- Portugal

- /

- Entertainment

- /

- ENXTLS:SCP

Investors Holding Back On Sporting Clube de Portugal - Futebol, SAD (ELI:SCP)

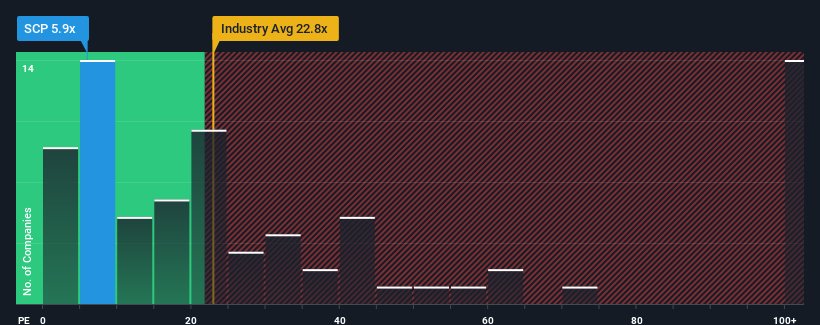

When close to half the companies in Portugal have price-to-earnings ratios (or "P/E's") above 12x, you may consider Sporting Clube de Portugal - Futebol, SAD (ELI:SCP) as an attractive investment with its 5.9x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

For instance, Sporting Clube de Portugal - Futebol SAD's receding earnings in recent times would have to be some food for thought. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Sporting Clube de Portugal - Futebol SAD

How Is Sporting Clube de Portugal - Futebol SAD's Growth Trending?

Sporting Clube de Portugal - Futebol SAD's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered a frustrating 55% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 10% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

It's interesting to note that the rest of the market is similarly expected to decline by 5.1% over the next year, which is just as bad as the company's recent medium-term earnings decline.

With this information, it's perhaps strange but not a major surprise that Sporting Clube de Portugal - Futebol SAD is trading at a lower P/E in comparison. With earnings going in reverse, it's not guaranteed that the P/E has found a floor yet, despite the market heading down in unison. Even just maintaining these prices will be difficult to achieve as recent earnings trends are already weighing down the shares heavily.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Sporting Clube de Portugal - Futebol SAD currently trades on a lower than expected P/E since its recent three-year earnings are matching the forecasts for a struggling market. When we see average earnings, we assume potential risks are what might be placing pressure on the P/E ratio. Perhaps there is some hesitation about the company's ability to stay its recent medium-term course and resist further pain to its business from the broader market turmoil. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Plus, you should also learn about these 4 warning signs we've spotted with Sporting Clube de Portugal - Futebol SAD (including 2 which are a bit unpleasant).

Of course, you might also be able to find a better stock than Sporting Clube de Portugal - Futebol SAD. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTLS:SCP

Sporting Clube de Portugal - Futebol SAD

Operates sports clubs in Portugal.

Low and slightly overvalued.

Market Insights

Community Narratives