Grupo Média Capital SGPS (ELI:MCP) Posted Healthy Earnings But There Are Some Other Factors To Be Aware Of

Grupo Média Capital, SGPS, S.A. (ELI:MCP) announced strong profits, but the stock was stagnant. Our analysis suggests that this might be because shareholders have noticed some concerning underlying factors.

View our latest analysis for Grupo Média Capital SGPS

Zooming In On Grupo Média Capital SGPS' Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. The ratio shows us how much a company's profit exceeds its FCF.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

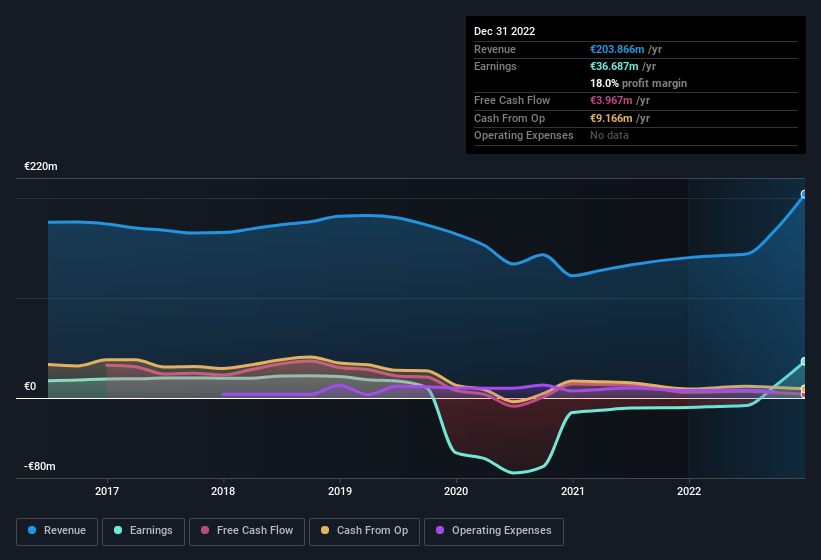

For the year to December 2022, Grupo Média Capital SGPS had an accrual ratio of 0.24. We can therefore deduce that its free cash flow fell well short of covering its statutory profit. To wit, it produced free cash flow of €4.0m during the period, falling well short of its reported profit of €36.7m. Grupo Média Capital SGPS shareholders will no doubt be hoping that its free cash flow bounces back next year, since it was down over the last twelve months. Having said that, there is more to the story. The accrual ratio is reflecting the impact of unusual items on statutory profit, at least in part. One positive for Grupo Média Capital SGPS shareholders is that it's accrual ratio was significantly better last year, providing reason to believe that it may return to stronger cash conversion in the future. Shareholders should look for improved cashflow relative to profit in the current year, if that is indeed the case.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Grupo Média Capital SGPS.

The Impact Of Unusual Items On Profit

Finally, we should also talk about the €6.2m in unusual items that weighed on profit over the year. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. If Grupo Média Capital SGPS doesn't see those unusual expenses repeat, then all else being equal we'd expect its profit to increase over the coming year.

Our Take On Grupo Média Capital SGPS' Profit Performance

Grupo Média Capital SGPS saw unusual items weigh on its profit, which should have made it easier to show high cash conversion, which it did not do, according to its accrual ratio. Given the contrasting considerations, we don't have a strong view as to whether Grupo Média Capital SGPS's profits are an apt reflection of its underlying potential for profit. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. For example, we've discovered 3 warning signs that you should run your eye over to get a better picture of Grupo Média Capital SGPS.

Our examination of Grupo Média Capital SGPS has focussed on certain factors that can make its earnings look better than they are. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you're looking to trade Grupo Média Capital SGPS, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTLS:MCP

Grupo Média Capital SGPS

Grupo Media Capital, SGPS, S.A. engages in the production and broadcasting of television and radio programs, and production and operation of cinematographic and video graphic activities in Portugal and internationally.

Adequate balance sheet with acceptable track record.