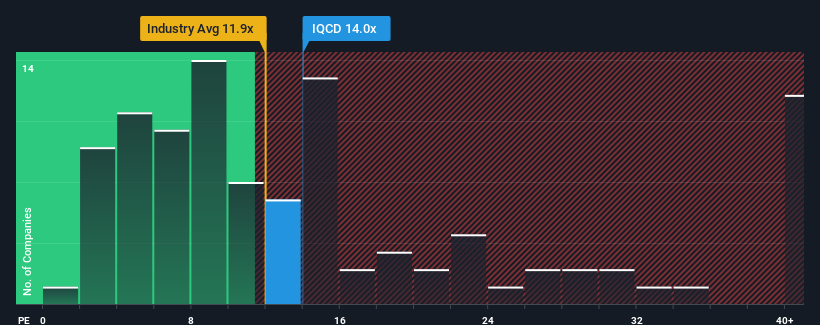

It's not a stretch to say that Industries Qatar Q.P.S.C.'s (DSM:IQCD) price-to-earnings (or "P/E") ratio of 14x right now seems quite "middle-of-the-road" compared to the market in Qatar, where the median P/E ratio is around 14x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

While the market has experienced earnings growth lately, Industries Qatar Q.P.S.C's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Industries Qatar Q.P.S.C

How Is Industries Qatar Q.P.S.C's Growth Trending?

Industries Qatar Q.P.S.C's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 44%. Even so, admirably EPS has lifted 209% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings growth is heading into negative territory, declining 3.3% per annum over the next three years. With the market predicted to deliver 9.5% growth each year, that's a disappointing outcome.

In light of this, it's somewhat alarming that Industries Qatar Q.P.S.C's P/E sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

The Bottom Line On Industries Qatar Q.P.S.C's P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Industries Qatar Q.P.S.C currently trades on a higher than expected P/E for a company whose earnings are forecast to decline. When we see a poor outlook with earnings heading backwards, we suspect share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You should always think about risks. Case in point, we've spotted 1 warning sign for Industries Qatar Q.P.S.C you should be aware of.

Of course, you might also be able to find a better stock than Industries Qatar Q.P.S.C. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DSM:IQCD

Industries Qatar Q.P.S.C

Through its subsidiaries operates petrochemical, fertilizer, and steel businesses in Qatar.

Flawless balance sheet and good value.