- Portugal

- /

- Paper and Forestry Products

- /

- ENXTLS:NVG

Navigator Company (ENXTLS:NVG) Margin Decline Challenges Valuation-Driven Bullish Narratives

Reviewed by Simply Wall St

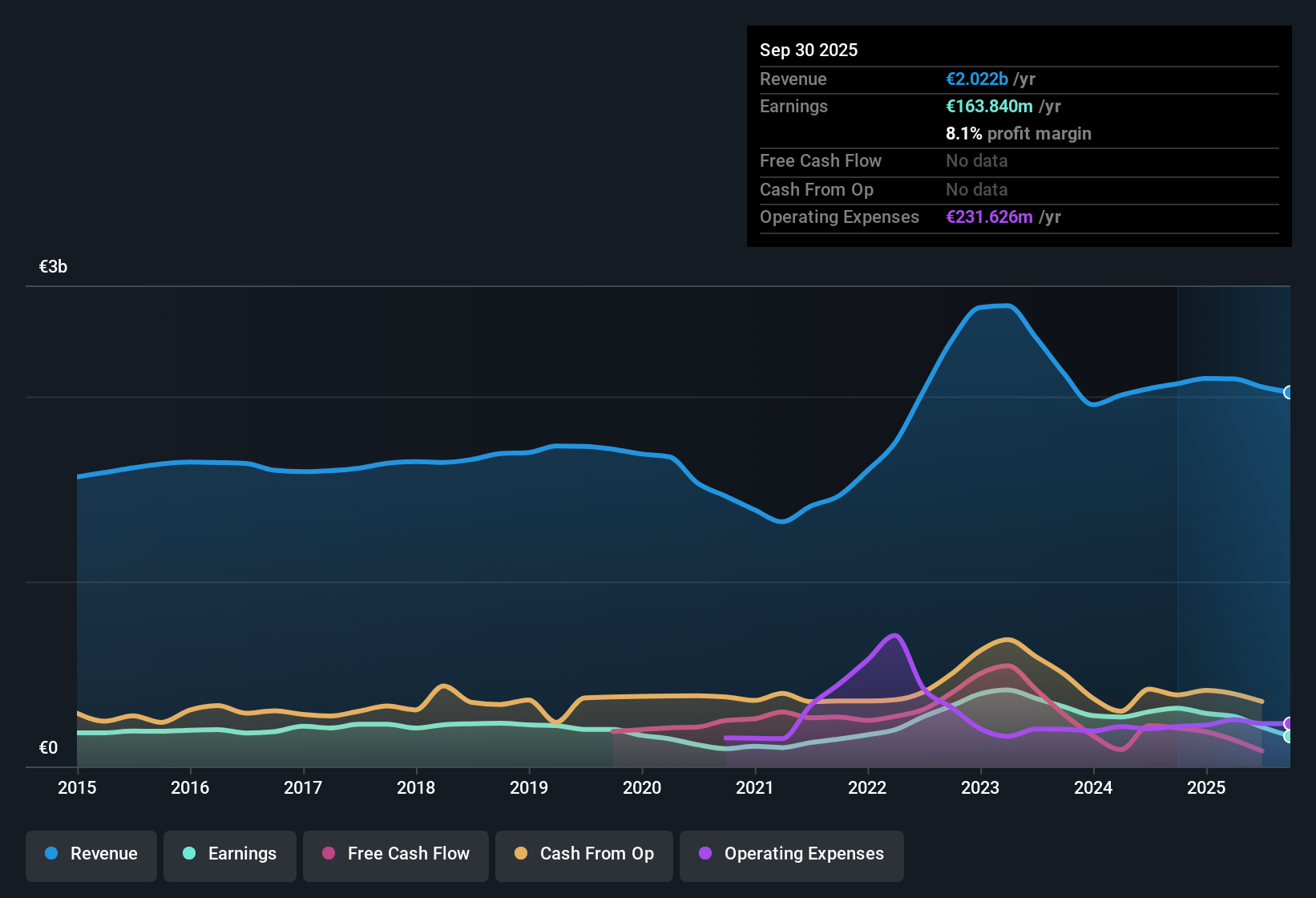

Navigator Company (ENXTLS:NVG) saw net profit margins slip to 10.4%, down from 14.5% last year, while earnings declined after a period of 16.5% annual growth over the past five years. Revenue is expected to edge up by just 0.6% per year, which is below the 3.5% annual growth expected for the wider Portuguese market. Earnings are forecast to decline by 5.6% per year over the next three years. With the company trading well below estimated fair value and analyst price targets, investors are likely to weigh the modest growth outlook against the discount to peers and historical earnings quality.

See our full analysis for Navigator Company.Next, we will see how these headline figures compare to the widely followed narratives for NVG, and whether the latest results reinforce or challenge investor expectations.

See what the community is saying about Navigator Company

DCF Fair Value Sits Well Above Market

- At a current share price of €3.07, Navigator Company is trading significantly below its DCF fair value of €5.17, a discount of around 40%, which is wider than most peers.

- Analysts' consensus view highlights several upside factors supporting this deep discount:

- Premium pricing power in sustainable packaging and tissue is expected to help lift margins to 11.7% in three years, counterbalancing weaker traditional paper demand.

- The lower price-to-earnings ratio (10.2x versus the peer average of 11.7x) still reflects strong historic earnings quality that underpins the optimistic price target of 4.40.

Consensus remains constructive given the upside gap to fair value. Unpack the data and see how the market view stacks up in the full narrative: 📊 Read the full Navigator Company Consensus Narrative.

Widening Margin Gap Tightens Debate

- Net profit margins slipped further to 10.4% from 14.5% a year earlier, even as operational efficiency offsets some rising input costs.

- The consensus narrative notes that the margin squeeze adds tension to the bullish thesis:

- The decline is stark compared to peers, yet is partly cushioned by Navigator's expansion into higher-margin segments like compostable food packaging and premium tissue, both seeing increased order flows.

- Despite efforts, persistently high chemical and energy costs in Portugal weigh on profits, challenging the view that efficiency initiatives will fully offset these external headwinds anytime soon.

Revenue Growth Lags Broader Market

- Navigator's revenue is forecast to grow by just 0.6% per year, falling well short of the Portuguese market’s 3.5% average annual rate over the next three years.

- The consensus narrative points out that underperformance versus the local market is a core concern:

- Analysts expect Navigator’s core paper segments to struggle with ongoing decline in European demand, magnifying reliance on new products and global sales channels to hit future targets.

- The muted revenue outlook leaves the company more exposed if expansion into sustainable and tissue offerings does not accelerate as planned.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Navigator Company on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the data from another angle? Capture your perspective and shape your own narrative in just a few minutes with Do it your way.

A great starting point for your Navigator Company research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Navigator Company faces shrinking profit margins and anemic revenue growth, struggling to keep pace with the broader market’s stronger performance outlook.

If you’re looking for more consistent top-line and bottom-line progress, check out stable growth stocks screener (2099 results) to spot companies delivering steady gains through changing conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Navigator Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTLS:NVG

Navigator Company

Manufactures and markets pulp and paper products worldwide.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)