- Poland

- /

- Electric Utilities

- /

- WSE:TPE

Revenues Not Telling The Story For TAURON Polska Energia S.A. (WSE:TPE) After Shares Rise 32%

TAURON Polska Energia S.A. (WSE:TPE) shareholders would be excited to see that the share price has had a great month, posting a 32% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 70% in the last year.

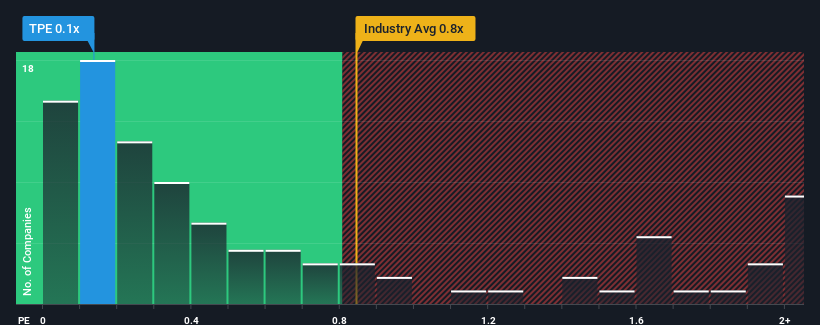

In spite of the firm bounce in price, there still wouldn't be many who think TAURON Polska Energia's price-to-sales (or "P/S") ratio of 0.1x is worth a mention when the median P/S in Poland's Electric Utilities industry is similar at about 0.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for TAURON Polska Energia

What Does TAURON Polska Energia's Recent Performance Look Like?

Recent times have been advantageous for TAURON Polska Energia as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think TAURON Polska Energia's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, TAURON Polska Energia would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 38%. Pleasingly, revenue has also lifted 142% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the five analysts covering the company suggest revenue growth is heading into negative territory, declining 13% each year over the next three years. Meanwhile, the broader industry is forecast to expand by 2.2% per annum, which paints a poor picture.

In light of this, it's somewhat alarming that TAURON Polska Energia's P/S sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

What We Can Learn From TAURON Polska Energia's P/S?

TAURON Polska Energia's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our check of TAURON Polska Energia's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for TAURON Polska Energia that you should be aware of.

If these risks are making you reconsider your opinion on TAURON Polska Energia, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if TAURON Polska Energia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:TPE

TAURON Polska Energia

Through its subsidiaries, generates, distributes, and supplies electricity and heat in Poland.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives