- Portugal

- /

- Paper and Forestry Products

- /

- ENXTLS:NVG

Navigator Company (ENXTLS:NVG): Assessing Valuation After Recent Subtle Price Movements

Reviewed by Simply Wall St

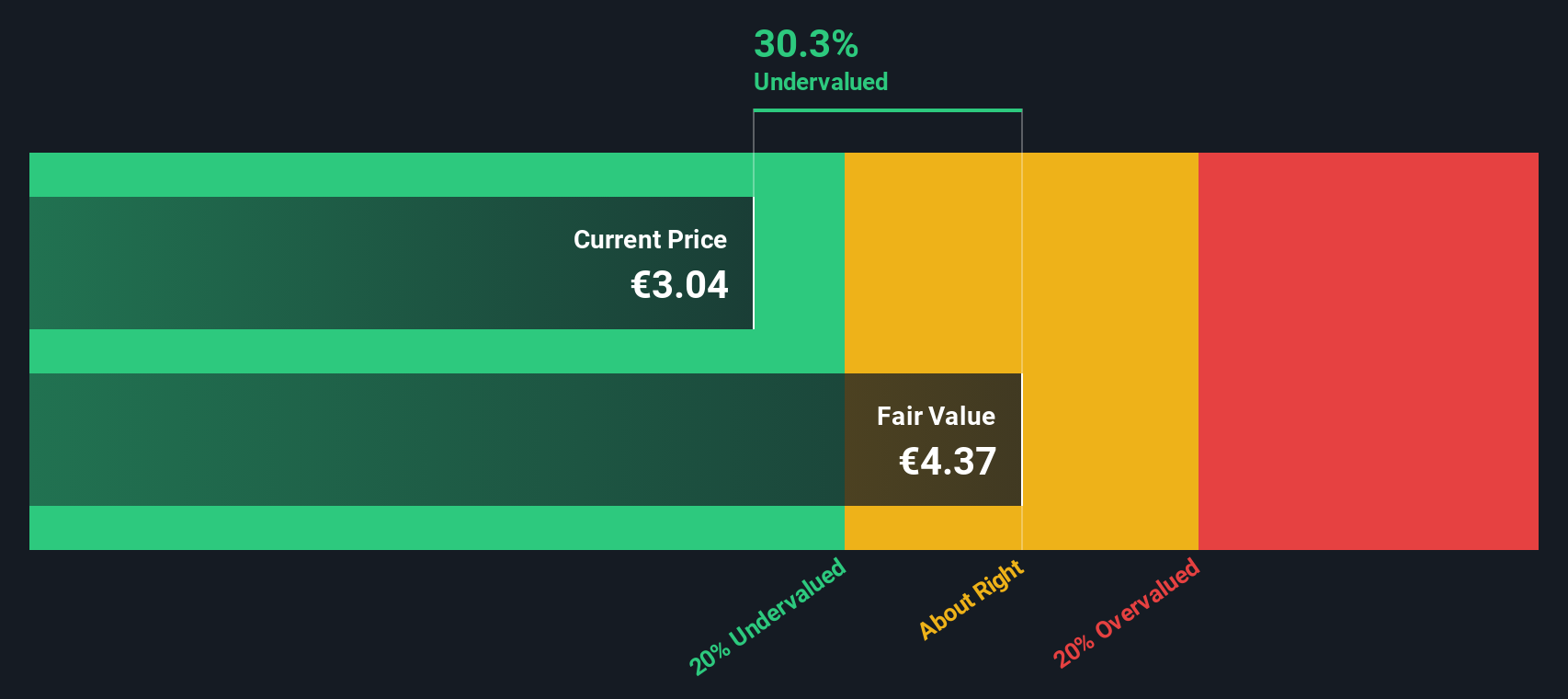

Most Popular Narrative: 27.4% Undervalued

According to the most widely followed narrative, Navigator Company’s shares are trading below their estimated fair value, suggesting potential for upside if key assumptions hold true.

Robust expansion into sustainable packaging and tissue segments, supported by major investments such as the PM3 machine conversion and molded cellulose product lines, positions Navigator to benefit from the global shift towards plastic bans, circular economy policies, and rising demand for renewable packaging. This development supports future revenue growth and higher margins because these products command premium pricing relative to legacy paper.

Curious how a traditional paper company could be priced for rapid, margin-rich growth in a world turning away from paper? The market’s most popular valuation relies on optimistic forecasts where Navigator capitalizes on industry shifts and squeezes more from every euro earned. How big are the bets that buyers are making on these transformation plans? The formula behind this target will definitely surprise you.

Result: Fair Value of €4.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, accelerating digitalization and ongoing declines in paper demand across Europe could easily challenge Navigator’s growth trajectory and threaten analyst optimism.

Find out about the key risks to this Navigator Company narrative.Another View: Discounted Cash Flow Perspective

Looking through the lens of our DCF model, a different picture emerges. This approach evaluates Navigator Company based on future cash flow projections and suggests the shares remain undervalued. Does this second method strengthen the case or raise more questions?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Navigator Company for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Navigator Company Narrative

If you want to dig deeper or see things from your own unique perspective, you are welcome to build your own view in just a few minutes. Do it your way

A great starting point for your Navigator Company research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Turn today’s insights into action. With so many stocks competing for your attention, you owe it to yourself to get ahead and uncover standout companies poised for success.

- Spot the next wave of market disruptors by checking out AI penny stocks. These are driving artificial intelligence breakthroughs and transforming entire industries before the crowd catches on.

- Unlock hidden value by targeting undervalued stocks based on cash flows, which the market has overlooked, and position yourself ahead of the next big re-rating.

- Strengthen your portfolio with steady income from dividend stocks with yields > 3%, offering attractive yields and the financial stability that anchors long-term growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Navigator Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ENXTLS:NVG

Navigator Company

Manufactures and markets pulp and paper products worldwide.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion