Are Strong Financial Prospects The Force That Is Driving The Momentum In PRO-LOG Spólka Akcyjna's WSE:PRL) Stock?

Most readers would already be aware that PRO-LOG Spólka Akcyjna's (WSE:PRL) stock increased significantly by 26% over the past three months. Since the market usually pay for a company’s long-term fundamentals, we decided to study the company’s key performance indicators to see if they could be influencing the market. In this article, we decided to focus on PRO-LOG Spólka Akcyjna's ROE.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

Check out our latest analysis for PRO-LOG Spólka Akcyjna

How Is ROE Calculated?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for PRO-LOG Spólka Akcyjna is:

30% = zł3.1m ÷ zł10m (Based on the trailing twelve months to September 2020).

The 'return' is the yearly profit. Another way to think of that is that for every PLN1 worth of equity, the company was able to earn PLN0.30 in profit.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of PRO-LOG Spólka Akcyjna's Earnings Growth And 30% ROE

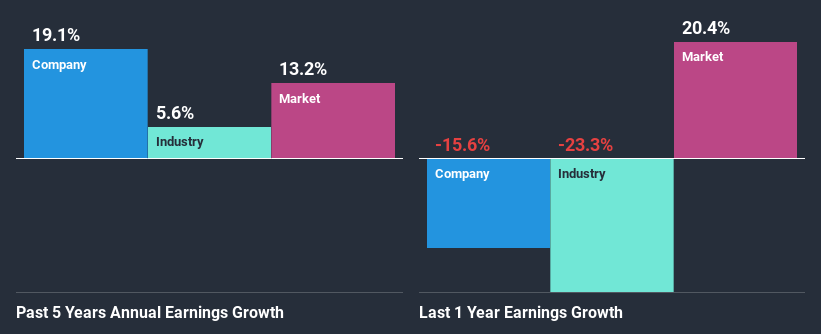

Firstly, we acknowledge that PRO-LOG Spólka Akcyjna has a significantly high ROE. Secondly, even when compared to the industry average of 8.0% the company's ROE is quite impressive. Probably as a result of this, PRO-LOG Spólka Akcyjna was able to see a decent net income growth of 19% over the last five years.

As a next step, we compared PRO-LOG Spólka Akcyjna's net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 8.7%.

Earnings growth is a huge factor in stock valuation. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if PRO-LOG Spólka Akcyjna is trading on a high P/E or a low P/E, relative to its industry.

Is PRO-LOG Spólka Akcyjna Making Efficient Use Of Its Profits?

PRO-LOG Spólka Akcyjna has a significant three-year median payout ratio of 62%, meaning that it is left with only 38% to reinvest into its business. This implies that the company has been able to achieve decent earnings growth despite returning most of its profits to shareholders.

Additionally, PRO-LOG Spólka Akcyjna has paid dividends over a period of eight years which means that the company is pretty serious about sharing its profits with shareholders.

Conclusion

On the whole, we feel that PRO-LOG Spólka Akcyjna's performance has been quite good. In particular, its high ROE is quite noteworthy and also the probable explanation behind its considerable earnings growth. Yet, the company is retaining a small portion of its profits. Which means that the company has been able to grow its earnings in spite of it, so that's not too bad. Until now, we have only just grazed the surface of the company's past performance by looking at the company's fundamentals. So it may be worth checking this free detailed graph of PRO-LOG Spólka Akcyjna's past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

If you’re looking to trade PRO-LOG Spólka Akcyjna, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade XBS PRO-LOG, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:XBS

Flawless balance sheet and good value.

Market Insights

Community Narratives