- Taiwan

- /

- Consumer Durables

- /

- TWSE:6201

Top 3 Dividend Stocks To Consider

Reviewed by Simply Wall St

In an exceptionally busy week for global markets, major indices like the Nasdaq Composite and S&P MidCap 400 Index hit record highs before retreating amid mixed earnings reports and economic data. As investors navigate this volatile landscape, dividend stocks offer a potential source of steady income, especially when growth stocks are underperforming. A good dividend stock often combines a reliable payout history with strong fundamentals, providing stability in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.12% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.83% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 5.03% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.48% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.93% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.00% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.97% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.83% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.10% | ★★★★★★ |

Click here to see the full list of 2032 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

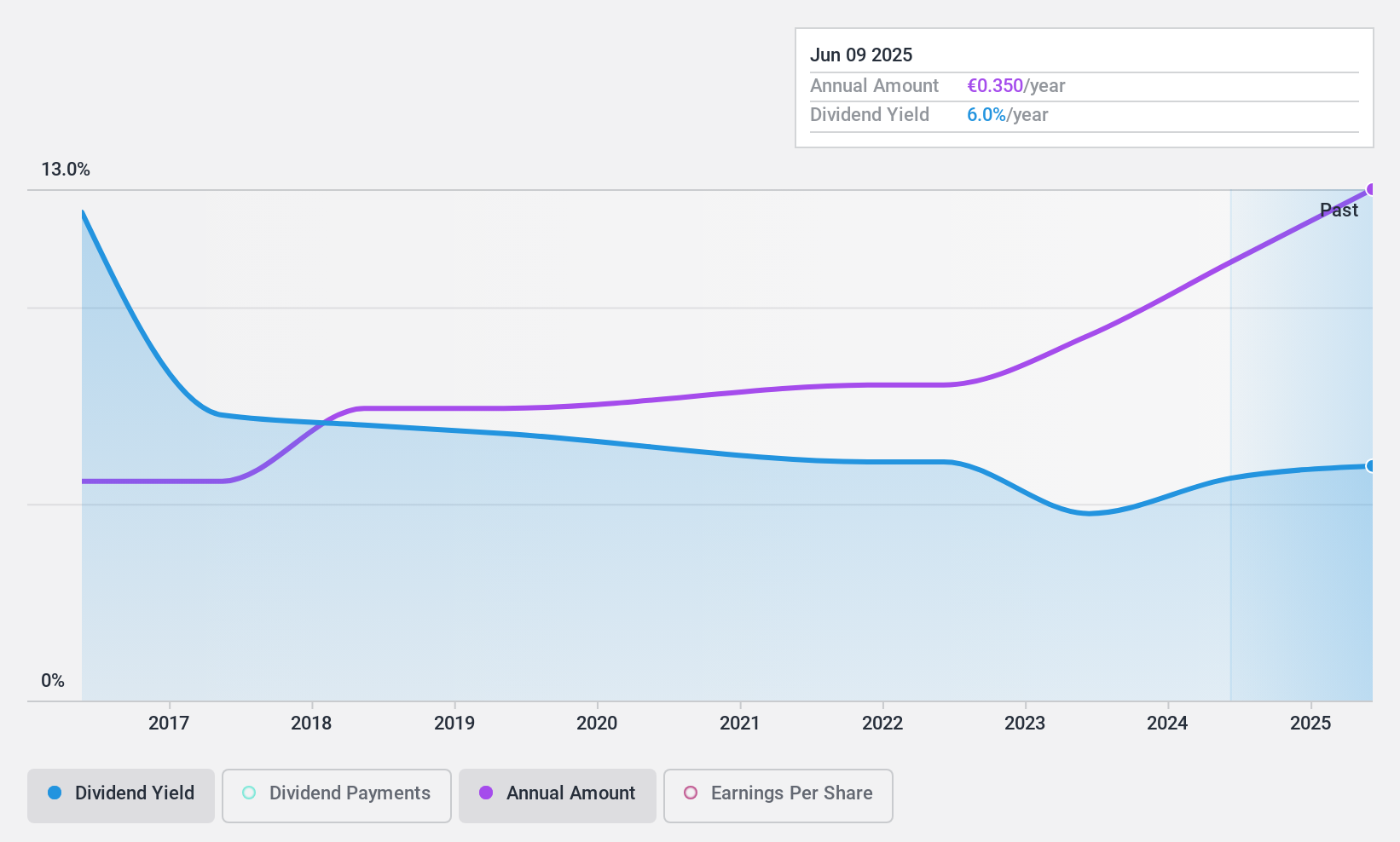

Toyota Caetano Portugal (ENXTLS:SCT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Toyota Caetano Portugal, S.A. imports, assembles, and commercializes light and heavy vehicles with a market cap of €201.25 million.

Operations: Toyota Caetano Portugal, S.A.'s revenue segments include €764.41 million from Domestic Motor Vehicles Commercialization, €61.96 million from External Motor Vehicles Industry, €28.15 million from External Motor Vehicles Commercialization, €24.70 million from Domestic Motor Vehicles Services, and various other contributions such as Domestic Industrial Equipment Machines at €12.25 million and smaller amounts in rental and services categories.

Dividend Yield: 5.2%

Toyota Caetano Portugal's recent earnings growth of 40.2% reflects a positive financial trajectory, with sales reaching €304.35 million for the half-year ending June 2024. Despite this growth, the company's dividend history is marked by volatility, with past drops exceeding 20%. However, dividends are well-covered by earnings and cash flows, supported by a payout ratio of 47.2% and a cash payout ratio of 65.8%. The current dividend yield is below Portugal's top tier at 5.22%.

- Click here and access our complete dividend analysis report to understand the dynamics of Toyota Caetano Portugal.

- In light of our recent valuation report, it seems possible that Toyota Caetano Portugal is trading beyond its estimated value.

