Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, TAURON Polska Energia S.A. (WSE:TPE) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for TAURON Polska Energia

How Much Debt Does TAURON Polska Energia Carry?

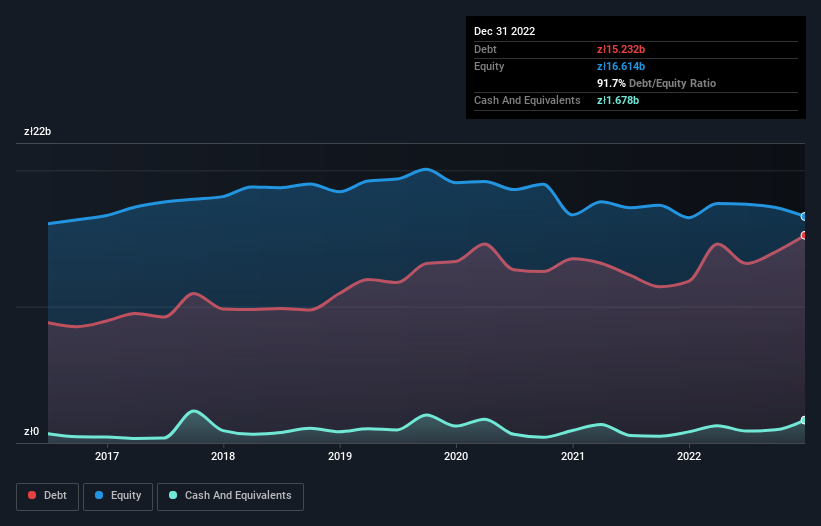

As you can see below, at the end of December 2022, TAURON Polska Energia had zł15.2b of debt, up from zł11.9b a year ago. Click the image for more detail. However, it also had zł1.68b in cash, and so its net debt is zł13.6b.

A Look At TAURON Polska Energia's Liabilities

Zooming in on the latest balance sheet data, we can see that TAURON Polska Energia had liabilities of zł10.2b due within 12 months and liabilities of zł18.5b due beyond that. Offsetting these obligations, it had cash of zł1.68b as well as receivables valued at zł5.14b due within 12 months. So its liabilities total zł21.9b more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the zł4.11b company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, TAURON Polska Energia would likely require a major re-capitalisation if it had to pay its creditors today.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While TAURON Polska Energia's debt to EBITDA ratio (4.4) suggests that it uses some debt, its interest cover is very weak, at 2.0, suggesting high leverage. In large part that's due to the company's significant depreciation and amortisation charges, which arguably mean its EBITDA is a very generous measure of earnings, and its debt may be more of a burden than it first appears. So shareholders should probably be aware that interest expenses appear to have really impacted the business lately. Worse, TAURON Polska Energia's EBIT was down 55% over the last year. If earnings keep going like that over the long term, it has a snowball's chance in hell of paying off that debt. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine TAURON Polska Energia's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. In the last three years, TAURON Polska Energia created free cash flow amounting to 13% of its EBIT, an uninspiring performance. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Our View

To be frank both TAURON Polska Energia's EBIT growth rate and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. And even its net debt to EBITDA fails to inspire much confidence. We should also note that Electric Utilities industry companies like TAURON Polska Energia commonly do use debt without problems. Taking into account all the aforementioned factors, it looks like TAURON Polska Energia has too much debt. That sort of riskiness is ok for some, but it certainly doesn't float our boat. While TAURON Polska Energia didn't make a statutory profit in the last year, its positive EBIT suggests that profitability might not be far away. Click here to see if its earnings are heading in the right direction, over the medium term.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if TAURON Polska Energia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:TPE

TAURON Polska Energia

Through its subsidiaries, generates, distributes, and supplies electricity and heat in Poland.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives