- Portugal

- /

- Other Utilities

- /

- ENXTLS:RENE

These 4 Measures Indicate That REN - Redes Energéticas Nacionais SGPS (ELI:RENE) Is Using Debt Extensively

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that REN - Redes Energéticas Nacionais, SGPS, S.A. (ELI:RENE) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for REN - Redes Energéticas Nacionais SGPS

What Is REN - Redes Energéticas Nacionais SGPS's Net Debt?

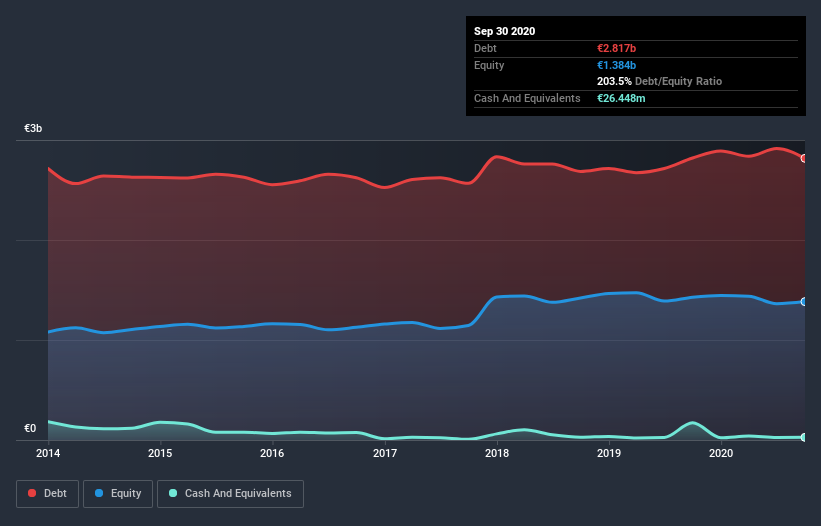

The chart below, which you can click on for greater detail, shows that REN - Redes Energéticas Nacionais SGPS had €2.82b in debt in September 2020; about the same as the year before. And it doesn't have much cash, so its net debt is about the same.

How Strong Is REN - Redes Energéticas Nacionais SGPS's Balance Sheet?

We can see from the most recent balance sheet that REN - Redes Energéticas Nacionais SGPS had liabilities of €850.0m falling due within a year, and liabilities of €2.92b due beyond that. Offsetting these obligations, it had cash of €26.4m as well as receivables valued at €188.8m due within 12 months. So its liabilities total €3.56b more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the €1.56b company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, REN - Redes Energéticas Nacionais SGPS would likely require a major re-capitalisation if it had to pay its creditors today.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

REN - Redes Energéticas Nacionais SGPS has a rather high debt to EBITDA ratio of 6.2 which suggests a meaningful debt load. But the good news is that it boasts fairly comforting interest cover of 4.1 times, suggesting it can responsibly service its obligations. Even more troubling is the fact that REN - Redes Energéticas Nacionais SGPS actually let its EBIT decrease by 6.3% over the last year. If that earnings trend continues the company will face an uphill battle to pay off its debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if REN - Redes Energéticas Nacionais SGPS can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Happily for any shareholders, REN - Redes Energéticas Nacionais SGPS actually produced more free cash flow than EBIT over the last three years. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

To be frank both REN - Redes Energéticas Nacionais SGPS's net debt to EBITDA and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But at least it's pretty decent at converting EBIT to free cash flow; that's encouraging. It's also worth noting that REN - Redes Energéticas Nacionais SGPS is in the Integrated Utilities industry, which is often considered to be quite defensive. Looking at the bigger picture, it seems clear to us that REN - Redes Energéticas Nacionais SGPS's use of debt is creating risks for the company. If everything goes well that may pay off but the downside of this debt is a greater risk of permanent losses. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with REN - Redes Energéticas Nacionais SGPS , and understanding them should be part of your investment process.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you decide to trade REN - Redes Energéticas Nacionais SGPS, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTLS:RENE

REN - Redes Energéticas Nacionais SGPS

Engages in the transmission of electricity and natural gas in Portugal.

Undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026