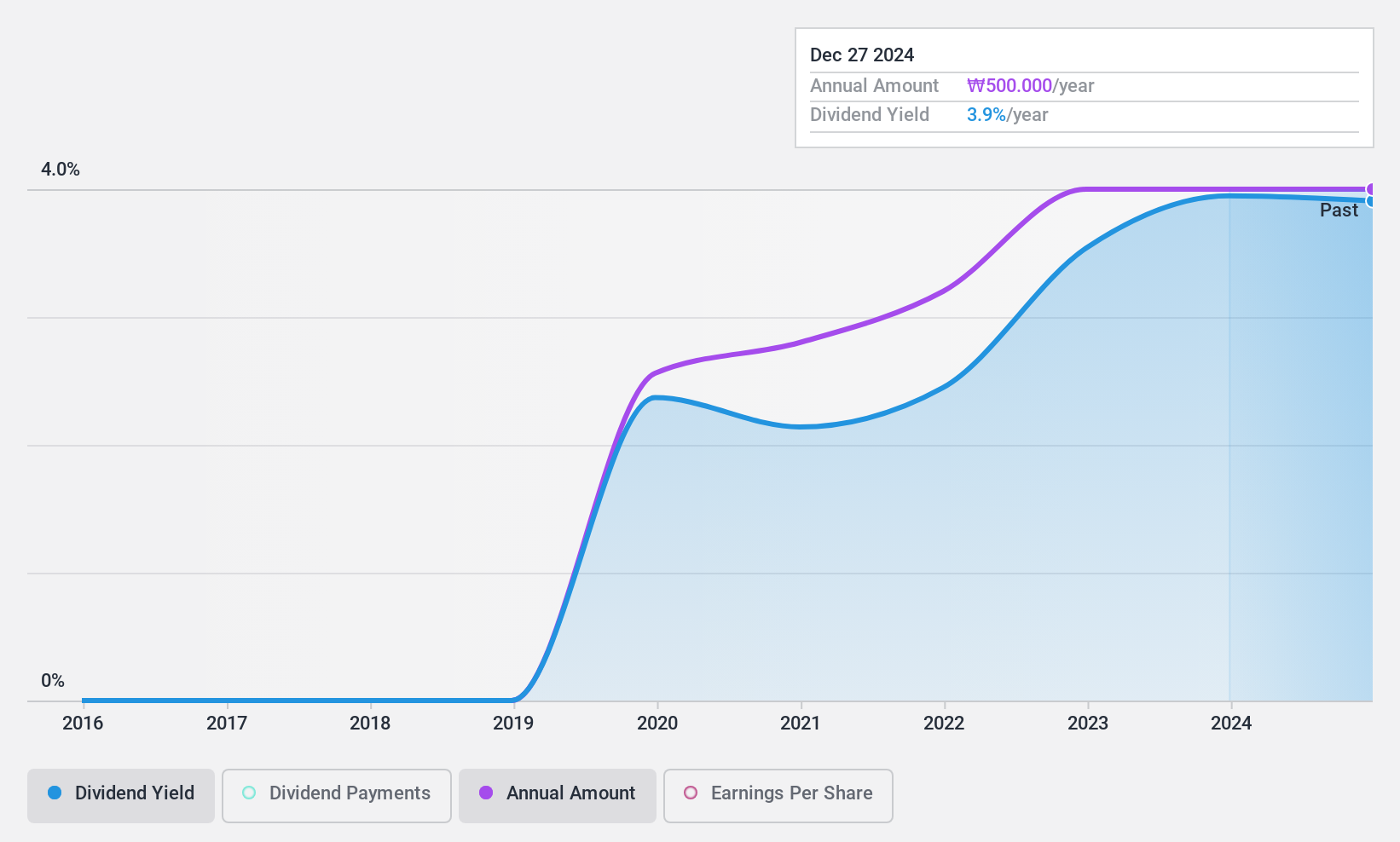

WINS (KOSDAQ:A136540)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: WINS Co., Ltd. offers information security solutions and services in South Korea with a market cap of ₩159.23 billion.

Operations: WINS Co., Ltd. generates revenue of ₩104.58 billion from its security software and services segment in South Korea.

Dividend Yield: 3.9%

WINS Co., Ltd has a stable dividend payout, backed by a low payout ratio of 31.4% and cash flow coverage at 32%, despite only five years of dividend history. Its yield is in the top 25% of the KR market. However, recent earnings showed a decline in net income to KRW 3.75 billion for Q2 compared to last year, and it was dropped from the S&P Global BMI Index in September 2024.

- Delve into the full analysis dividend report here for a deeper understanding of WINS.

- The analysis detailed in our WINS valuation report hints at an deflated share price compared to its estimated value.

