As Doha Bank Q.P.S.C (DSM:DHBK) climbs 4.2% this past week, investors may now be noticing the company's three-year earnings growth

While it may not be enough for some shareholders, we think it is good to see the Doha Bank Q.P.S.C. (DSM:DHBK) share price up 20% in a single quarter. But that cannot eclipse the less-than-impressive returns over the last three years. After all, the share price is down 38% in the last three years, significantly under-performing the market.

Although the past week has been more reassuring for shareholders, they're still in the red over the last three years, so let's see if the underlying business has been responsible for the decline.

Check out our latest analysis for Doha Bank Q.P.S.C

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the unfortunate three years of share price decline, Doha Bank Q.P.S.C actually saw its earnings per share (EPS) improve by 10% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Alternatively, growth expectations may have been unreasonable in the past.

It's worth taking a look at other metrics, because the EPS growth doesn't seem to match with the falling share price.

We note that the dividend seems healthy enough, so that probably doesn't explain the share price drop. It's good to see that Doha Bank Q.P.S.C has increased its revenue over the last three years. If the company can keep growing revenue, there may be an opportunity for investors. You might have to dig deeper to understand the recent share price weakness.

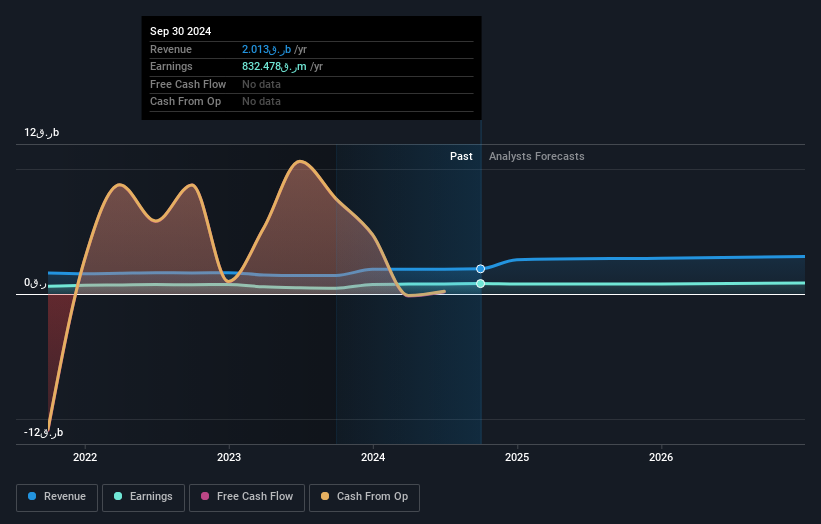

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that Doha Bank Q.P.S.C has improved its bottom line lately, but what does the future have in store? If you are thinking of buying or selling Doha Bank Q.P.S.C stock, you should check out this free report showing analyst profit forecasts.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Doha Bank Q.P.S.C the TSR over the last 3 years was -30%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Doha Bank Q.P.S.C's TSR for the year was broadly in line with the market average, at 18%. To take a positive view, the gain is pleasing, and it sure beats annualized TSR loss of 3%, which was endured over half a decade. While 'turnarounds seldom turn' there are green shoots for Doha Bank Q.P.S.C. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Doha Bank Q.P.S.C has 1 warning sign we think you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Qatari exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DSM:DHBK

Doha Bank Q.P.S.C

Provides various banking products and services to individual and corporate clients in Qatar and internationally.

Solid track record with adequate balance sheet.