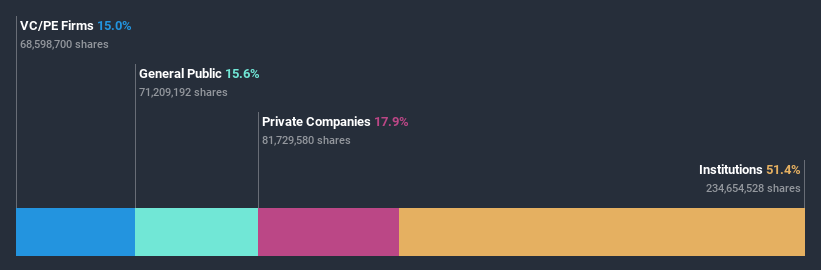

Mannai Corporation Q.P.S.C is not a large company by global standards. It has a market capitalization of ر.ق1.4b, which means it wouldn't have the attention of many institutional investors. In the chart below, we can see that institutions are noticeable on the share registry. We can zoom in on the different ownership groups, to learn more about Mannai Corporation Q.P.S.C.

See our latest analysis for Mannai Corporation Q.P.S.C

What Does The Institutional Ownership Tell Us About Mannai Corporation Q.P.S.C?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

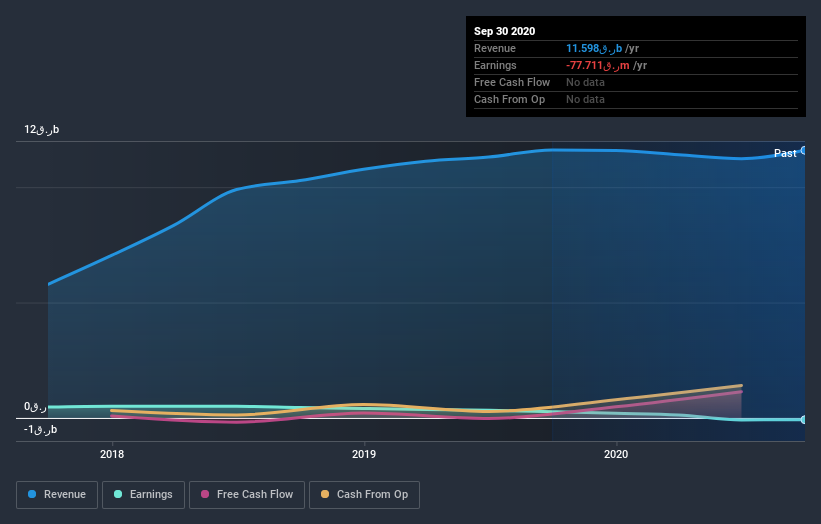

As you can see, institutional investors have a fair amount of stake in Mannai Corporation Q.P.S.C. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Mannai Corporation Q.P.S.C's earnings history below. Of course, the future is what really matters.

Since institutional investors own more than half the issued stock, the board will likely have to pay attention to their preferences. Hedge funds don't have many shares in Mannai Corporation Q.P.S.C. Our data shows that Qatar Investment & Projects Development Holding Co., W.L.L. is the largest shareholder with 51% of shares outstanding. This essentially means that they have extensive influence, if not outright control, over the future of the corporation. For context, the second largest shareholder holds about 18% of the shares outstanding, followed by an ownership of 15% by the third-largest shareholder.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. We're not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of Mannai Corporation Q.P.S.C

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

We note our data does not show any board members holding shares, personally. Not all jurisdictions have the same rules around disclosing insider ownership, and it is possible we have missed something, here. So you can click here learn more about the CEO.

General Public Ownership

With a 16% ownership, the general public have some degree of sway over Mannai Corporation Q.P.S.C. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Private Equity Ownership

With a stake of 15%, private equity firms could influence the Mannai Corporation Q.P.S.C board. Some investors might be encouraged by this, since private equity are sometimes able to encourage strategies that help the market see the value in the company. Alternatively, those holders might be exiting the investment after taking it public.

Private Company Ownership

Our data indicates that Private Companies hold 18%, of the company's shares. It might be worth looking deeper into this. If related parties, such as insiders, have an interest in one of these private companies, that should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Mannai Corporation Q.P.S.C better, we need to consider many other factors. For example, we've discovered 3 warning signs for Mannai Corporation Q.P.S.C (2 are a bit unpleasant!) that you should be aware of before investing here.

If you would prefer check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, backed by strong financial data.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you decide to trade Mannai Corporation Q.P.S.C, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About DSM:MCCS

Mannai Corporation Q.P.S.C

Offers information technology services in Qatar, other GCC countries, and internationally.

Good value with acceptable track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026