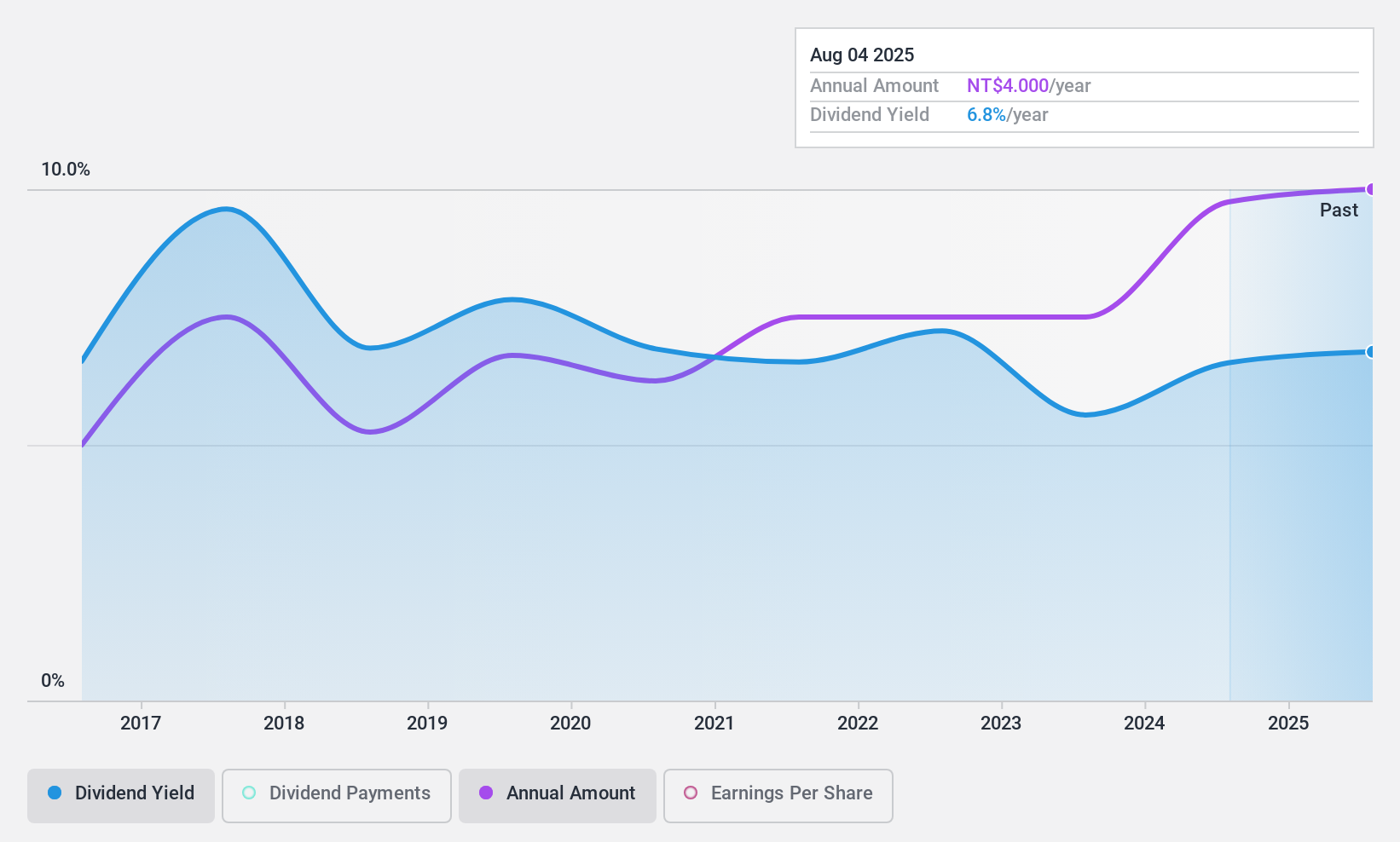

Ya Horng Electronic (TWSE:6201)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ya Horng Electronic Co., Ltd. is engaged in the development, manufacturing, and sale of audio products, household appliances, and healthcare products both in Taiwan and internationally, with a market cap of NT$5.29 billion.

Operations: Ya Horng Electronic Co., Ltd.'s revenue segments include NT$3.34 billion from Taiwan's Operational Headquarters and NT$1.37 billion from Production Factories in China and Southeast Asia.

Dividend Yield: 6.6%

Ya Horng Electronic's dividend yield is among the top 25% in Taiwan, supported by a cash payout ratio of 42.7%, indicating strong cash flow coverage. However, its dividend history over the past decade has been volatile and unreliable, with fluctuations exceeding 20%. Despite this instability, dividends are currently covered by earnings with an 83.6% payout ratio. Recent Q2 earnings showed slight growth in sales and net income compared to last year.

- Navigate through the intricacies of Ya Horng Electronic with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Ya Horng Electronic's current price could be quite moderate.

Make It Happen

- Gain an insight into the universe of 2032 Top Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6201

Ya Horng Electronic

Manufactures and sells audio products, household appliances, and healthcare products in Taiwan, the United States, Japan, France, and internationally.

Flawless balance sheet established dividend payer.