Toyota Caetano Portugal, S.A. (ELI:SCT) Screens Well But There Might Be A Catch

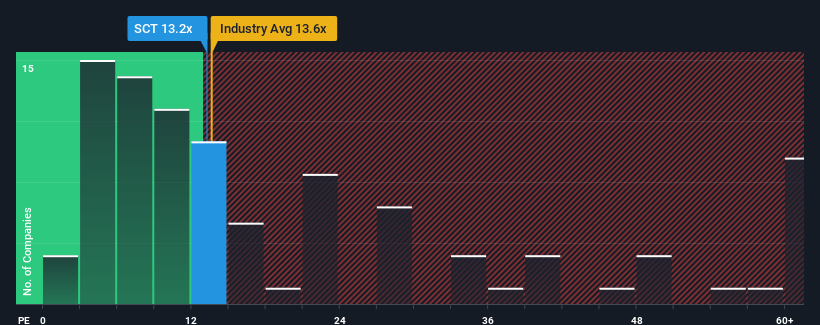

It's not a stretch to say that Toyota Caetano Portugal, S.A.'s (ELI:SCT) price-to-earnings (or "P/E") ratio of 13.2x right now seems quite "middle-of-the-road" compared to the market in Portugal, where the median P/E ratio is around 12x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

As an illustration, earnings have deteriorated at Toyota Caetano Portugal over the last year, which is not ideal at all. One possibility is that the P/E is moderate because investors think the company might still do enough to be in line with the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Toyota Caetano Portugal

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like Toyota Caetano Portugal's is when the company's growth is tracking the market closely.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 1.1%. Still, the latest three year period has seen an excellent 200% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to decline by 5.9% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

In light of this, it's peculiar that Toyota Caetano Portugal's P/E sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Toyota Caetano Portugal currently trades on a lower than expected P/E since its recent three-year earnings growth is beating forecasts for a struggling market. When we see its superior earnings with some actual growth, we assume potential risks are what might be placing pressure on the P/E ratio. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader market turmoil. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Toyota Caetano Portugal (2 make us uncomfortable) you should be aware of.

You might be able to find a better investment than Toyota Caetano Portugal. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Toyota Caetano Portugal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTLS:SCT

Toyota Caetano Portugal

Imports, assembles, and commercializes light and heavy vehicles.

Established dividend payer with adequate balance sheet.

Market Insights

Community Narratives