- Portugal

- /

- Construction

- /

- ENXTLS:MAR

3 Penny Stocks With Promising Growth And Market Caps Larger Than US$100M

Reviewed by Simply Wall St

Global markets have shown resilience with major indices reaching new highs, driven by optimism around potential trade deals and advancements in artificial intelligence. For investors exploring opportunities beyond established giants, penny stocks—despite their somewhat outdated label—remain a relevant investment area. These smaller or newer companies can offer surprising value when built on solid financial foundations, potentially leading to significant returns while providing greater stability.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.525 | MYR2.59B | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.70 | £176.46M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.395 | MYR1.1B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.75 | HK$43.09B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.825 | £472.83M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR285.47M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.72 | MYR423.03M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.10 | £787.54M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.11 | HK$704.62M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

Click here to see the full list of 5,718 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Martifer SGPS (ENXTLS:MAR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Martifer SGPS, S.A. is involved in metallic constructions and renewable energy development across Portugal, Angola, Saudi Arabia, Europe, and other international markets with a market cap of €172.10 million.

Operations: The company generates its revenue primarily from Metallic Construction (€134.89 million) and the Naval Industry (€86.78 million), with additional contributions from the Renewables segment (€13.37 million).

Market Cap: €172.1M

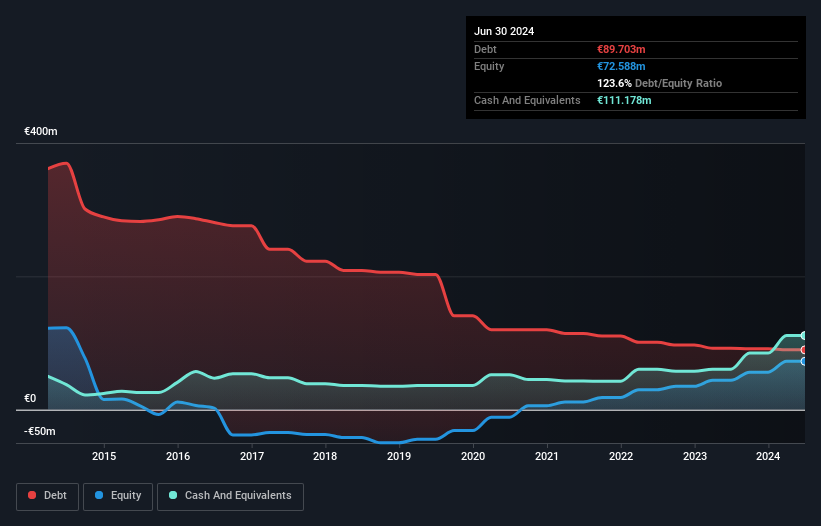

Martifer SGPS has demonstrated significant profit growth, with earnings increasing by 75% over the past year, surpassing both its 5-year average and industry growth. The company's financial health is robust, as its operating cash flow effectively covers debt obligations and short-term assets exceed liabilities. Despite having a high Return on Equity of 30.95%, this is influenced by debt levels; however, Martifer maintains more cash than total debt. Additionally, the management team and board are seasoned with an average tenure of 6.7 years, contributing to stable operations amidst market volatility.

- Get an in-depth perspective on Martifer SGPS' performance by reading our balance sheet health report here.

- Understand Martifer SGPS' track record by examining our performance history report.

Mayar Holding (SASE:9568)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Mayar Holding Company operates in Saudi Arabia, focusing on the manufacturing, selling, trading, installing, and maintaining of elevators and escalators along with their spare parts, with a market cap of SAR415.09 million.

Operations: The company's revenue is primarily derived from its Elevators and Escalators segment at SAR186.62 million, followed by the Feed and Agriculture sector generating SAR170.84 million, and the Plastic division contributing SAR81.06 million.

