- Poland

- /

- Electric Utilities

- /

- WSE:TPE

These Analysts Think TAURON Polska Energia S.A.'s (WSE:TPE) Sales Are Under Threat

The latest analyst coverage could presage a bad day for TAURON Polska Energia S.A. (WSE:TPE), with the analysts making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic. The stock price has risen 6.9% to zł3.85 over the past week. Investors could be forgiven for changing their mind on the business following the downgrade; but it's not clear if the revised forecasts will lead to selling activity.

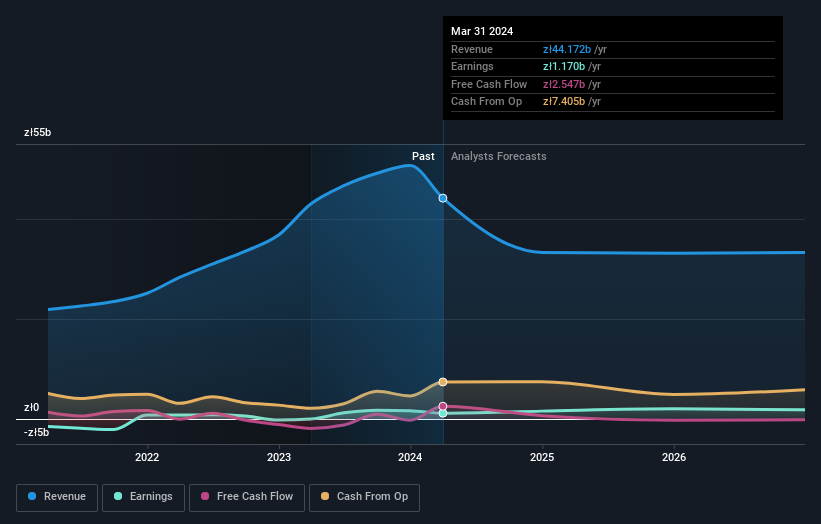

Following the latest downgrade, the four analysts covering TAURON Polska Energia provided consensus estimates of zł33b revenue in 2024, which would reflect a sizeable 25% decline on its sales over the past 12 months. Statutory earnings per share are presumed to jump 39% to zł0.93. Prior to this update, the analysts had been forecasting revenues of zł39b and earnings per share (EPS) of zł0.94 in 2024. Indeed we can see that the consensus opinion has undergone some fundamental changes following the recent consensus updates, with a substantial drop in revenues and some minor tweaks to earnings numbers.

Check out our latest analysis for TAURON Polska Energia

the analysts have also increased their price target 25% to zł5.93, clearly signalling that lower revenue forecasts this year are not expected to have a material impact on TAURON Polska Energia's valuation.

Of course, another way to look at these forecasts is to place them into context against the industry itself. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 31% by the end of 2024. This indicates a significant reduction from annual growth of 23% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 1.2% annually for the foreseeable future. It's pretty clear that TAURON Polska Energia's revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The most important thing to take away is that there's been no major change in sentiment, with analysts reconfirming that earnings per share are expected to continue performing in line with their prior expectations. Unfortunately analysts also downgraded their revenue estimates, and industry data suggests that TAURON Polska Energia's revenues are expected to grow slower than the wider market. There was also a nice increase in the price target, with analysts apparently feeling that the intrinsic value of the business is improving. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on TAURON Polska Energia after today.

A high debt burden combined with a downgrade of this magnitude always gives us some reason for concern, especially if these forecasts are just the first sign of a business downturn. To see more of our financial analysis, you can click through to our free platform to learn more about its balance sheet and specific concerns we've identified.

Another thing to consider is whether management and directors have been buying or selling stock recently. We provide an overview of all open market stock trades for the last twelve months on our platform, here.

Valuation is complex, but we're here to simplify it.

Discover if TAURON Polska Energia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:TPE

TAURON Polska Energia

Through its subsidiaries, generates, distributes, and supplies electricity and heat in Poland.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives