- Portugal

- /

- Electric Utilities

- /

- ENXTLS:EDP

EDP (ENXTLS:EDP) Valuation After Italian Solar Sale and New Cost Cutting Drive

Reviewed by Simply Wall St

EDP (ENXTLS:EDP) has turned heads after selling a 207 MW solar portfolio in Italy and unveiling a fresh cost cutting plan, a combination that is subtly reframing how the market values its growth profile.

See our latest analysis for EDP.

After a quieter few months, EDP’s 1 year to date share price return of 20.37 percent and 1 year total shareholder return of 26.44 percent suggest momentum is rebuilding as the market reassesses its reshaped renewables and cost efficiency story.

If EDP’s repositioning has caught your eye, it could be a good moment to see how it stacks up against other fast growing stocks with high insider ownership that might be early in their own rerating stories.

Yet even after this rerating, EDP still trades around 16 percent below consensus targets. This raises a key question: is the market underestimating its margin upside, or already baking in the next leg of growth?

Most Popular Narrative: 14.6% Undervalued

Compared with EDP’s last close of €3.81, the most widely followed narrative points to a higher fair value, framing recent moves as just the opening act.

In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €15.0 billion, earnings will come to €1.3 billion, and it would be trading on a PE ratio of 16.5x, assuming you use a discount rate of 6.9 percent.

Curious how modest top line expectations can still back a richer price tag? The real twist lies in the margin story and that lower future earnings multiple. Want to see how those levers combine to produce this fair value call? Dive into the full narrative to unpack the assumptions driving this upside case.

Result: Fair Value of €4.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside hinges on execution, with Brazil FX swings and Iberian regulatory shifts both capable of knocking the margin and valuation story off course.

Find out about the key risks to this EDP narrative.

Another Angle on Valuation

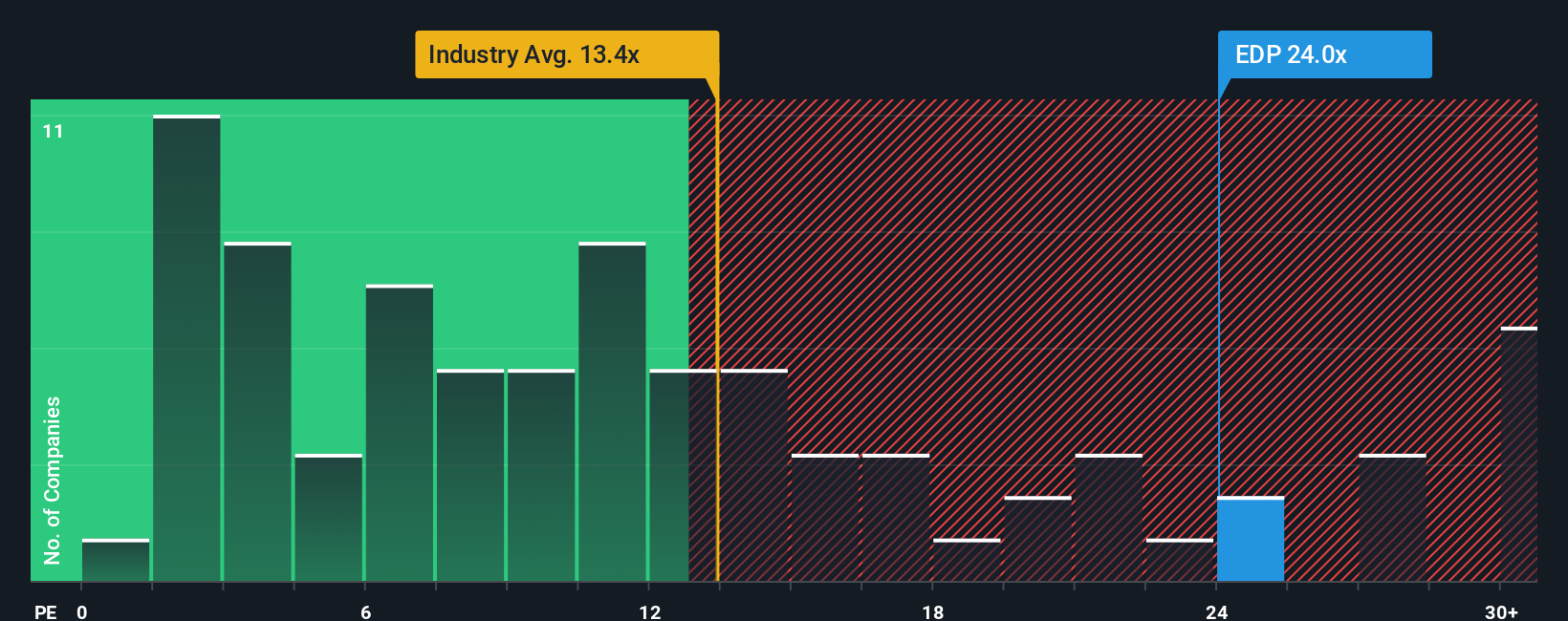

While the consensus narrative flags EDP as around 14.6 percent undervalued, its current price to earnings ratio of 23.5 times tells a tougher story. That is richer than both the European utilities average of 13.5 times and its own fair ratio of 21.4 times, which hints at limited margin for error if growth stumbles. Is the market already paying up for execution that has not yet arrived?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own EDP Narrative

If this interpretation does not quite fit your view, or you would rather lean on your own analysis, you can build a custom narrative in minutes: Do it your way.

A great starting point for your EDP research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with EDP when you can quickly scan fresh opportunities on Simply Wall Street’s Screener and position yourself ahead of the next wave of reratings.

- Target reliable income by assessing these 13 dividend stocks with yields > 3% that could strengthen your portfolio’s cash flow without stretching your risk tolerance.

- Capitalize on rapid innovation by reviewing these 25 AI penny stocks that are reshaping industries with scalable, data driven business models.

- Hunt for mispriced potential by filtering these 915 undervalued stocks based on cash flows that may offer attractive upside if the market has not yet caught up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if EDP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTLS:EDP

EDP

Engages in the generation, transmission, distribution, and supply of electricity in Portugal, Spain, France, Poland, Romania, Italy, Belgium, the United Kingdom, Greece, Colombia, Brazil, North America, and internationally.

Second-rate dividend payer with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)