- Poland

- /

- Electric Utilities

- /

- WSE:PGE

The Market Lifts PGE Polska Grupa Energetyczna S.A. (WSE:PGE) Shares 31% But It Can Do More

Despite an already strong run, PGE Polska Grupa Energetyczna S.A. (WSE:PGE) shares have been powering on, with a gain of 31% in the last thirty days. The last 30 days bring the annual gain to a very sharp 29%.

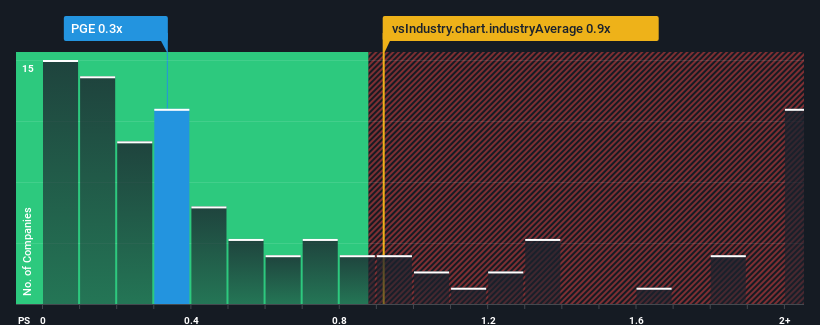

Even after such a large jump in price, you could still be forgiven for feeling indifferent about PGE Polska Grupa Energetyczna's P/S ratio of 0.3x, since the median price-to-sales (or "P/S") ratio for the Electric Utilities industry in Poland is about the same. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for PGE Polska Grupa Energetyczna

What Does PGE Polska Grupa Energetyczna's Recent Performance Look Like?

PGE Polska Grupa Energetyczna has been struggling lately as its revenue has declined faster than most other companies. One possibility is that the P/S is moderate because investors think the company's revenue trend will eventually fall in line with most others in the industry. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on PGE Polska Grupa Energetyczna.Do Revenue Forecasts Match The P/S Ratio?

PGE Polska Grupa Energetyczna's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 33% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 22% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 7.3% per annum during the coming three years according to the five analysts following the company. That's shaping up to be materially higher than the 3.1% per annum growth forecast for the broader industry.

With this information, we find it interesting that PGE Polska Grupa Energetyczna is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From PGE Polska Grupa Energetyczna's P/S?

Its shares have lifted substantially and now PGE Polska Grupa Energetyczna's P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite enticing revenue growth figures that outpace the industry, PGE Polska Grupa Energetyczna's P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for PGE Polska Grupa Energetyczna with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on PGE Polska Grupa Energetyczna, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade PGE Polska Grupa Energetyczna, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:PGE

PGE Polska Grupa Energetyczna

Engages in the production and distribution of electricity and heat in Poland.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives