- Portugal

- /

- Electric Utilities

- /

- ENXTLS:EDP

With EPS Growth And More, EDP - Energias de Portugal (ELI:EDP) Is Interesting

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like EDP - Energias de Portugal (ELI:EDP). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for EDP - Energias de Portugal

EDP - Energias de Portugal's Earnings Per Share Are Growing.

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That makes EPS growth an attractive quality for any company. I, for one, am blown away by the fact that EDP - Energias de Portugal has grown EPS by 45% per year, over the last three years. That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

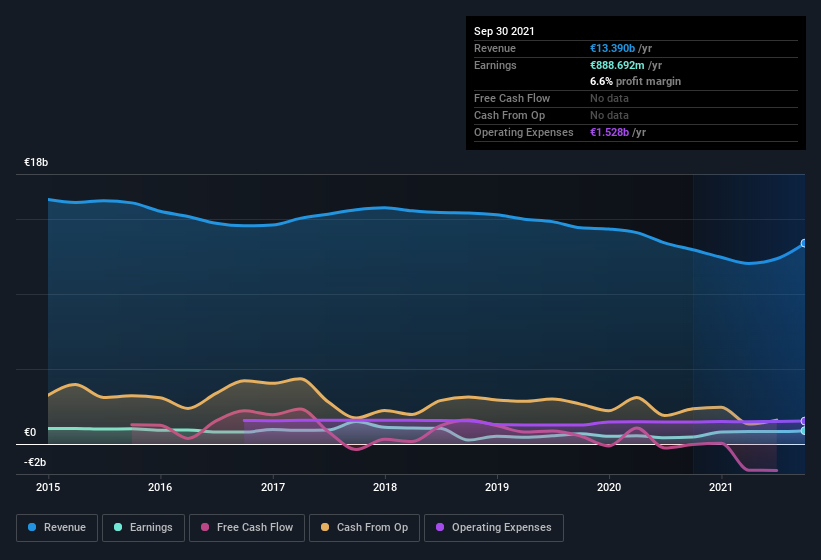

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). EDP - Energias de Portugal maintained stable EBIT margins over the last year, all while growing revenue 3.4% to €13b. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of EDP - Energias de Portugal's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are EDP - Energias de Portugal Insiders Aligned With All Shareholders?

As a general rule, I think it worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. For companies with market capitalizations over €7.1b, like EDP - Energias de Portugal, the median CEO pay is around €3.1m.

The EDP - Energias de Portugal CEO received €1.6m in compensation for the year ending . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. I'd also argue reasonable pay levels attest to good decision making more generally.

Is EDP - Energias de Portugal Worth Keeping An Eye On?

EDP - Energias de Portugal's earnings per share have taken off like a rocket aimed right at the moon. With rocketing profits, its seems likely the business has a rosy future; and it may have hit an inflection point. At the same time the reasonable CEO compensation reflects well on the board of directors. While I couldn't be sure without a deeper dive, it does seem that EDP - Energias de Portugal has the hallmarks of a quality business; and that would make it well worth watching. Still, you should learn about the 2 warning signs we've spotted with EDP - Energias de Portugal (including 1 which is a bit unpleasant) .

Although EDP - Energias de Portugal certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade EDP, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if EDP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTLS:EDP

EDP

Engages in the generation, transmission, distribution, and supply of electricity in Portugal, Spain, France, Poland, Romania, Italy, Belgium, the United Kingdom, Greece, Colombia, Brazil, North America, and internationally.

Average dividend payer with questionable track record.