Market Cap: SAR415.09M

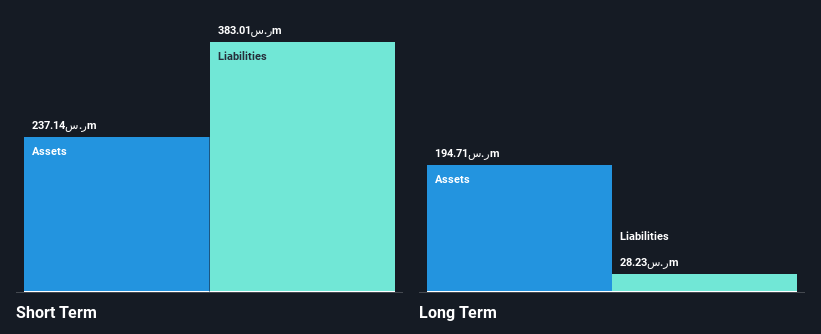

Mayar Holding, operating in Saudi Arabia's elevator and escalator industry, faces financial challenges despite generating SAR186.62 million from its core segment. The company is unprofitable with losses increasing annually by 54.6% over five years, and it has a high net debt to equity ratio of 1046.8%. Short-term liabilities exceed short-term assets by SAR145.9 million, but long-term liabilities are covered. Although the share price has been volatile recently, Mayar benefits from a positive cash flow runway exceeding three years if maintained at current levels without further dilution to shareholders this past year.

- Take a closer look at Mayar Holding's potential here in our financial health report.

- Review our historical performance report to gain insights into Mayar Holding's track record.

Cutia Therapeutics (SEHK:2487)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cutia Therapeutics is an investment holding company focused on the research, development, manufacture, and commercialization of scalp disease and skin care products in China and Hong Kong, with a market cap of approximately HK$1.39 billion.

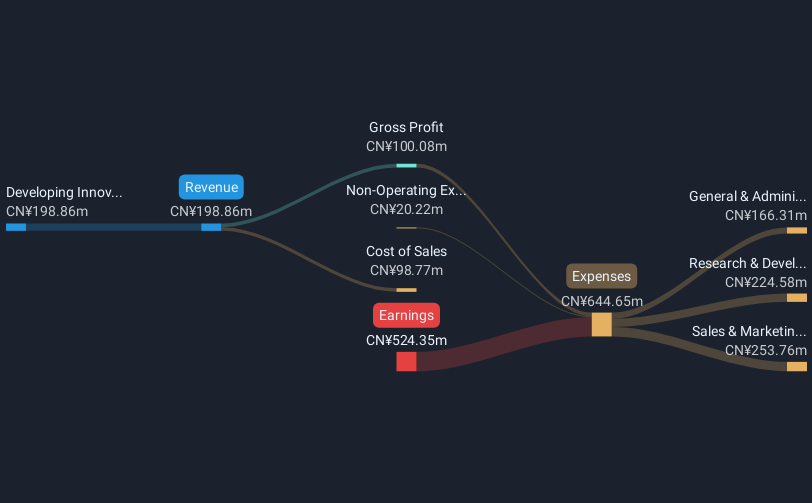

Operations: The company's revenue primarily comes from developing innovative and comprehensive solutions, amounting to CN¥198.86 million.

Market Cap: HK$1.39B

Cutia Therapeutics, with a market cap of approximately HK$1.39 billion, is focused on innovative dermatological solutions in China and Hong Kong. Despite being unprofitable, the company has shown significant revenue growth to CN¥198.86 million and maintains more cash than its total debt. Recent clinical trials for products like CU-20401 and CU-40102 have demonstrated promising efficacy and safety outcomes, potentially enhancing Cutia's market position. The management team is experienced with a stable board of directors, while analysts suggest the stock trades significantly below its estimated fair value with potential for substantial price appreciation.

- Navigate through the intricacies of Cutia Therapeutics with our comprehensive balance sheet health report here.

- Examine Cutia Therapeutics' earnings growth report to understand how analysts expect it to perform.

Make It Happen

- Click this link to deep-dive into the 5,718 companies within our Penny Stocks screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTLS:MAR

Martifer SGPS

Operates in the metallic constructions and renewable energy development sectors in Portugal, Angola, Saudi Arabia, Europe, and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives